15+ Money laundering client risk assessment form information

Home » money laundering idea » 15+ Money laundering client risk assessment form informationYour Money laundering client risk assessment form images are ready. Money laundering client risk assessment form are a topic that is being searched for and liked by netizens now. You can Get the Money laundering client risk assessment form files here. Find and Download all royalty-free images.

If you’re looking for money laundering client risk assessment form images information related to the money laundering client risk assessment form topic, you have pay a visit to the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

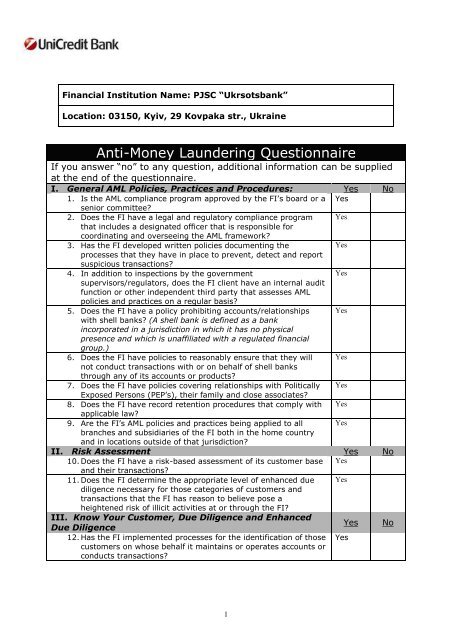

Money Laundering Client Risk Assessment Form. This Lettings Agency Client Identification and Risk Assessment Form is for use by a lettings agency dealing with high value residential lettings at a monthly rent of 10000 euros or more when checking the identity of a new client for Anti-Money Laundering purposes from the 10 January 2020. Responses should be provided in the designated spaces in the questionnaire. The types of customer you have. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm.

Pdf Anti Money Laundering In Italian Banks From researchgate.net

Pdf Anti Money Laundering In Italian Banks From researchgate.net

The Estate Agency Client Identification and Risk Assessment Form is for use by an Estate Agent when checking the identity of a new client for Anti-Money Laundering purposes. This risk assessment sets out the main money laundering risks that we consider relevant to those we supervise. Client Risk Assessment. The form can also be used to verify the other contracting party andor any beneficial owners. This assessment could take the form clusters or groups of clients with similar characteristics. Anti-money laundering risk assessments.

This is a manual prompt sheet for carrying out a risk assessment on a client.

They are also non-exhaustive and should be used as a. They are also non-exhaustive and should be used as a. For example you can group together clients with similar incomes occupations and portfolios or. The form is designed to help firms in assessing AML risks posed at both client and transactional level. The questions posed are indicative only and not all will be applicable to all clients. CLC AML Sector Risk Assessment Jan 2021.

Source: yumpu.com

Source: yumpu.com

They are also non-exhaustive and should be used as a. Risk assessment and free consultations. The conclusion should include a short narrative in support of the conclusion. Consider the need to obtain MLNO approval of the extent of the verification evidence obtained given the risk associated with this client. View as a pdf here.

Source: pinterest.com

Source: pinterest.com

The Estate Agency Client Identification and Risk Assessment Form is for use by an Estate Agent when checking the identity of a new client for Anti-Money Laundering purposes. Other procedures required to complete client due diligence. The Estate Agency Client Identification and Risk Assessment Form is for use by an Estate Agent when checking the identity of a new client for Anti-Money Laundering purposes. Money laundering is the process of concealing the origin ownership or destination of illegally or dishonestly-obtained money by hiding it within legitimate economic activities in order to make it appear legal. The form is designed to help firms in assessing AML risks posed at both client and transactional level.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. The types of customer you have. This Lettings Agency Client Identification and Risk Assessment Form is for use by a lettings agency dealing with high value residential lettings at a monthly rent of 10000 euros or more when checking the identity of a new client for Anti-Money Laundering purposes from the 10 January 2020. ACCA client risk-assessment tool and know-your-client form. The questions posed are indicative only and not all will be applicable to all clients.

Source: researchgate.net

Source: researchgate.net

The AMLCTF regimes in the UK requires a risk assessment of your practice to be conducted and documented to identify what money laundering and terrorist financing risks your practice may face and how you will control them. The templates below can be amended to suit your own practice. The guidance then outlines the Money Laundering risks that could be associated with clients who hold crypto-assets and the issues that members will need to consider in their risk assessments. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry. The questions posed are indicative only and not all will be applicable to all clients.

Source: semanticscholar.org

Source: semanticscholar.org

You can assess the MLTF risk for individual clients or for groups of clients. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. Money launderingterrorism financing risk assessment. Responses should be provided in the designated spaces in the questionnaire. You should use AML Online for your official Risk Assessment.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Practice Risk Assessment Template UK. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. Updated Money Laundering Risk Assessments for Estate Agents and Letting Agents. The guidance then outlines the Money Laundering risks that could be associated with clients who hold crypto-assets and the issues that members will need to consider in their risk assessments. This form should be used when reporting a suspicion of money laundering internally to the.

