16+ Money launderers in history ideas in 2021

Home » money laundering idea » 16+ Money launderers in history ideas in 2021Your Money launderers in history images are ready in this website. Money launderers in history are a topic that is being searched for and liked by netizens now. You can Get the Money launderers in history files here. Download all royalty-free images.

If you’re looking for money launderers in history images information linked to the money launderers in history keyword, you have come to the right site. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Money Launderers In History. Money laundering is not the oldest crime in the book but its certainly close. Loan-back money laundering Front company. AMLA served to strengthen and modernize the BSA by addressing the money laundering threats posed by shell companies and by emerging technologies like cryptocurrencies. In December 2012 it paid a 19 billion fine for money-laundering activities to smugglers terrorists and sanctioned governments such as Iran.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

The report aims to the describe functions and characteristics that define aprofessional money launderer namely. However the advent of modern technology has given rise to a whole new range of sophisticated methods. Money laundering is not the oldest crime in the book but its certainly close. Laws against money laundering were created to use against organized crime during the period of Prohibition in the United States during the 1930s. In the US money laundering took off in the 1920s during the prohibition era. AMLA served to strengthen and modernize the BSA by addressing the money laundering threats posed by shell companies and by emerging technologies like cryptocurrencies.

Loan-back money laundering Front company.

For instance they may open an antiquities shop in the centre of a big city in. Money laundering has evolved over the years with the oldest methods based on paper and hard currency. You may have heard of. Loan-back money laundering Front company. Well successful until they got caught of course. And of course from those seeking to enforce judgments in civil cases or to follow the money that results from other crime.

Money laundering is not the oldest crime in the book but its certainly close. However the advent of modern technology has given rise to a whole new range of sophisticated methods. In the US money laundering took off in the 1920s during the prohibition era. If money launderers have recurrent income they typically set up antiquities businesses through which they combine an actual activity with fictitious transactions and clients. Laws against money laundering were created to use against organized crime during the period of Prohibition in the United States during the 1930s.

Source: pinterest.com

Source: pinterest.com

In the 1930s he was the first to use the Caribbean to hide the criminal proceeds that had been laundered through Casinos in Las Vegas before moving to Cuba where he oversaw gambling concessions. The report aims to the describe functions and characteristics that define aprofessional money launderer namely. Organized crime received a major boost from Prohibition and a large source of new funds that were obtained from illegal sales of alcohol. And of course from those seeking to enforce judgments in civil cases or to follow the money that results from other crime. Money laundering is not the oldest crime in the book but its certainly close.

One of the first big money launderers Capone is estimated to have laundered 1 billion through various businesses. In the US money laundering took off in the 1920s during the prohibition era. Organized crime boomed as the demand for alcohol rose. In the 1930s he was the first to use the Caribbean to hide the criminal proceeds that had been laundered through Casinos in Las Vegas before moving to Cuba where he oversaw gambling concessions. Organized crime received a major boost from Prohibition and a large source of new funds that were obtained from illegal sales of alcohol.

Source: arachnys.com

Source: arachnys.com

From the Wikipedia article Money Laundering Money laundering is the act of concealing the transformation of profits from illegal activities and corruption into ostensibly legitimate assets. However the advent of modern technology has given rise to a whole new range of sophisticated methods. In December 2012 it paid a 19 billion fine for money-laundering activities to smugglers terrorists and sanctioned governments such as Iran. If money launderers have recurrent income they typically set up antiquities businesses through which they combine an actual activity with fictitious transactions and clients. Well successful until they got caught of course.

Source: bi.go.id

Source: bi.go.id

Laws against money laundering were created to use against organized crime during the period of Prohibition in the United States during the 1930s. Money laundering has evolved over the years with the oldest methods based on paper and hard currency. Meyer Lansky is recognized as the father of the modern form of money laundering. Loan-back money laundering Front company. If money launderers have recurrent income they typically set up antiquities businesses through which they combine an actual activity with fictitious transactions and clients.

