14+ Mirror trading money laundering explained info

Home » money laundering idea » 14+ Mirror trading money laundering explained infoYour Mirror trading money laundering explained images are available in this site. Mirror trading money laundering explained are a topic that is being searched for and liked by netizens today. You can Find and Download the Mirror trading money laundering explained files here. Get all royalty-free images.

If you’re searching for mirror trading money laundering explained images information related to the mirror trading money laundering explained keyword, you have pay a visit to the ideal blog. Our website always gives you hints for downloading the highest quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

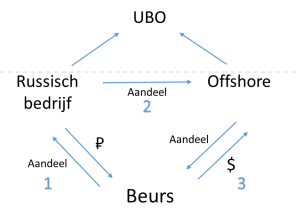

Mirror Trading Money Laundering Explained. Mirror trading is effectively a type of wash trading a well-known form of manipulation which can be used to give the market a misleading impression around the liquidity volume and supply of a financial instrument. The term mirror trading refers to a strategy where trades are executed automatically in order to mirror a selected individuals trades or an automated bots algorithm. They would buy shares in Russia and sell the stock to one of the European shell companies they owned. The red flags for regulators were two-fold.

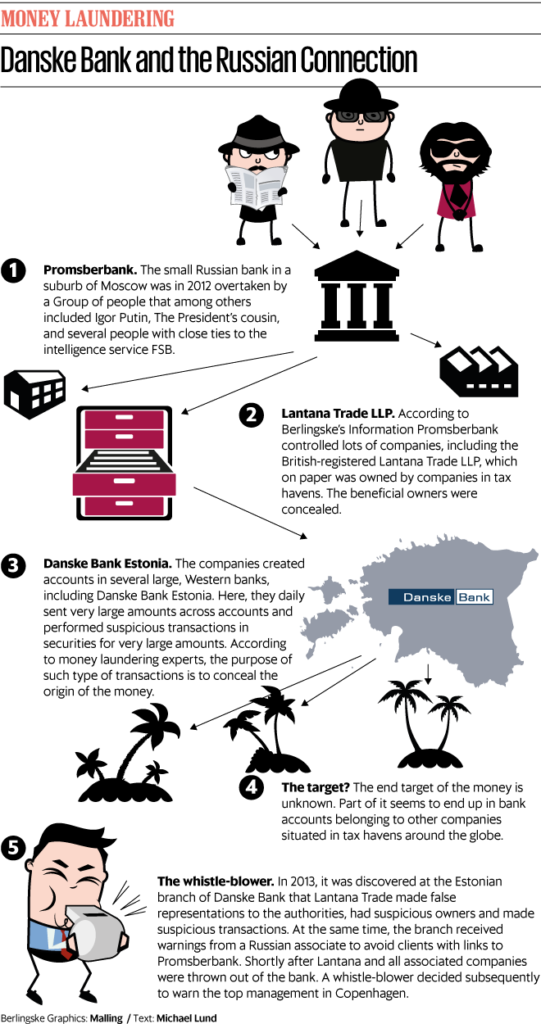

Money Laundering At Danske Bank 360storybank From 360storybank.com

Money Laundering At Danske Bank 360storybank From 360storybank.com

This trading method is not prohibited by definition. Mirror trading is a trading methodology used primarily in forex markets. An additional US38 billion might also have been laundered outside of Russia through suspicious one-sided trades conducted by the same customers involved in the mirror trading transactions. There are different varieties. Regulators and the bank. German said there is dirty money and black money.

First neither the end buyer nor the end seller of the mirror made any money on the trades.

