18+ Money laundering and terrorist financing risk assessment guidelines for banking sector ideas

Home » money laundering Info » 18+ Money laundering and terrorist financing risk assessment guidelines for banking sector ideasYour Money laundering and terrorist financing risk assessment guidelines for banking sector images are ready. Money laundering and terrorist financing risk assessment guidelines for banking sector are a topic that is being searched for and liked by netizens today. You can Get the Money laundering and terrorist financing risk assessment guidelines for banking sector files here. Get all free vectors.

If you’re searching for money laundering and terrorist financing risk assessment guidelines for banking sector pictures information connected with to the money laundering and terrorist financing risk assessment guidelines for banking sector interest, you have pay a visit to the right blog. Our site always gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Money Laundering And Terrorist Financing Risk Assessment Guidelines For Banking Sector. A risk assessment is an analysis of potential threats and vulnerabilities to money laundering and terrorist financing to which your business is exposed. For example the National risk assessment of money laundering and terrorist financing is the guidance published by the UK government. They are a resource for reporting entities to use to refine internal controls and to meet your reporting obligations particularly in relation to. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1.

What Role Performs By Online Video Identity Verification In The Present Times Video Online Video Staying Safe Online From in.pinterest.com

What Role Performs By Online Video Identity Verification In The Present Times Video Online Video Staying Safe Online From in.pinterest.com

Risk assessments examine current money laundering and terrorism financing threats and vulnerabilities in specific parts of Australias financial sector. An MLTF risk assessment is a product or process based on a methodology agreed by those parties involved that attempts to identify analyse and understand MLTF risks and serves as a first step in addressing them FATF Guidance on NRA. The purpose of this workshop is to introduce the assessment tool and launch the assessment process. Guidelines Governing Money Laundering and Terrorist Financing Risks Assessment and Relevant Prevention Program Development by the Banking Sector 1 The Guidelines are formulated in accordance with Guidelines Governing Anti-Money Laundering and Combating the Financing of Terrorism by the Banking Sector for the. For example the National risk assessment of money laundering and terrorist financing is the guidance published by the UK government. Guidelines to Banks on Money Laundering and Terrorist Financing Risks Assessment and Relevant Prevention Program I.

Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

The sector specific guidance is further granulated keeping in view the specific threats to certain parts of the sector. This guidance paper should be read in conjunction with. The FATF Recommendations especially Recommendations 1 and 26 R. Are initially covered in the guideline. Working Group members also get hands-on training on the Risk Assessment Tool. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1.

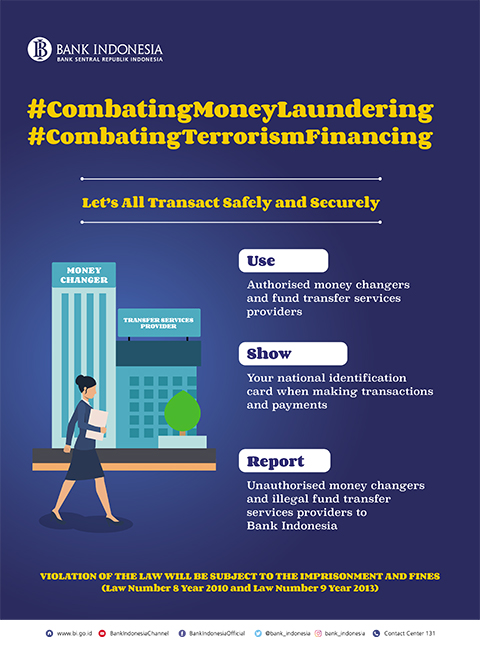

Source: bi.go.id

Source: bi.go.id

For example the National risk assessment of money laundering and terrorist financing is the guidance published by the UK government. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. A risk-based approach means that countries competent authorities and banks identify assess and understand the money laundering and terrorist financing risk to which they are exposed and take the appropriate mitigation measures in accordance with the level of risk. Risk assessments examine current money laundering and terrorism financing threats and vulnerabilities in specific parts of Australias financial sector. The assessment process starts during the workshop.

Based on the assessment MLTF risks should be classified as low medium and high impact risks. Risk Assessment Overview A risk-based approach requires institutions to have systems and controls in place that are commensurate with the specific risks of money laundering and terrorist financing facing them1 1 Study Guide for the CAMS Certification Examination Ch. RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. The securities industry along with banking and insurance is one of the core industries through which persons and entities can access the financial system. The FATF Recommendations especially Recommendations 1 and 26 R.