Source: jagranjosh.com

Source: jagranjosh.com

For instance they may open an antiquities shop in the centre of a big city in. The most recent and significant development in the history of the BSA and AMLCFT in the United States was the passage of the Anti-Money Laundering Act 2020 on 1st January 2021. The history of money laundering is primarily that of hiding money or assets from the state - either from blatant confiscation or from taxation - and indeed from a combination of both. To coordinate an international response to this danger the Group of Seven G-7 Canada France Germany Italy Japan the United Kingdom and the United States in 1989 formed a global money-laundering watchdog organization called the Financial Action Task Force FATF. Professional money launderers PMLs that specialise in enabling criminals to evade anti-money laundering and counter terrorist financing safeguards and sanctionsin order to enjoy the profits from illegal activities.

Source: slideshare.net

Source: slideshare.net

You may have heard of. From the Wikipedia article Money Laundering Money laundering is the act of concealing the transformation of profits from illegal activities and corruption into ostensibly legitimate assets. In December 2012 it paid a 19 billion fine for money-laundering activities to smugglers terrorists and sanctioned governments such as Iran. However the advent of modern technology has given rise to a whole new range of sophisticated methods. As alcohol was made illegal in the US a profitable black market soon arose to fill the boozy gap.

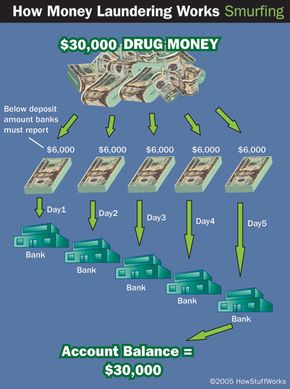

Source: money.howstuffworks.com

Source: money.howstuffworks.com

You may have heard of. In December 2012 it paid a 19 billion fine for money-laundering activities to smugglers terrorists and sanctioned governments such as Iran. One of the first big money launderers Capone is estimated to have laundered 1 billion through various businesses. Loan-back money laundering Front company. Organized crime received a major boost from Prohibition and a large source of new funds that were obtained from illegal sales of alcohol.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Money laundering has evolved over the years with the oldest methods based on paper and hard currency. The history of money laundering is primarily that of hiding money or assets from the state - either from blatant confiscation or from taxation - and indeed from a combination of both. Organized crime received a major boost from Prohibition and a large source of new funds that were obtained from illegal sales of alcohol. To coordinate an international response to this danger the Group of Seven G-7 Canada France Germany Italy Japan the United Kingdom and the United States in 1989 formed a global money-laundering watchdog organization called the Financial Action Task Force FATF. Money laundering is the process of disguising the proceeds of crime and integrating it into the legitimate financial system.

Loan-back money laundering Front company. Money laundering is not the oldest crime in the book but its certainly close. The report aims to the describe functions and characteristics that define aprofessional money launderer namely. Laws against money laundering were created to use against organized crime during the period of Prohibition in the United States during the 1930s. Laundering can be done in a bunch of different ways but the people listed below had to get creative in order to establish themselves as some of the most successful money launderers in history.

Professional money launderers PMLs that specialise in enabling criminals to evade anti-money laundering and counter terrorist financing safeguards and sanctionsin order to enjoy the profits from illegal activities. However the advent of modern technology has given rise to a whole new range of sophisticated methods. In todays environment money laundering is generally undertaken through four primary methods. In December 2012 it paid a 19 billion fine for money-laundering activities to smugglers terrorists and sanctioned governments such as Iran. For instance they may open an antiquities shop in the centre of a big city in.

Source: kyc-chain.com

Source: kyc-chain.com

Money laundering has evolved over the years with the oldest methods based on paper and hard currency. One of the first big money launderers Capone is estimated to have laundered 1 billion through various businesses. To coordinate an international response to this danger the Group of Seven G-7 Canada France Germany Italy Japan the United Kingdom and the United States in 1989 formed a global money-laundering watchdog organization called the Financial Action Task Force FATF. Well successful until they got caught of course. Money laundering has evolved over the years with the oldest methods based on paper and hard currency.

Source: book.coe.int

Source: book.coe.int

Before proceeds of crime are laundered it is problematic for criminals to use the illicit money because they cannot explain where it came from and it is easier to trace it back to the crime. In the US money laundering took off in the 1920s during the prohibition era. Money laundering has evolved over the years with the oldest methods based on paper and hard currency. The history of money laundering is primarily that of hiding money or assets from the state - either from blatant confiscation or from taxation - and indeed from a combination of both. If money launderers have recurrent income they typically set up antiquities businesses through which they combine an actual activity with fictitious transactions and clients.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money launderers in history by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.