18+ Money laundering cases in insurance industry ideas

Home » money laundering idea » 18+ Money laundering cases in insurance industry ideasYour Money laundering cases in insurance industry images are ready. Money laundering cases in insurance industry are a topic that is being searched for and liked by netizens today. You can Download the Money laundering cases in insurance industry files here. Find and Download all free photos.

If you’re looking for money laundering cases in insurance industry images information linked to the money laundering cases in insurance industry keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Money Laundering Cases In Insurance Industry. Given the growing size of the insurance industry in Canada and the focus placed on life insurance products as a conduit for money laundering by authoritative international bodies one might wonder why is the suspicious transaction reporting levels. These goods had also been purchased with dirty money. Money Laundering in the Insurance Industry. Ad Unlimited access to Insurance market reports on 180 countries.

Anti Money Laundering In The Insurance Industry From infopro.com.my

Anti Money Laundering In The Insurance Industry From infopro.com.my

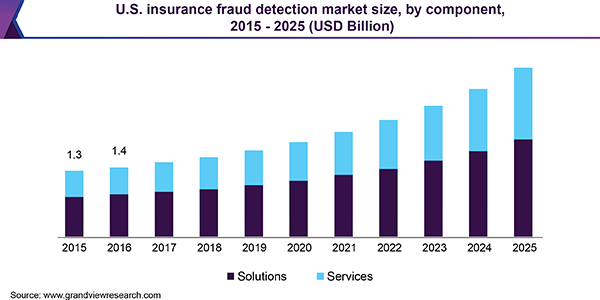

Case study on AXA Sun Life - Anti Money Laundering The threats posed to the Insurance industry by organised crime in the areas of fraud and anti-money laundering. According to encompass Group 2019 is on track to be year a record year for anti-money laundering AML fines overtaking the 1089bn levied in 2014. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. Anti-Money Laundering In The Insurance Industry Published by Lee Chee Keong at August 25 2020 Around 62 of the global insurance firms have been exposed to fraud or financial crimes in the past 24 months. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Between January and April 2019 77bn of AML fines were handed out compared to 116bn in the same period in 2018.

In other words money laundering in the insurance sector is a growing global problem.

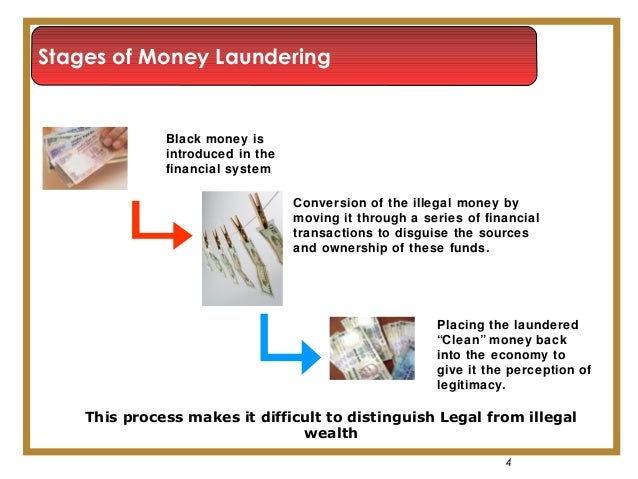

Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. They subsequently made a fraudulent claim against the policy. Actual Money Laundering Cases. So they effectively laundered their money several times. Anti-Money Laundering In The Insurance Industry Published by Lee Chee Keong at August 25 2020 Around 62 of the global insurance firms have been exposed to fraud or financial crimes in the past 24 months. These goods had also been purchased with dirty money.

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

Patriot Act rules and investigate customers and the source of their money. Between January and April 2019 77bn of AML fines were handed out compared to 116bn in the same period in 2018. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of. First Last.

Source: getid.ee

Source: getid.ee

Instant industry overview Market sizing forecast key players trends. That is why insurance companies need to adhere to US. Actual Money Laundering Cases. Collusion case study 21 An insurer in collusion with an insured person attempted to launder money through insurance transactions. Between January and April 2019 77bn of AML fines were handed out compared to 116bn in the same period in 2018.

