12+ Money housing reverse mortgage info

Home » money laundering idea » 12+ Money housing reverse mortgage infoYour Money housing reverse mortgage images are available in this site. Money housing reverse mortgage are a topic that is being searched for and liked by netizens now. You can Download the Money housing reverse mortgage files here. Get all free vectors.

If you’re looking for money housing reverse mortgage images information linked to the money housing reverse mortgage topic, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

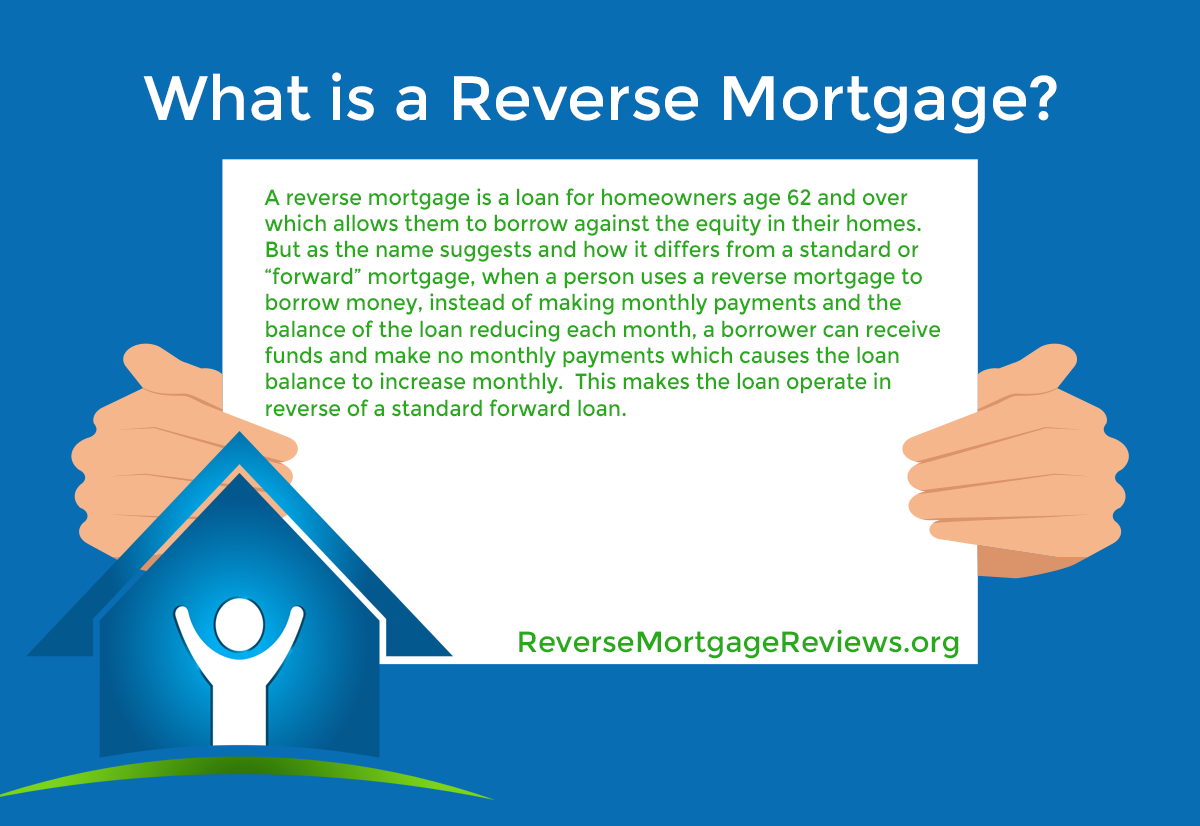

Money Housing Reverse Mortgage. It is usually marketed to seniors as the structure of such loans can suit their lifestyles. For example an. Instead the lender is simply loaning money which is secured by the. A reverse mortgage is a loan for senior homeowners that allows for use of a portion of the homes equity as collateral.

Five Alternatives To A Reverse Mortgage Mortgage Professional America From mpamag.com

Five Alternatives To A Reverse Mortgage Mortgage Professional America From mpamag.com

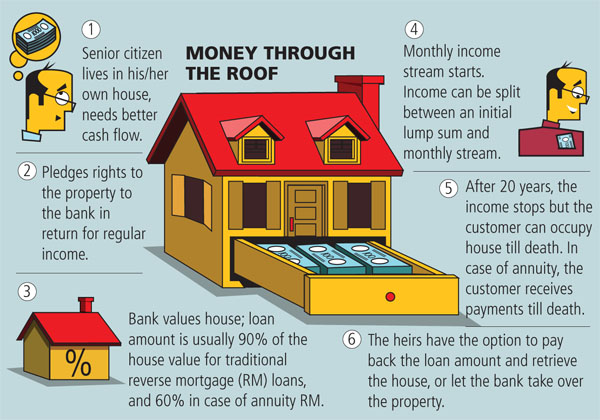

Department of Housing and Urban Development HUD backs HECMs which are one of the most popular types of reverse mortgage. You will owe the total debt of the reverse mortgage upon selling or 95 of the appraised value if the debt exceeds the value. As a guide add 1 for each year over 60. For people living in the home they plan to stay in for the rest of their life the extra money can make a big. In layman terms a reverse mortgage allows a homeowner to receive monthly payments like an annuity which is actually the money they have in the propertys value. Reverse mortgage purchase amortization.

The extra 5 is covered by insurance.

After a reverse mortgage has been approved the borrowers must use. The down payment includes all upfront mortgage insurance premium and third-party closing. Must fully own their home. Typically the lender recovers the loan after the death of the last surviving borrower or when they leave the property. For people living in the home they plan to stay in for the rest of their life the extra money can make a big. For example an.

