16+ Money laundering act bafin information

Home » money laundering idea » 16+ Money laundering act bafin informationYour Money laundering act bafin images are ready in this website. Money laundering act bafin are a topic that is being searched for and liked by netizens now. You can Download the Money laundering act bafin files here. Find and Download all royalty-free photos.

If you’re looking for money laundering act bafin images information connected with to the money laundering act bafin topic, you have visit the ideal blog. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Money Laundering Act Bafin. This applies for example to the design of the transparency registers the national risk analysis or the structure of the Financial Intelligence Units FIUs. 13 Payment institutions and electronic money institutions. The requirements concern the areas of. This order comes two years after BaFin first accused the N26 of loose anti-money laundering controls.

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium From medium.com

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium From medium.com

The N26 is also said to have adequate personnel technical and organizational resources to comply with its obligations under the Anti-Money Laundering Act. The requirements concern the areas of. However developments in recent years the planned expansion of the Federal Financial Supervisory Authority BaFin and the call for stricter supervision are increasing the pressure on the industry. BaFin finalized the Interpretation and Application Guidance AuA of the Money Laundering Act In June 2021 BaFin published the final version section of the Application Guidance of the Money Laundering Act for credit institutions. For the first time BaFin specifies the requirements for the adequacy of a data processing system so that a credit institution can fulfil its obligations under money laundering law. Germany February 7 2020 In December 2018 the German Federal Financial Supervisory Authority BaFin published its general Guidance on the.

13 Payment institutions and electronic money institutions.

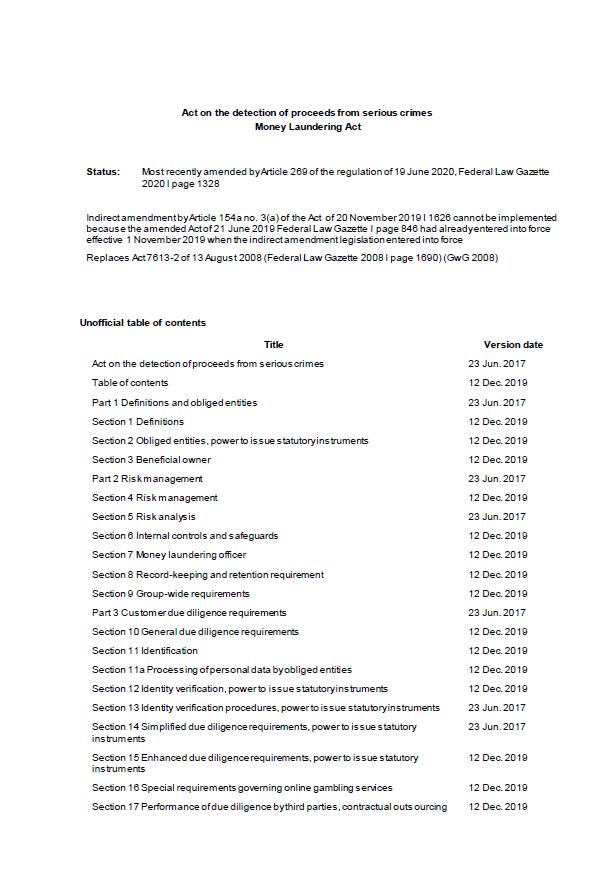

In accordance with section 518 of the Anti Money Laundering Act Geldwäschebekämpfungsgesetz-GWG BaFin provides the obligated persons and entities under its supervision with regularly updated interpretation and application instructions for the implementation of due diligence obligations and internal safeguarding measures in accordance with the statutory provisions on the prevention of money. The N26 is also said to have adequate personnel technical and organizational resources to comply with its obligations under the Anti-Money Laundering Act. The directive is to contain specifications the design of which is to be left to the member states. BaFin-Interpretation and Application Guidance in relation to the German Money Laundering Act May 2020 Table of contents. The only authentic text is the German one as published in the Federal Law Gazette Bundesgesetzblatt. Pursuant to the German Money Laundering Act GwG BaFin has to provide obliged entities belonging to the financial sector with regularly updated interpretation and application notes for the implementation of the due diligence and internal safeguard measures to prevent money laundering.

