13++ Money laundering 3 types ideas in 2021

Home » money laundering idea » 13++ Money laundering 3 types ideas in 2021Your Money laundering 3 types images are available. Money laundering 3 types are a topic that is being searched for and liked by netizens now. You can Get the Money laundering 3 types files here. Download all free vectors.

If you’re looking for money laundering 3 types images information linked to the money laundering 3 types interest, you have pay a visit to the right site. Our site always gives you hints for downloading the highest quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

Money Laundering 3 Types. You must seek legal counsel when accused of money laundering. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes. The idea of cash laundering is essential to be understood for those working in the monetary sector. Stage 1 of Money Laundering.

Understanding Money Laundering European Institute Of Management And Finance From eimf.eu

Understanding Money Laundering European Institute Of Management And Finance From eimf.eu

Up to 20 years in a federal prison. Up to 500000 in fines. Money laundering is a term used to describe the process of taking funds generated from illegal activities and making legitimate and clean. The stages of money laundering include the. Stage 1 of Money Laundering. Transferring or concealing the source of.

What are the 3 types of risks.

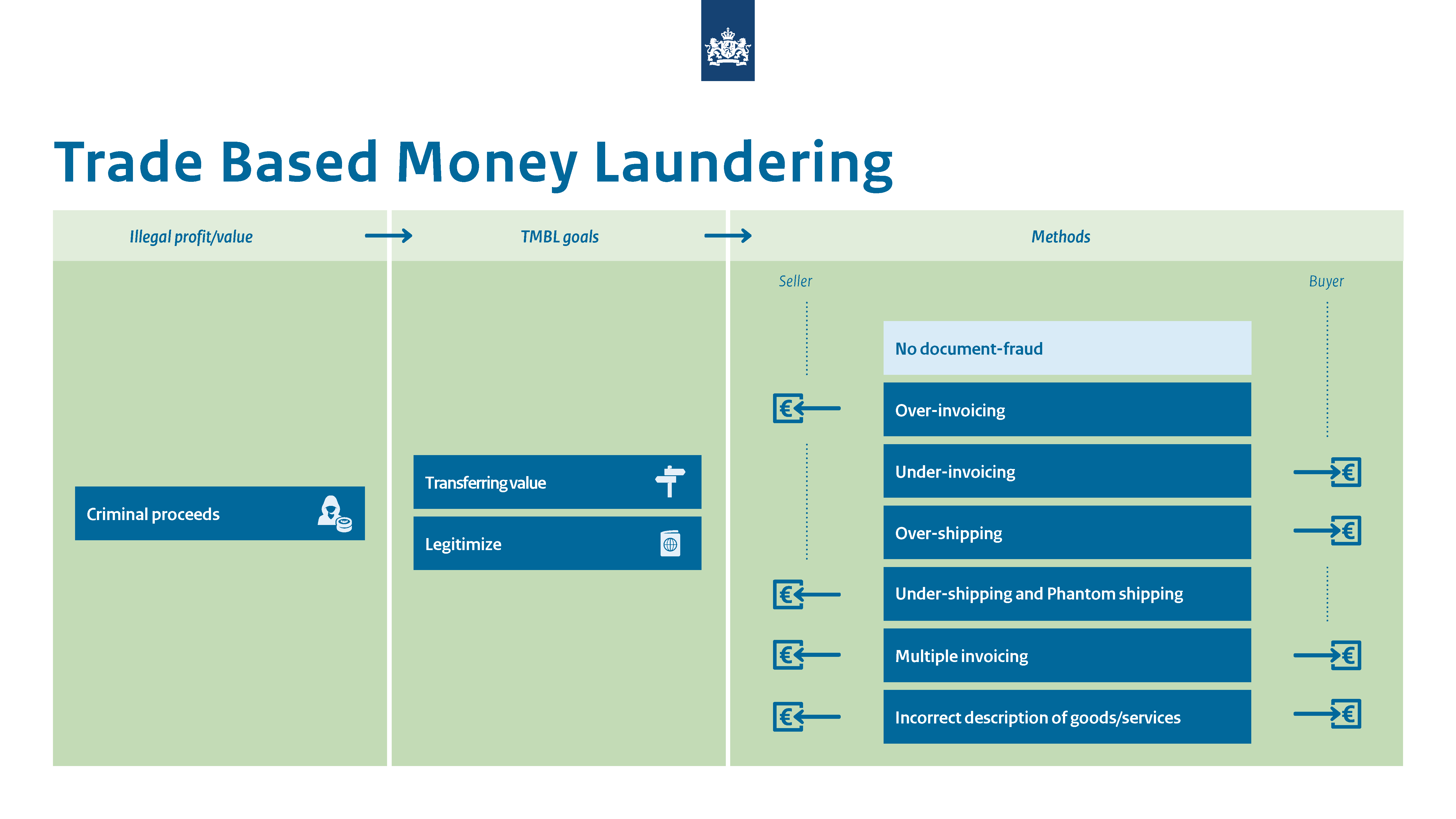

Business Risk Non-Business Risk and Financial Risk. Transferring or concealing the source of. Its a course of by which soiled money is converted into clear cash. They include bank methods smurfing or structuring currency exchanges and double-invoicing. Obtaining the money or introducing it into the financial system in some way. Money laundering is accomplished in many ways though most include three common steps including.

Source: amlc.eu

Source: amlc.eu

The money laundering cycle can be broken down into three distinct stages. The stages of money laundering include the. To be criminally culpable under 18 U. What are the 3 types of risks. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The idea of cash laundering is essential to be understood for those working within the monetary sector. One of the most common ways to perform money laundering may be creating a shell company or business. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process. Up to 500000 in fines. Stage 1 of Money Laundering.

Source: brittontime.com

Source: brittontime.com

However it is important to remember that money laundering is a single process. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. What are the 3 types of risks. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. Examples of money laundering 1.

Source: pinterest.com

Source: pinterest.com

They include bank methods smurfing or structuring currency exchanges and double-invoicing. Stage 1 of Money Laundering. Risk and Types of Risks. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. The sources of the cash in actual are prison and the cash is invested in a manner that makes it appear like clear cash and hide the identification of the prison a part of.

Source: bitquery.io

Source: bitquery.io

Money laundering is a term used to describe the process of taking funds generated from illegal activities and making legitimate and clean. This final stage of money laundering successfully puts the so-called cleaned money back into the economy. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes. How Money Laundering Works. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk.