Source: bi.go.id

Source: bi.go.id

Based on the assessment MLTF risks should be classified as low medium and high impact risks. Risk Assessment Overview A risk-based approach requires institutions to have systems and controls in place that are commensurate with the specific risks of money laundering and terrorist financing facing them1 1 Study Guide for the CAMS Certification Examination Ch. You can use these tools or you can develop your own risk assessment tools. Threat vulnerability and consequence. The sector specific guidance is further granulated keeping in view the specific threats to certain parts of the sector.

Source: yumpu.com

Source: yumpu.com

Working Group members also get hands-on training on the Risk Assessment Tool. Money laundering and terrorist financing in the securities sector October 2009 6 - 2009 FATFOECD CHAPTER 1. RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. Working Group members also get hands-on training on the Risk Assessment Tool. Guidelines to Banks on Money Laundering and Terrorist Financing Risks Assessment and Relevant Prevention Program I.

Source: in.pinterest.com

Source: in.pinterest.com

Risk assessments examine current money laundering and terrorism financing threats and vulnerabilities in specific parts of Australias financial sector. BFIU and renamed it as Risk Assessment and Management Guidelines on Money Laundering and Terrorist Financing. INTRODUCTION 11 Introduction 1. The assessment process starts during the workshop. This guidance is applicable to all REs subject to the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations.

This guidance paper should be read in conjunction with. This guidance is applicable to all REs subject to the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. Other relevant FATF documents such as the. The purpose of the Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector the Guidelines is to assist credit and financial institutions Firms in understanding their AMLCFT obligations under Part 4 of the.

Source: bi.go.id

Source: bi.go.id

This guidance paper should be read in conjunction with. It provides sector specific guidance for risk assessment. The purpose of the Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector the Guidelines is to assist credit and financial institutions Firms in understanding their AMLCFT obligations under Part 4 of the. I am very happy to know that basic ideas regarding Money Laundering and Terrorist Financing local and international major initiatives against ML TF ML-TF risks assessment and management etc. An MLTF risk assessment is a product or process based on a methodology agreed by those parties involved that attempts to identify analyse and understand MLTF risks and serves as a first step in addressing them FATF Guidance on NRA.

RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. They are a resource for reporting entities to use to refine internal controls and to meet your reporting obligations particularly in relation to. This flexibility allows for a more efficient use of resources as banks. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. This guidance paper should be read in conjunction with.

Source: bi.go.id

Source: bi.go.id

RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. The securities industry along with banking and insurance is one of the core industries through which persons and entities can access the financial system. Money laundering and terrorist financing in the securities sector October 2009 6 - 2009 FATFOECD CHAPTER 1. INTRODUCTION 11 Introduction 1. A risk-based approach means that countries competent authorities and banks identify assess and understand the money laundering and terrorist financing risk to which they are exposed and take the appropriate mitigation measures in accordance with the level of risk.

Source: bi.go.id

Source: bi.go.id

The FATF Recommendations especially Recommendations 1 and 26 R. The assessment process starts during the workshop. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. FATF Guidance on National Money Laundering and Terrorist Financing Risk Assessment the. The sector specific guidance is further granulated keeping in view the specific threats to certain parts of the sector.

Source: pinterest.com

Source: pinterest.com

RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. Risk assessments examine current money laundering and terrorism financing threats and vulnerabilities in specific parts of Australias financial sector. RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. This guidance paper should be read in conjunction with. 26 and their Interpretive Notes INR and the Glossary.

I am very happy to know that basic ideas regarding Money Laundering and Terrorist Financing local and international major initiatives against ML TF ML-TF risks assessment and management etc. The purpose of the Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector the Guidelines is to assist credit and financial institutions Firms in understanding their AMLCFT obligations under Part 4 of the. Money laundering and terrorist financing in the securities sector October 2009 6 - 2009 FATFOECD CHAPTER 1. 26 and their Interpretive Notes INR and the Glossary. The securities industry along with banking and insurance is one of the core industries through which persons and entities can access the financial system.

Are initially covered in the guideline. Risk can be seen as a function of three factors. For example the National risk assessment of money laundering and terrorist financing is the guidance published by the UK government. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Are initially covered in the guideline.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering and terrorist financing risk assessment guidelines for banking sector by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.