Source: pinterest.com

Source: pinterest.com

In addition to the AML Regulation the Commission proposes a 6th Anti-Money Laundering Directive. The N26 is also said to have adequate personnel technical and organizational resources to comply with its obligations under the Anti-Money Laundering Act. The requirements concern the areas of. This translation is not official. Selection free choice and nature of the data processing system Suitability of the software.

Source: bitquery.io

Source: bitquery.io

Addressees of the anti-money laundering obligations under the supervision of BaFin. BaFin finalized the Interpretation and Application Guidance AuA of the Money Laundering Act In June 2021 BaFin published the final version section of the Application Guidance of the Money Laundering Act for credit institutions. For the first time BaFin specifies the requirements for the adequacy of a data processing system so that a credit institution can fulfil its obligations under money laundering law. The German supervisory authority is obliged to issue guidance on how to construe and to apply the provisions of the German Anti-Money Laundering Act every once in a while sect. The German Act Implementing the Amending Directive on the Fourth EU Anti-Money Laundering Directive made Germany one of the first countries in the world to enable financial institutions FIs to custody crypto assets as a new type of financial service by incorporating it into the German Banking Act Kreditwesengesetz KWG.

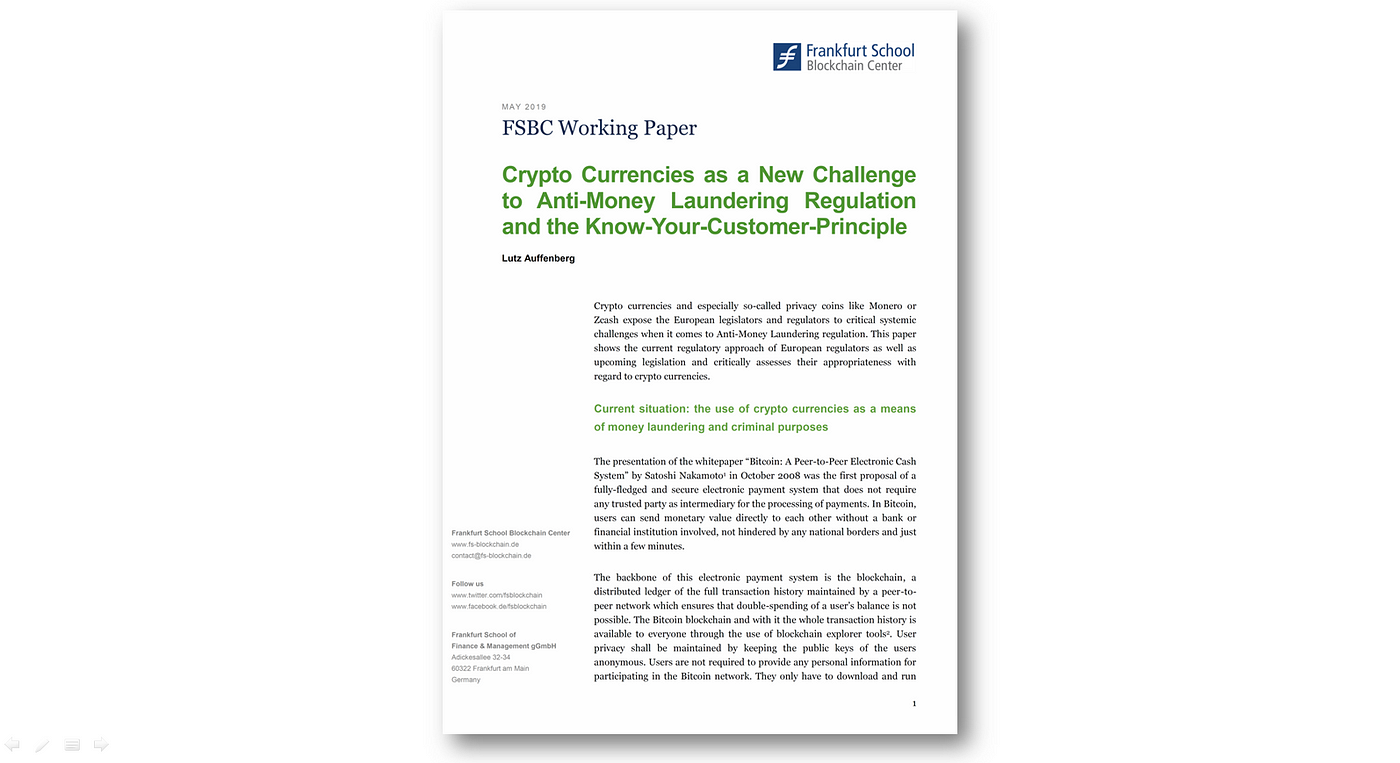

Source: fsblockchain.medium.com

Source: fsblockchain.medium.com

The German supervisory authority is obliged to issue guidance on how to construe and to apply the provisions of the German Anti-Money Laundering Act every once in a while sect. The German supervisory authority is obliged to issue guidance on how to construe and to apply the provisions of the German Anti-Money Laundering Act every once in a while sect. Germany February 7 2020 In December 2018 the German Federal Financial Supervisory Authority BaFin published its general Guidance on the. 13 Payment institutions and electronic money institutions. BaFin being the German supervisory authority has fulfilled its obligation by issuing the Guidance for insurance undertakings.

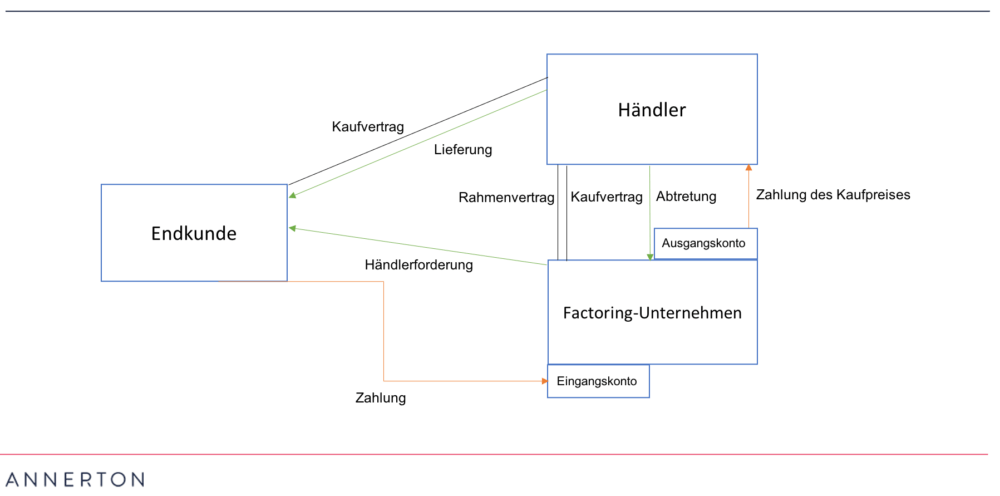

Source: paytechlaw.com

Source: paytechlaw.com

For the first time BaFin specifies the requirements for the adequacy of a data processing system so that a credit institution can fulfil its obligations under money laundering law. The N26 is also said to have adequate personnel technical and organizational resources to comply with its obligations under the Anti-Money Laundering Act. This translation is not official. For the first time BaFin specifies the requirements for the adequacy of a data processing system so that a credit institution can fulfil its obligations under money laundering law. They apply to all credit institutions under the supervision of BaFin.