Source: efinancemanagement.com

Source: efinancemanagement.com

The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. Section 1956 a defines three types of criminal conduct. Money laundering is accomplished in many ways though most include three common steps including. They include bank methods smurfing or structuring currency exchanges and double-invoicing. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes.

Source: eimf.eu

Source: eimf.eu

1 placement 2 layering and 3 integration. Having successfully processed criminal profits through the first two phases money launderers then move the funds to the third stage integration. They include using shell companies small bank deposits and regular consistent bank deposits. They pretend service sales justifying the difficulty of quantification with this they argue the refund of foreign currency that once legalized to the local currency is distributed to natural persons incurring money laundering. The stages of money laundering include the.

Its a course of by which soiled money is converted into clear cash. It is important to understand some widely used money. They include using shell companies small bank deposits and regular consistent bank deposits. The stages of money laundering include the. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of.

Source: br.pinterest.com

Source: br.pinterest.com

Domestic money laundering transactions 1956 a 1. You must seek legal counsel when accused of money laundering. However it is important to remember that money laundering is a single process. It is conducted in three stages to manipulate the authorities. These money laundering methods can broadly be categorised into a few types.

Source: shuftipro.com

Source: shuftipro.com

There are three stages of money laundering each with a unique purpose. The stages of money laundering include the. If convicted of money laundering you could be facing. Money laundering typically occurs in three phases. One of the most common ways to perform money laundering may be creating a shell company or business.

Source: piranirisk.com

Source: piranirisk.com

You must seek legal counsel when accused of money laundering. Money laundering is the illegal movement of black money through several transactions conducted through financial infrastructure. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. You must seek legal counsel when accused of money laundering. This is where the cash comes back into the legitimate economy.

Source: id.pinterest.com

Source: id.pinterest.com

Stage 1 of Money Laundering. Examples of money laundering 1. Increasing digitalization and new online payment and entertainment options have created new avenues for money launderers. However it is important to remember that money laundering is a single process. International money laundering transactions 1956 a 2.

Source: pinterest.com

Source: pinterest.com

Money laundering is a threat to the good functioning of a financial system. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. This is where the cash comes back into the legitimate economy. Steps in Money Laundering. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering 3 types by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.