Money Laundering Internal Report. The templates below can be amended to suit your own practice. Anti-money laundering risk assessments. It is the first thing you must do because it determines what measures you need to include in your program. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm.

Source: slidetodoc.com

Source: slidetodoc.com

Responses should be provided in the designated spaces in the questionnaire. Practice Risk Assessment Template UK. This risk assessment sets out the main money laundering risks that we consider relevant to those we supervise. Draft money laundering risk assessment form The factors posed below should be considered when assessing the risk of the client andor the transaction. Money Laundering Internal Report.

Source: docplayer.net

Source: docplayer.net

This is a manual prompt sheet for carrying out a risk assessment on a client. The AMLCTF regimes in the UK requires a risk assessment of your practice to be conducted and documented to identify what money laundering and terrorist financing risks your practice may face and how you will control them. This is a manual prompt sheet for carrying out a risk assessment on a client. ACCA client risk-assessment tool and know-your-client form. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry.

Source: lexology.com

Source: lexology.com

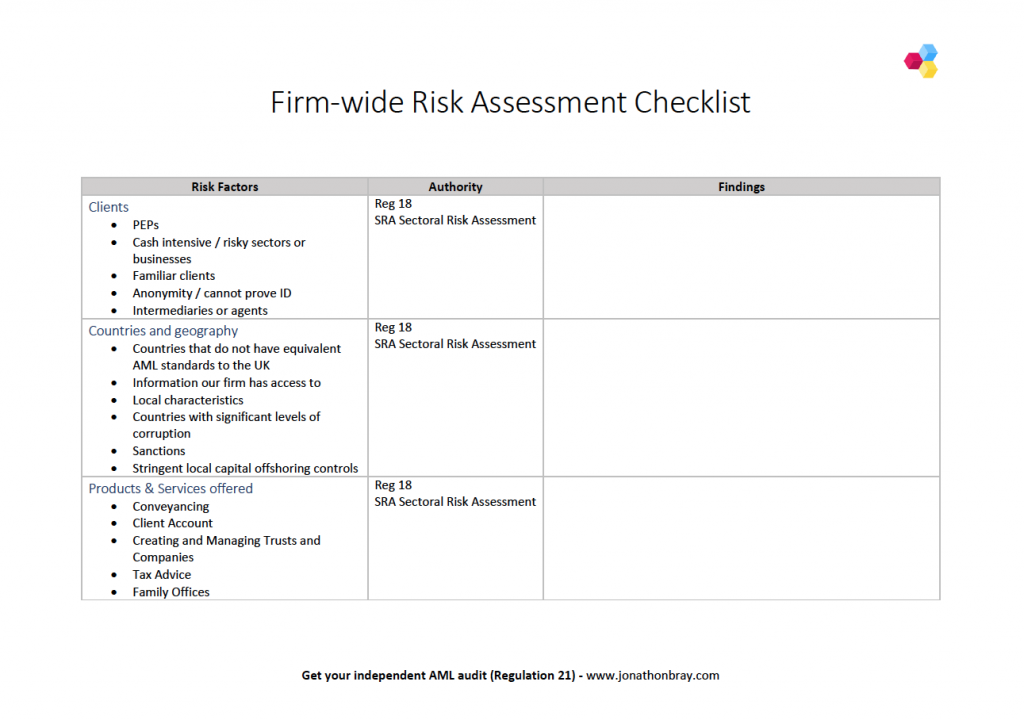

This form should be used when reporting a suspicion of money laundering internally to the. Please use the notes column to summarise observationsassessment of risks involved where the issue is applicable to the clienttransaction. Anti-money laundering firm-wide risk assessment Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Updated Money Laundering Risk Assessments for Estate Agents and Letting Agents. The Estate Agency Client Identification and Risk Assessment Form is for use by an Estate Agent when checking the identity of a new client for Anti-Money Laundering purposes.

Source: slidetodoc.com

Source: slidetodoc.com

Draft money laundering risk assessment form The factors posed below should be considered when assessing the risk of the client andor the transaction. The AMLCTF regimes in the UK requires a risk assessment of your practice to be conducted and documented to identify what money laundering and terrorist financing risks your practice may face and how you will control them. Draft money laundering risk assessment form The factors posed below should be considered when assessing the risk of the client andor the transaction. Updated Money Laundering Risk Assessments for Estate Agents and Letting Agents. Risk assessment and free consultations.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

Consider on a risk sensitive basis the need to verify the identity of this individual or organisation. The templates below can be amended to suit your own practice. The form can also be used to verify the other contracting party andor any beneficial owners. Carrying out a risk assessment will help you to. When you assess the risks of money laundering that apply to your business you need to consider.

Source: researchgate.net

Source: researchgate.net

The templates below can be amended to suit your own practice. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. Regulation 18 of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 requires law firms to carry out a written risk assessment to identify and assess the risk of money laundering that they face. Anti-money laundering firm-wide risk assessment Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering client risk assessment form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.