18++ Money laundering and terrorism financing risk assessment guide information

Home » money laundering idea » 18++ Money laundering and terrorism financing risk assessment guide informationYour Money laundering and terrorism financing risk assessment guide images are available. Money laundering and terrorism financing risk assessment guide are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering and terrorism financing risk assessment guide files here. Find and Download all free images.

If you’re looking for money laundering and terrorism financing risk assessment guide images information related to the money laundering and terrorism financing risk assessment guide topic, you have come to the ideal site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

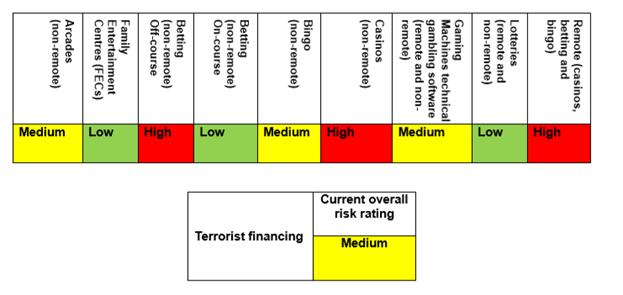

Money Laundering And Terrorism Financing Risk Assessment Guide. MONEY LAUNDERING AND TERRORISM FINANCING RISK ASSESSMENT. 9 your risk assessment is documented 9 you understand the MLTF risks to your business and review them regularly to identify new and emerging risks 9 your AMLCTF program enables you to identify mitigate and. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. The risk management guidelines published today include cross-references to FATF standards to help.

Money Laundering Terrorist Financing Risk Assessment From worldbank.org

Money Laundering Terrorist Financing Risk Assessment From worldbank.org

INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. Risk assessments examine current money laundering and terrorism financing threats and vulnerabilities in specific parts of Australias financial sector. This report draws on inputs from over 35. 1 The AsiaPacific Group on Money Laundering is an inter-governmental organization consisting of 41 member jurisdictions focused on ensuring that its members effectively implement the international standards against money laundering terrorism financing and proliferation financing related to weapons of mass destruction. In addition to strengthening financial institutions risk-based approaches to.

Working Group members also get hands-on training on the Risk Assessment Tool.

The revisions take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and address new MLTF risks including those identified by the EBAs implementation reviews. They are a resource for reporting entities to use to refine internal controls and to meet your reporting obligations particularly in relation to suspicious matter reporting. AUSTRALIA S NON BANK LENDING AND FINANCING SECTOR CONTENTS. The revisions take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and address new MLTF risks including those identified by the EBAs implementation reviews. The assessment process starts during the workshop. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Source: pinterest.com

Source: pinterest.com

Money launderingterrorism financing risk assessment. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. A risk assessment allows countries to identify assess and understand its money laundering and terrorist financing risks. Money launderingterrorism financing risk assessments REGULATORY QUICK GUIDE What is an effective approach to assessing MLTF risk. 9 your risk assessment is documented 9 you understand the MLTF risks to your business and review them regularly to identify new and emerging risks 9 your AMLCTF program enables you to identify mitigate and.

Source: pinterest.com

Source: pinterest.com

This report builds on the 2013 FATF guidance on national money laundering and terrorist financing risk assessments and draws on inputs from over 35 jurisdictions from across the FATF Global Network on their extensive experience and lessons learnt in assessing terrorist financing risk. AUSTRALIA S NON BANK LENDING AND FINANCING SECTOR CONTENTS. 2 Preface Banking is considered as life blood of an economy and it plays a vital role in socio-economic. Working Group members also get hands-on training on the Risk Assessment Tool. The inherent risk assessment consists of an assessment of the MLTF threats and inherent MLTF vulnerabilities of Canada as a whole eg economy geography demographics and its key economic sectors and financial products while taking into account the consequences of money laundering and terrorist financing.

Source: bi.go.id

Source: bi.go.id

These guidelines are consistent with the International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation issued by the Financial Action Task Force FATF in 2012 and supplement their goals and objectives. The purpose of this workshop is to introduce the assessment tool and launch the assessment process. This report draws on inputs from over 35. The enterprise-wide money laundering and terrorism financing MLTF risk assessment EWRA assesses a financial institutions FI inherent MLTF risks the effectiveness of the control environment designed to mitigate those risks and the need to implement additional measures to manage residual risks where necessary. Building on the FATFs 2013 Guidance on National Money Laundering and Terrorist Financing Risk Assessments2 this report provides good approaches relevant information sources and practical examples for practitioners to consider when assessing TF risk at the jurisdiction level.

Source: bi.go.id

Source: bi.go.id

AUSTRALIA S NON BANK LENDING AND FINANCING SECTOR CONTENTS. 11 CRIMINAL THREAT ENVIRONMENT 12 Money Laundering 15 Terrorism Financing 17 Predicate Offences 18 VULNERABILITIES 24 Customers 25 Products. This report draws on inputs from over 35. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. They are a resource for reporting entities to use to refine internal controls and to meet your reporting obligations particularly in relation to suspicious matter reporting.

