11+ Money laundering capital punishment ideas

Home » money laundering Info » 11+ Money laundering capital punishment ideasYour Money laundering capital punishment images are ready. Money laundering capital punishment are a topic that is being searched for and liked by netizens today. You can Download the Money laundering capital punishment files here. Download all free photos.

If you’re looking for money laundering capital punishment images information related to the money laundering capital punishment topic, you have visit the ideal site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

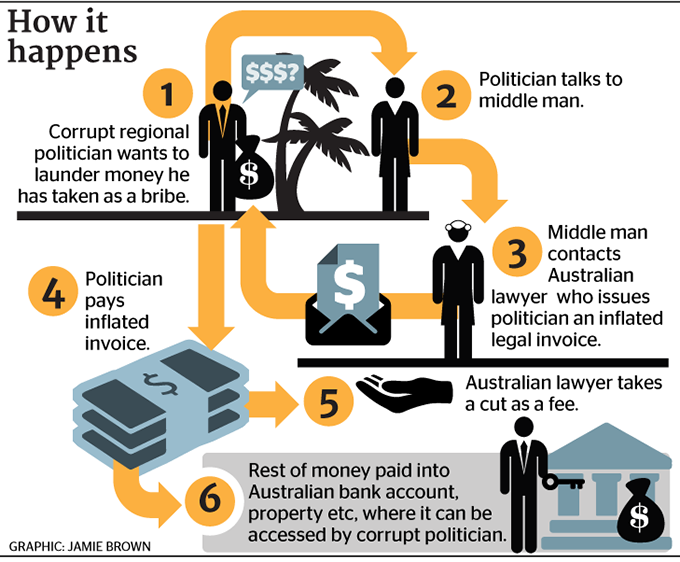

Money Laundering Capital Punishment. Under Penal Code 18610 money laundering is committed when one conducts or attempts to conduct a transaction with a bank deposit withdrawal write a check involving a total value of 5000 over a seven-day period or more than 25000 in a thirty-day period with the specific intent to promote criminal activity or with knowledge that. The court will also impose a penalty of up to Rs 5 Lakh in such a case. Money laundering definition is studied from wide verity perspectives but generally it includes the conversion or transfer of capital knowing that the capital is the result of a crime in order to conceal the illegal origin and nature of the capital. Fisher Capital does not serve and will hold accountable any entity under suspicion of any attempt or form of money laundering to the full punishment of law.

Qatar In Imf Staff Country Reports Volume 2008 Issue 322 2008 From elibrary.imf.org

Qatar In Imf Staff Country Reports Volume 2008 Issue 322 2008 From elibrary.imf.org

There are the headline-grabbing cases to be sure such as Deutsche Banks trouble with mirror trades or Goldman Sachs connection to the 1MDB bonds but these are rarities that fall short of. The sources of the cash in precise are prison and the cash is invested in a means that makes it appear like clean money and hide the id of the prison part of the money earned. The court will also impose a penalty of up to Rs 5 Lakh in such a case. The concept of money laundering is essential to be understood for these working within the financial sector. Therefore it is hereby enacted as follows- 1. Money laundering definition is studied from wide verity perspectives but generally it includes the conversion or transfer of capital knowing that the capital is the result of a crime in order to conceal the illegal origin and nature of the capital.

Therefore it is hereby enacted as follows- 1.

Its a process by which dirty cash is transformed into clear money. Money laundering in capital markets All financial institutions are now aware of mirror trades but what else should they worry about. The minimum punishment in case of money laundering is 3 years and the maximum punishment is restricted to 7 years. The aim of disguising the source of the property is to allow the holder to enjoy it free from suspicion as to its source. The Financial and Capital Market Commission is a public body that oversees financial institutions in Lithuania. Chinas central bank has increased the punishment for financial institutions that fail to adequately guard against money laundering imposing fines.

Source: elibrary.imf.org

Source: elibrary.imf.org

Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. Chinas central bank has increased the punishment for financial institutions that fail to adequately guard against money laundering imposing fines. The various types of money laundering charges for criminal activity and involvement often lead to punishment through conviction in the courtroom with certain minimum sentencing. Money laundering definition is studied from wide verity perspectives but generally it includes the conversion or transfer of capital knowing that the capital is the result of a crime in order to conceal the illegal origin and nature of the capital. But real estate was by far the dirtiest type of laundry.