Source: aag.com

Source: aag.com

Thats a lot to consider and the relationship between these multiple factors is complicated. So at 65 the most you can borrow will be about 2025. It is usually marketed to seniors as the structure of such loans can suit their lifestyles. A reverse mortgage is essentially a secured loan against property that enables a homeowner to access equity in the property. Instead the lender is simply loaning money which is secured by the.

Source: debt.org

Source: debt.org

So at 65 the most you can borrow will be about 2025. The extra 5 is covered by insurance. You hold the remaining home equity. The FHA-insured HECM is the most common reverse mortgage type in the USA. According to its eligibility standards the borrower must meet one of the following reverse mortgage requirements.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

A reverse mortgage is a loan that allows people 62 years old and older to cash the equity value of their home. Our programs address homebuyer education mortgage delinquency foreclosure intervention credit counseling SB1167 the Illinois Predatory Lending Database reverse mortgages and debtor education as required by the. Weve simplified the process with MoneyGeeks Reverse Mortgage Calculator. There is no fixed equity requirement to borrow a reverse mortgage. When you sell your reverse mortgaged home you must pay back the mortgage balance and the lender will close your loan account.

Source: reversemortgagereviews.org

Source: reversemortgagereviews.org

Expect an appraiser hired by the lender to appraise the property. After a reverse mortgage has been approved the borrowers must use. You might choose a reverse mortgage if youre struggling to make ends meet and need a source of extra income. Respond to the lender within 30 days of receiving the letter that you plan to sell the home. There is no fixed equity requirement to borrow a reverse mortgage.

Source: fha.com

Source: fha.com

If youre age 60 the most you can borrow is likely to be 1520 of the value of your home. It is usually marketed to seniors as the structure of such loans can suit their lifestyles. When you sell your reverse mortgaged home you must pay back the mortgage balance and the lender will close your loan account. For example an. A reverse mortgage or Home Equity Conversion Loan HECM is a loan that a credit agency takes out against your home while youre still living in it.

Source: investopedia.com

Source: investopedia.com

A reverse mortgage is a type of loan for homeowners age 62 and older. The down payment includes all upfront mortgage insurance premium and third-party closing. The lender is not attempting to buy the property. In layman terms a reverse mortgage allows a homeowner to receive monthly payments like an annuity which is actually the money they have in the propertys value. Expect an appraiser hired by the lender to appraise the property.

Source: globalnews.ca

Source: globalnews.ca

In this example we will use a borrower aged 70 years old using a reverse mortgage for home purchase with a sales price of 400000. There is no fixed equity requirement to borrow a reverse mortgage. Expect an appraiser hired by the lender to appraise the property. Yes you can sell a house with a reverse mortgage at any time just like on a traditional mortgage. You hold the remaining home equity.

Source: investopedia.com

Source: investopedia.com

The down payment includes all upfront mortgage insurance premium and third-party closing. The required down payment is 182000 or approximately 45 of the purchase price. Yes you can sell a house with a reverse mortgage at any time just like on a traditional mortgage. That depends on your age home value the number of years you plan to occupy the property current interest rates and your loan costs. If youre 62 or older own a home and need money for your retirement you may be intrigued by a home equity conversion mortgage HECM.

Source: shutterstock.com

Source: shutterstock.com

So the answer is. In this example we will use a borrower aged 70 years old using a reverse mortgage for home purchase with a sales price of 400000. Thats a lot to consider and the relationship between these multiple factors is complicated. Yes you can sell a house with a reverse mortgage at any time just like on a traditional mortgage. Borrowers can repay a reverse mortgageat any time without penalty.

Source: investopedia.com

Source: investopedia.com

If youre age 60 the most you can borrow is likely to be 1520 of the value of your home. For people living in the home they plan to stay in for the rest of their life the extra money can make a big. Reverse mortgage purchase amortization. A reverse mortgage is a loan for senior homeowners that allows for use of a portion of the homes equity as collateral. So the answer is.

Source: money.com

Source: money.com

So at 65 the most you can borrow will be about 2025. You will owe the total debt of the reverse mortgage upon selling or 95 of the appraised value if the debt exceeds the value. How much can you borrow with a reverse mortgage. Typically the lender recovers the loan after the death of the last surviving borrower or when they leave the property. A reverse mortgage or Home Equity Conversion Loan HECM is a loan that a credit agency takes out against your home while youre still living in it.

Source: forbesindia.com

Source: forbesindia.com

When property charges typically real estate taxes hazard insurance flood insurance and assessments are paid current the loan generally does not have to be repaid until the last surviving homeowner permanently moves out of the. Typically the lender recovers the loan after the death of the last surviving borrower or when they leave the property. As a guide add 1 for each year over 60. It is usually marketed to seniors as the structure of such loans can suit their lifestyles. If youre aged 62 or more and own your own home Arvest Bank Home Loan Qualifications then youre eligible to take out a Home Equity Conversion Mortgage a type of reverse mortgage guaranteed by the Federal Housing Administration FHA in which the home owner borrows a portion of their homes equity.

Source: mpamag.com

Source: mpamag.com

The lender is not attempting to buy the property. When property charges typically real estate taxes hazard insurance flood insurance and assessments are paid current the loan generally does not have to be repaid until the last surviving homeowner permanently moves out of the. In layman terms a reverse mortgage allows a homeowner to receive monthly payments like an annuity which is actually the money they have in the propertys value. Reverse mortgage purchase amortization. The extra 5 is covered by insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money housing reverse mortgage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.