Source: worldbank.org

Source: worldbank.org

They are a resource for reporting entities to use to refine internal controls and to meet your reporting obligations particularly in relation to suspicious matter reporting. Understanding the money laundering and terrorist financing risks is an essential part of developing and implementing a national anti-money laundering countering the financing of terrorism AMLCFT regime. The enterprise-wide money laundering and terrorism financing MLTF risk assessment EWRA assesses a financial institutions FI inherent MLTF risks the effectiveness of the control environment designed to mitigate those risks and the need to implement additional measures to manage residual risks where necessary. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. The purpose of this workshop is to introduce the assessment tool and launch the assessment process.

Source: lexology.com

Source: lexology.com

Money launderingterrorism financing risk assessments REGULATORY QUICK GUIDE What is an effective approach to assessing MLTF risk. 11 CRIMINAL THREAT ENVIRONMENT 12 Money Laundering 15 Terrorism Financing 17 Predicate Offences 18 VULNERABILITIES 24 Customers 25 Products. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. Money launderingterrorism financing risk assessment. Understanding the money laundering and terrorist financing risks is an essential part of developing and implementing a national anti-money laundering countering the financing of terrorism AMLCFT regime.

Source: government.se

Money launderingterrorism financing risk assessments REGULATORY QUICK GUIDE What is an effective approach to assessing MLTF risk. This report draws on inputs from over 35. 9 your risk assessment is documented 9 you understand the MLTF risks to your business and review them regularly to identify new and emerging risks 9 your AMLCTF program enables you to identify mitigate and. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. The risk management guidelines published today include cross-references to FATF standards to help.

Source: fatf-gafi.org

Source: fatf-gafi.org

Money launderingterrorism financing risk assessments REGULATORY QUICK GUIDE What is an effective approach to assessing MLTF risk. National risk assessment of money laundering and terrorist financing 2020 PDF 124MB 152 pages This file may not be suitable for users of assistive technology. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. Risk Assessment and Management Guidelines on Money Laundering and Terrorist Financing Sonali Bank Limited Money Laundering Terrorism Financing Prevention and Vigilance Division Head Office Dhaka. AUSTRALIA S NON BANK LENDING AND FINANCING SECTOR CONTENTS.

Source: bi.go.id

These guidelines are consistent with the International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation issued by the Financial Action Task Force FATF in 2012 and supplement their goals and objectives. The EBA published today its final revised Guidelines on MLTF risk factors. 11 CRIMINAL THREAT ENVIRONMENT 12 Money Laundering 15 Terrorism Financing 17 Predicate Offences 18 VULNERABILITIES 24 Customers 25 Products. National risk assessment of money laundering and terrorist financing 2020 PDF 124MB 152 pages This file may not be suitable for users of assistive technology. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Source: bi.go.id

Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. A risk assessment allows countries to identify assess and understand its money laundering and terrorist financing risks. Money launderingterrorism financing risk assessments REGULATORY QUICK GUIDE What is an effective approach to assessing MLTF risk. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country. This report builds on the 2013 FATF guidance on national money laundering and terrorist financing risk assessments and draws on inputs from over 35 jurisdictions from across the FATF Global Network on their extensive experience and lessons learnt in assessing terrorist financing risk.

Source: bi.go.id

Source: bi.go.id

The assessment process starts during the workshop. EXECUTIVE SUMMARY 03 PURPOSE08 BACKGROUND 09 METHODOLOGY. Money launderingterrorism financing risk assessments REGULATORY QUICK GUIDE What is an effective approach to assessing MLTF risk. These guidelines are consistent with the International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation issued by the Financial Action Task Force FATF in 2012 and supplement their goals and objectives. The EBA published today its final revised Guidelines on MLTF risk factors.

Source: greenclimate.fund

Source: greenclimate.fund

The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. Money launderingterrorism financing risk assessment. These guidelines are consistent with the International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation issued by the Financial Action Task Force FATF in 2012 and supplement their goals and objectives. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program.

Source: bi.go.id

Source: bi.go.id

1 The AsiaPacific Group on Money Laundering is an inter-governmental organization consisting of 41 member jurisdictions focused on ensuring that its members effectively implement the international standards against money laundering terrorism financing and proliferation financing related to weapons of mass destruction. 11 CRIMINAL THREAT ENVIRONMENT 12 Money Laundering 15 Terrorism Financing 17 Predicate Offences 18 VULNERABILITIES 24 Customers 25 Products. In addition to strengthening financial institutions risk-based approaches to. 1 The AsiaPacific Group on Money Laundering is an inter-governmental organization consisting of 41 member jurisdictions focused on ensuring that its members effectively implement the international standards against money laundering terrorism financing and proliferation financing related to weapons of mass destruction. Money launderingterrorism financing risk assessment.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering and terrorism financing risk assessment guide by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.