Source: slideshare.net

Source: slideshare.net

In other words money laundering in the insurance sector is a growing global problem. Notice in these cases the insurance company is simply the victim of the underlying fraud Neither it nor its products are used to commit the money laundering offense but the money laundering has the effect of concealing the proceeds of the fraud so that its harder for the victim the insurance company to recover the money. In this summers Money Laundering and Terrorist Financing Typologies 2004-5 the Financial Action Task Force FATF analysed 94 reported cases of money laundering through the insurance industry between 1999 and 2003 with a total value of US525 million. Case study on AXA Sun Life - Anti Money Laundering The threats posed to the Insurance industry by organised crime in the areas of fraud and anti-money laundering. The manager of an insurance company sold health and personal injury insurance policies insuring against the liability from accidents to dummy persons normally in the names of friends and relatives.

Source: infopro.com.my

Source: infopro.com.my

They subsequently made a fraudulent claim against the policy. Given the growing size of the insurance industry in Canada and the focus placed on life insurance products as a conduit for money laundering by authoritative international bodies one might wonder why is the suspicious transaction reporting levels. Actual Money Laundering Cases. Instant industry overview Market sizing forecast key players trends. Money launders will then try to get the money back through a fraudulent claim.

Source: infopro.com.my

Source: infopro.com.my

Instant industry overview Market sizing forecast key players trends. Getting the Regulator on BoardTaking a Risk-Based Approach vs. First Last. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim.

Source: slideshare.net

Source: slideshare.net

First Last. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. First Last. Money Laundering in the Insurance Industry. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract.

Source: slideshare.net

Source: slideshare.net

Between January and April 2019 77bn of AML fines were handed out compared to 116bn in the same period in 2018. Insurance industry doubled from just over 4000 to just over 8000 from 2003 to 20065. Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of. Ad Unlimited access to Insurance market reports on 180 countries. Ad Unlimited access to Insurance market reports on 180 countries.

Source:

They subsequently made a fraudulent claim against the policy. Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of. This access provides opportunities for criminals to misuse the financial system to engage in money laundering ML and terrorist financing TF. Ad Unlimited access to Insurance market reports on 180 countries. Patriot Act rules and investigate customers and the source of their money.

Source: researchgate.net

Source: researchgate.net

Getting the Regulator on BoardTaking a Risk-Based Approach vs. Instant industry overview Market sizing forecast key players trends. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. Getting the Regulator on BoardTaking a Risk-Based Approach vs. Ad Unlimited access to Insurance market reports on 180 countries.

Source:

They subsequently made a fraudulent claim against the policy. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently. Between January and April 2019 77bn of AML fines were handed out compared to 116bn in the same period in 2018. Buying furniture then buying a policy then receiving a clean cheque from their insurance company when they made a claim. This access provides opportunities for criminals to misuse the financial system to engage in money laundering ML and terrorist financing TF.

Source: researchgate.net

Source: researchgate.net

First Last. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. That is why insurance companies need to adhere to US. Getting the Regulator on BoardTaking a Risk-Based Approach vs. In other words money laundering in the insurance sector is a growing global problem.

Source: grandviewresearch.com

Source: grandviewresearch.com

Insurance industry doubled from just over 4000 to just over 8000 from 2003 to 20065. Notice in these cases the insurance company is simply the victim of the underlying fraud Neither it nor its products are used to commit the money laundering offense but the money laundering has the effect of concealing the proceeds of the fraud so that its harder for the victim the insurance company to recover the money. Ad Unlimited access to Insurance market reports on 180 countries. Money launders will then try to get the money back through a fraudulent claim. Increasingly money is being laundered to fund terrorist activities.

Source: acamstoday.org

Source: acamstoday.org

The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Instant industry overview Market sizing forecast key players trends. Anti-Money Laundering In The Insurance Industry Published by Lee Chee Keong at August 25 2020 Around 62 of the global insurance firms have been exposed to fraud or financial crimes in the past 24 months. Patriot Act rules and investigate customers and the source of their money. According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering cases in insurance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.