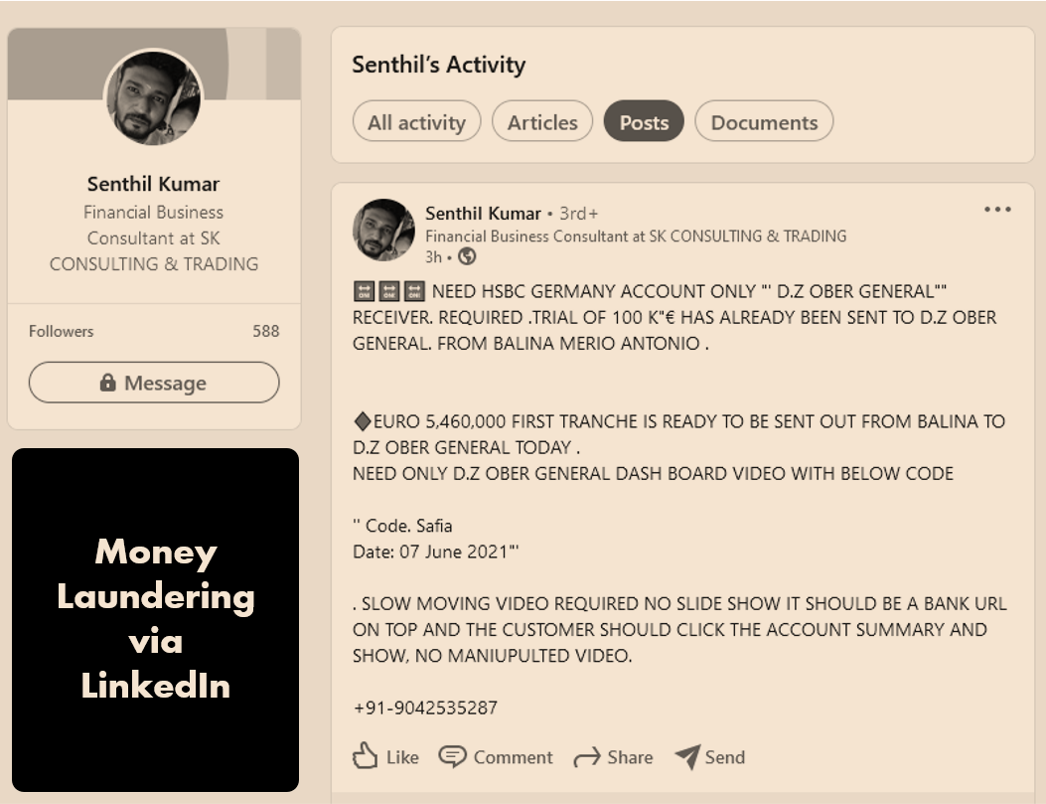

Source: medium.com

Source: medium.com

This translation is not official. The only authentic text is the German one as published in the Federal Law Gazette Bundesgesetzblatt. BaFin finalized the Interpretation and Application Guidance AuA of the Money Laundering Act In June 2021 BaFin published the final version section of the Application Guidance of the Money Laundering Act for credit institutions. The directive is to contain specifications the design of which is to be left to the member states. This applies for example to the design of the transparency registers the national risk analysis or the structure of the Financial Intelligence Units FIUs.

Source: q-perior.com

Source: q-perior.com

13 Payment institutions and electronic money institutions. 29092020 Topic Anti-money laundering Anti-Money Laundering Act Geldwäschegesetz - GwG Translated by BaFin. This translation is not official. They apply to all credit institutions under the supervision of BaFin. The only authentic text is the German one as published in the Federal Law Gazette Bundesgesetzblatt.

For the first time BaFin specifies the requirements for the adequacy of a data processing system so that a credit institution can fulfil its obligations under money laundering law. They apply to all credit institutions under the supervision of BaFin. The German supervisory authority is obliged to issue guidance on how to construe and to apply the provisions of the German Anti-Money Laundering Act every once in a while sect. Germany February 7 2020 In December 2018 the German Federal Financial Supervisory Authority BaFin published its general Guidance on the. 12 Financial services institutions.

