20+ Micro structuring money laundering ideas

Home » money laundering Info » 20+ Micro structuring money laundering ideasYour Micro structuring money laundering images are available. Micro structuring money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Micro structuring money laundering files here. Download all free images.

If you’re searching for micro structuring money laundering images information related to the micro structuring money laundering topic, you have pay a visit to the right blog. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

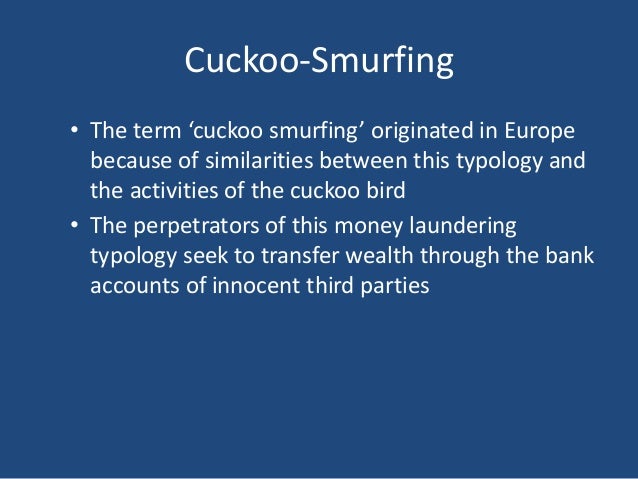

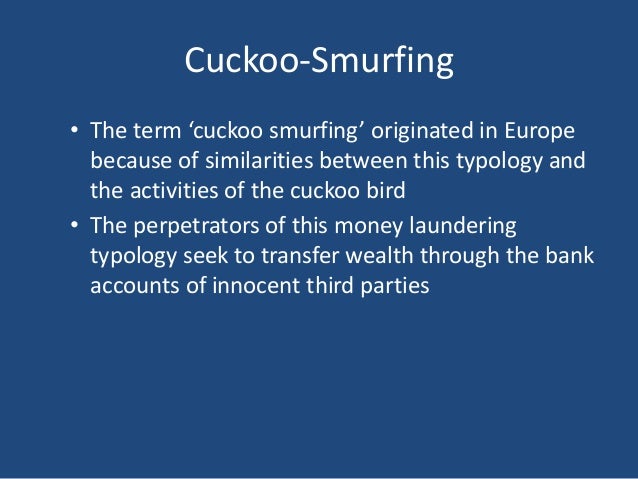

Micro Structuring Money Laundering. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. How To Spot Micro Laundering. A customer provides an individual taxpayer identification number after having previously used a Social Security number.

Red Flags Of Money Laundering From slideshare.net

Red Flags Of Money Laundering From slideshare.net

Attendees will learn how to identify the red flags of money laundering in an account within your institution. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities. This type of laundering. Bank accounts at one or more financial institutions. Some of the more popular money laundering techniques include.

The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across.