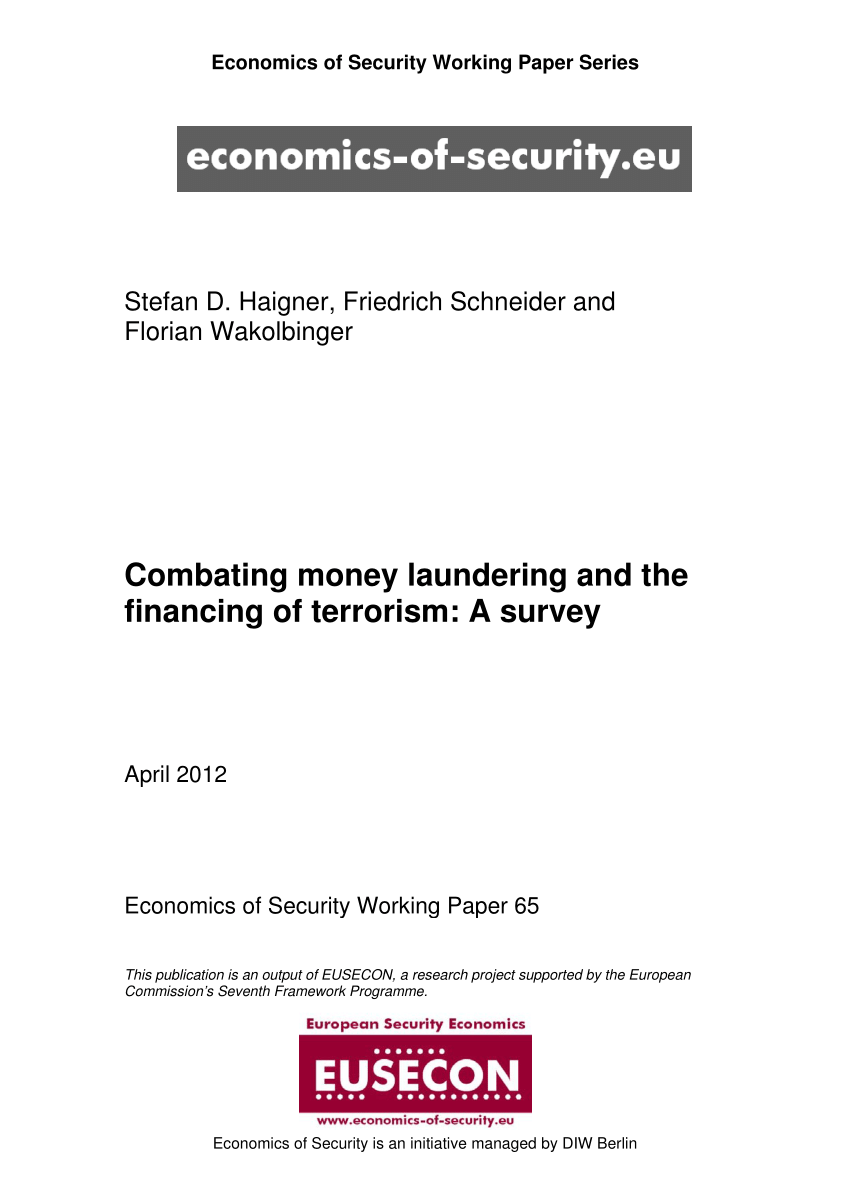

Infographic Deutsche Banks 10 billion scandal. The 10 billion mirror trading scheme remains one of Deutsches darkest stains. The case resulted in the largest fine. In January Deutsche Bank agreed to pay six hundred and thirty million dollars in fines levied by. It fined Deutsche Bank 163 million 204 million for lacking an adequate AML control framework between 2012 and 2015. There are different varieties.

Source: 360storybank.com

Source: 360storybank.com

What Is Mirror Trading. Part One The Mirror Trades. They would buy shares in Russia and sell the stock to one of the European shell companies they owned. These mirror trades transferred billions in roubles originating in Russia to dollars paid into offshore companies based in Cyprus and the British Virgin Islands between 2011 and 2015. The term mirror trading refers to a strategy where trades are executed automatically in order to mirror a selected individuals trades or an automated bots algorithm.

Source: pinterest.com

Source: pinterest.com

Regulators and the bank. It is unrelated to the South African firm Mirror Trading International whose crypto-gambling site was uncovered as fraudulent. This trading method is not prohibited by definition. Given the scale of what was revealed quotes like 200bn mostly suspicious 10000. Mirror trading explained17 Feb 2017.

Source: researchgate.net

Source: researchgate.net

In January Deutsche Bank agreed to pay six hundred and thirty million dollars in fines levied by. The term mirror trading refers to a strategy where trades are executed automatically in order to mirror a selected individuals trades or an automated bots algorithm. These mirror trades transferred billions in roubles originating in Russia to dollars paid into offshore companies based in Cyprus and the British Virgin Islands between 2011 and 2015. The red flags for regulators were two-fold. The process bypassed tax officials currency regulators and anti-money-laundering controls.

Source: pinterest.com

Source: pinterest.com

They would buy shares in Russia and sell the stock to one of the European shell companies they owned. The mirror scheme started in 2011 as Deutsche traders struggled with a slowdown in business in the wake of a slump in oil and gas prices as well as. Mirror trading explained17 Feb 2017. An additional US38 billion might also have been laundered outside of Russia through suspicious one-sided trades conducted by the same customers involved in the mirror trading transactions. In essence mirror trading involves two opposite transactions where bonds or shares are bought in one currency and sold in another.

Source: bloombergquint.com

Source: bloombergquint.com

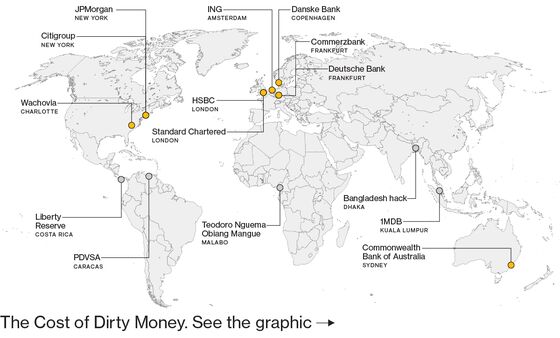

What is mirror trading. Traders can select strategies that match their personal trading preferences such as risk tolerance and past profits. The mirror trading featured in the Russian Laundromat is only one of a large number of typologies that criminals can use to covertly move funds via the markets whether for laundering money to circumvent sanctions rules to fund terrorist activity or to effect payment for illegal activity. It involves copying the trading activity of other forex traders and implementing the same trades. The red flags for regulators were two-fold.