Source: asiapacificreport.nz

Source: asiapacificreport.nz

Fisher Capital does not serve and will hold accountable any entity under suspicion of any attempt or form of money laundering to the full punishment of law. It is important for the accused to know what charges to expect and how to proceed through and defend against the punishments and penalties that may occur. Money laundering is the process by which the proceeds of crime are converted into assets which appear to have a legal rather than an illegal source. Money laundering in capital markets All financial institutions are now aware of mirror trades but what else should they worry about. Speaking generally large fines and jail time are possible.

Source: elibrary.imf.org

Source: elibrary.imf.org

There are the headline-grabbing cases to be sure such as Deutsche Banks trouble with mirror trades or Goldman Sachs connection to the 1MDB bonds but these are rarities that fall short of. Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. Its a process by which dirty money is converted into clean cash. Chinas central bank has increased the punishment for financial institutions that fail to adequately guard against money laundering imposing fines.

Source: change.org

Source: change.org

What is the punishment for being involved in money laundering. Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. The various types of money laundering charges for criminal activity and involvement often lead to punishment through conviction in the courtroom with certain minimum sentencing. There is an exception where some of the criminals may be punished with 10 years of imprisonment. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

Money laundering definition is studied from wide verity perspectives but generally it includes the conversion or transfer of capital knowing that the capital is the result of a crime in order to conceal the illegal origin and nature of the capital. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The Financial and Capital Market Commission is a public body that oversees financial institutions in Lithuania. Its a process by which dirty money is converted into clean cash. Due to the nature of the crime the federal law has strict penalties for those involved in money laundering.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

Speaking generally large fines and jail time are possible. It is important for the accused to know what charges to expect and how to proceed through and defend against the punishments and penalties that may occur. For a legal entity the maximum penalty is an unlimited fine. Short title and commencement 1 This Act may be called the Money Laundering Prevention Act 2012. Fisher Capital does not serve and will hold accountable any entity under suspicion of any attempt or form of money laundering to the full punishment of law.

The concept of money laundering is essential to be understood for those working within the monetary sector. Chinas central bank has increased the punishment for financial institutions that fail to adequately guard against money laundering imposing fines. Short title and commencement 1 This Act may be called the Money Laundering Prevention Act 2012. The aim of disguising the source of the property is to allow the holder to enjoy it free from suspicion as to its source. Money laundering is the process by which the proceeds of crime are converted into assets which appear to have a legal rather than an illegal source.

Short title and commencement 1 This Act may be called the Money Laundering Prevention Act 2012. Therefore it is hereby enacted as follows- 1. Speaking generally large fines and jail time are possible. Money laundering in capital markets All financial institutions are now aware of mirror trades but what else should they worry about. Fisher Capital does not serve and will hold accountable any entity under suspicion of any attempt or form of money laundering to the full punishment of law.

Source: ibanet.org

Source: ibanet.org

What is the punishment for being involved in money laundering. Therefore it is hereby enacted as follows- 1. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Short title and commencement 1 This Act may be called the Money Laundering Prevention Act 2012. Money laundering in BC took many forms ranging from hockey bags stuffed full of cash to shady luxury car exports.

Source: elibrary.imf.org

Source: elibrary.imf.org

The aim of disguising the source of the property is to allow the holder to enjoy it free from suspicion as to its source. Laundering and other offences connected therewith including punishment thereof and the matters ancillary thereto by repealing the existing Act and Ordinance relating thereto. Money Laundering Punishment Penalties for money laundering differ based on the specifics of the crime. Money laundering in BC took many forms ranging from hockey bags stuffed full of cash to shady luxury car exports. Since the money laundering process is quite complicated people often become involved in it without being fully.

Therefore it is hereby enacted as follows- 1. For a legal entity the maximum penalty is an unlimited fine. Speaking generally large fines and jail time are possible. The court will also impose a penalty of up to Rs 5 Lakh in such a case. Due to the nature of the crime the federal law has strict penalties for those involved in money laundering.

Source: researchgate.net

Source: researchgate.net

Money laundering in capital markets All financial institutions are now aware of mirror trades but what else should they worry about. Chinas central bank has increased the punishment for financial institutions that fail to adequately guard against money laundering imposing fines. It is important for the accused to know what charges to expect and how to proceed through and defend against the punishments and penalties that may occur. In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. Its a process by which dirty cash is transformed into clear money.

Source: coe.int

Source: coe.int

Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. FCMC fined Signet Bank of Latvia 906610 Euro for violating anti-money laundering and anti-terrorism financing AML regulatory requirements. Money laundering in capital markets All financial institutions are now aware of mirror trades but what else should they worry about. According to the research 1 in 5 houses purchased in British Columbia is bought in cash enough to bring in 151B over the past 2. Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering capital punishment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.