Source: geldwaesche-beauftragte.de

Source: geldwaesche-beauftragte.de

This order comes two years after BaFin first accused the N26 of loose anti-money laundering controls. 29092020 Topic Anti-money laundering Anti-Money Laundering Act Geldwäschegesetz - GwG Translated by BaFin. Addressees of the anti-money laundering obligations under the supervision of BaFin. This order comes two years after BaFin first accused the N26 of loose anti-money laundering controls. 13 Payment institutions and electronic money institutions.

Source: fintelegram.com

Source: fintelegram.com

The German Act Implementing the Amending Directive on the Fourth EU Anti-Money Laundering Directive made Germany one of the first countries in the world to enable financial institutions FIs to custody crypto assets as a new type of financial service by incorporating it into the German Banking Act Kreditwesengesetz KWG. However developments in recent years the planned expansion of the Federal Financial Supervisory Authority BaFin and the call for stricter supervision are increasing the pressure on the industry. The directive is to contain specifications the design of which is to be left to the member states. The requirements concern the areas of. BaFin finalized the Interpretation and Application Guidance AuA of the Money Laundering Act In June 2021 BaFin published the final version section of the Application Guidance of the Money Laundering Act for credit institutions.

Source: pinterest.com

Source: pinterest.com

In addition to the AML Regulation the Commission proposes a 6th Anti-Money Laundering Directive. Kerberos Compliance helps you to meet the requirements of the Money Laundering Act. The requirements concern the areas of. The only authentic text is the German one as published in the Federal Law Gazette Bundesgesetzblatt. Germany February 7 2020 In December 2018 the German Federal Financial Supervisory Authority BaFin published its general Guidance on the.

Source: regtechtimes.com

Source: regtechtimes.com

13 Payment institutions and electronic money institutions. The requirements concern the areas of. This applies for example to the design of the transparency registers the national risk analysis or the structure of the Financial Intelligence Units FIUs. BaFin finalized the Interpretation and Application Guidance AuA of the Money Laundering Act In June 2021 BaFin published the final version section of the Application Guidance of the Money Laundering Act for credit institutions. Kerberos Compliance helps you to meet the requirements of the Money Laundering Act.

Source: theliberalwing.com

Source: theliberalwing.com

For the first time BaFin specifies the requirements for the adequacy of a data processing system so that a credit institution can fulfil its obligations under money laundering law. In addition to the AML Regulation the Commission proposes a 6th Anti-Money Laundering Directive. BaFin-Interpretation and Application Guidance in relation to the German Money Laundering Act May 2020 Table of contents. The N26 is also said to have adequate personnel technical and organizational resources to comply with its obligations under the Anti-Money Laundering Act. The only authentic text is the German one as published in the Federal Law Gazette Bundesgesetzblatt.

Source: pinterest.com

Source: pinterest.com

The German Act Implementing the Amending Directive on the Fourth EU Anti-Money Laundering Directive made Germany one of the first countries in the world to enable financial institutions FIs to custody crypto assets as a new type of financial service by incorporating it into the German Banking Act Kreditwesengesetz KWG. BaFin-Interpretation and Application Guidance in relation to the German Money Laundering Act May 2020 Table of contents. Pursuant to the German Money Laundering Act GwG BaFin has to provide obliged entities belonging to the financial sector with regularly updated interpretation and application notes for the implementation of the due diligence and internal safeguard measures to prevent money laundering. The German Act Implementing the Amending Directive on the Fourth EU Anti-Money Laundering Directive made Germany one of the first countries in the world to enable financial institutions FIs to custody crypto assets as a new type of financial service by incorporating it into the German Banking Act Kreditwesengesetz KWG. In accordance with section 518 of the Anti Money Laundering Act Geldwäschebekämpfungsgesetz-GWG BaFin provides the obligated persons and entities under its supervision with regularly updated interpretation and application instructions for the implementation of due diligence obligations and internal safeguarding measures in accordance with the statutory provisions on the prevention of money.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering act bafin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.