London office is one of few cases of money laundering involving the markets to make headlines in recent years. It is a strategy that allows investors to copy the trades of experienced and successful. London office is one of few cases of money laundering involving the markets to make headlines in recent years. The red flags for regulators were two-fold. The mirror trading method allows traders in financial markets to select a trading strategy and to automatically mirror the trades executed by the selected strategies in the traders brokerage account.

It is a strategy that allows investors to copy the trades of experienced and successful. The mirror trading featured in the Russian Laundromat is only one of a large number of typologies that criminals can use to covertly move funds via the markets whether for laundering money to circumvent sanctions rules to fund terrorist activity or to effect payment for illegal activity. Regulators and the bank. The term mirror trading refers to a strategy where trades are executed automatically in order to mirror a selected individuals trades or an automated bots algorithm. It involves trading between two different legal entities.

Source: bovill.com

Source: bovill.com

It is unrelated to the South African firm Mirror Trading International whose crypto-gambling site was uncovered as fraudulent. Mirror trades are at the root of more than 670 million in penalties that Deutsche Bank AG has agreed to pay US. These mirror trades transferred billions in roubles originating in Russia to dollars paid into offshore companies based in Cyprus and the British Virgin Islands between 2011 and 2015. The mirror trading featured in the Russian Laundromat is only one of a large number of typologies that criminals can use to covertly move funds via the markets whether for laundering money to circumvent sanctions rules to fund terrorist activity or to effect payment for illegal activity. It is unrelated to the South African firm Mirror Trading International whose crypto-gambling site was uncovered as fraudulent.

Source: exentrancement.weebly.com

Source: exentrancement.weebly.com

The red flags for regulators were two-fold. Mirror trades are at the root of more than 670 million in penalties that Deutsche Bank AG has agreed to pay US. The red flags for regulators were two-fold. Regulators and the bank. The mirror scheme started in 2011 as Deutsche traders struggled with a slowdown in business in the wake of a slump in oil and gas prices as well as.

Source: slideshare.net

Source: slideshare.net

Mirror trading takes place at international currency or stock markets. Once a strategy has been selected all the signals sent by the strategy will be. They would buy shares in Russia and sell the stock to one of the European shell companies they owned. It involves trading between two different legal entities. The mirror trading method allows traders in financial markets to select a trading strategy and to automatically mirror the trades executed by the selected strategies in the traders brokerage account.

Source: amlc.eu

Source: amlc.eu

Part One The Mirror Trades. The term mirror trading refers to a strategy where trades are executed automatically in order to mirror a selected individuals trades or an automated bots algorithm. Early on in his 247-page report he defines money laundering as the process by which money obtained through illegal activity is introduced into legitimate financial intermediaries where the source of funds is obscured by more than one further transaction creating an appearance of legitimacy. Mirror trading is effectively a type of wash trading a well-known form of manipulation which can be used to give the market a misleading impression around the liquidity volume and supply of a financial instrument. Mirror trades are at the root of more than 670 million in penalties that Deutsche Bank AG has agreed to pay US.

Source: researchgate.net

Source: researchgate.net

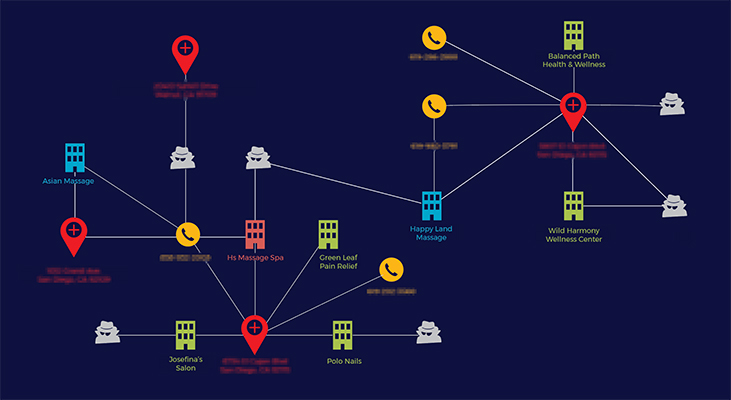

While it had many tentacles at its heart was a group of money launderers who controlled a network of anonymous companies around the world. Given the scale of what was revealed quotes like 200bn mostly suspicious 10000. At the end of January the UKs Financial Conduct Authority announced its largest ever penalty for anti-money laundering failures. The process bypassed tax officials currency regulators and anti-money-laundering controls. The Danske Bank Report my analysis.

Source: youtube.com

Source: youtube.com

Mirror trading takes place at international currency or stock markets. It is unrelated to the South African firm Mirror Trading International whose crypto-gambling site was uncovered as fraudulent. What is mirror trading. It involves trading between two different legal entities. The mirror trading method allows traders in financial markets to select a trading strategy and to automatically mirror the trades executed by the selected strategies in the traders brokerage account.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mirror trading money laundering explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.