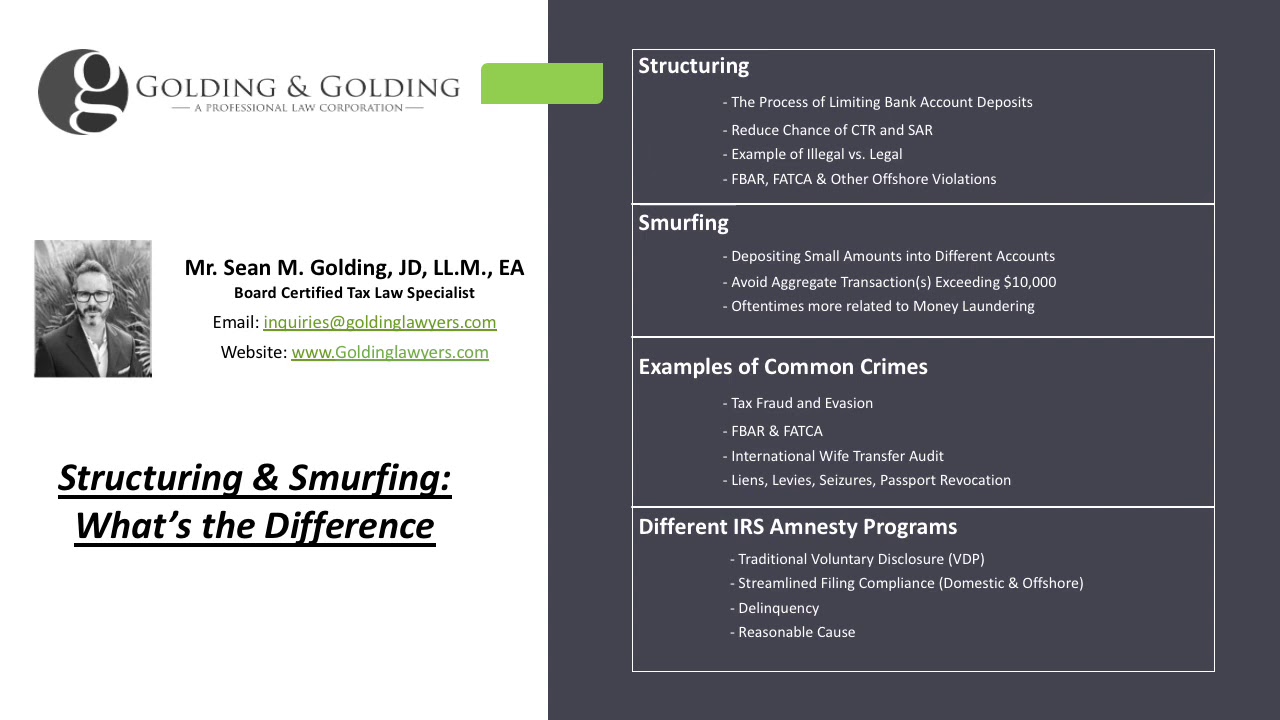

An important factor within money is micro-structuring also known as smurfing or digital smurfing This operates on the same concept and system of using mules in drug-trafficking networks eg. Rather than taking the traditional route and structuring cash deposits into accounts criminals have become savvier and began laundering in the cyber arena. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities. Copyright 2012 Campbell R. An unknown number of third parties anywhere between the hundreds or thousands are directly controlled by Organised Crime Gangs OCG and professional money launderers. Structuring involves splitting transactions into separate amounts under AUD10000 to avoid the transaction reporting requirements of the FTR Act and AMLCTF Act.

Source: aml-assassin.com

Source: aml-assassin.com

Attendees will learn how to identify the red flags of money laundering in an account within your institution. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. Some of the more popular money laundering techniques include. An important factor within money is micro-structuring also known as smurfing or digital smurfing This operates on the same concept and system of using mules in drug-trafficking networks eg. Copyright 2012 Campbell R.

Source: researchgate.net

Source: researchgate.net

A customer provides an individual taxpayer identification number after having previously used a Social Security number. Some of the more popular money laundering techniques include. Bank accounts at one or more financial institutions. Attendees will learn how to identify the red flags of money laundering in an account within your institution. As a financial institution it is your responsibility to assess the risks associated with businesses or ISOs that have privately owned ATMs.

Source: arcriskandcompliance.com

Source: arcriskandcompliance.com

Structuring is a global issue not limited just to the US. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Copyright 2012 Campbell R. Attendees will learn how to identify the red flags of money laundering in an account within your institution.

Source: cashstructured212.blogspot.com

Source: cashstructured212.blogspot.com

Bank accounts at one or more financial institutions. Structuring involves splitting transactions into separate amounts under AUD10000 to avoid the transaction reporting requirements of the FTR Act and AMLCTF Act. The reason being is that no financial institution wants to learn that they were a conduit or catalyst for any sort of fraud money-laundering terrorism etc like a game of Hot Potato. Micro structuring was criminalized by Congress in 1986. John Smith sells a car and goes to the bank with 14000 in cash to deposit.

Source: wikiwand.com

Source: wikiwand.com

Structuring can take two basic forms. Immigration and Customs Enforcement officials say that millions and millions of dollars are laundered through micro structuring every year. For example making multiple under US10000 deposits in banks and withdrawing it in overseas countries. Attendees will learn how to identify the red flags of money laundering in an account within your institution. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities.

First a customer might deposit currency on multiple days in amounts under 10000 eg 990000 for the intended purpose of circumventing a financial institutions obligation to report any cash deposit over 10000 on a currency transaction report as described in 31 CFR. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. First a customer might deposit currency on multiple days in amounts under 10000 eg 990000 for the intended purpose of circumventing a financial institutions obligation to report any cash deposit over 10000 on a currency transaction report as described in 31 CFR. Micro structuring was criminalized by Congress in 1986. Individuals may travel to the United States with instructions to establish multiple bank accounts as a straw party.

Structuring can take two basic forms. Individuals may travel to the United States with instructions to establish multiple bank accounts as a straw party. The consumer has a large balance with the Bank. A customer provides an individual taxpayer identification number after having previously used a Social Security number. An unknown number of third parties anywhere between the hundreds or thousands are directly controlled by Organised Crime Gangs OCG and professional money launderers.

Source: dev.amlology.org

Source: dev.amlology.org

Many countries have similar rules in place. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. For example making multiple under US10000 deposits in banks and withdrawing it in overseas countries. Many countries have similar rules in place.

A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. How To Spot Micro Laundering.

Source: wsj.com

Source: wsj.com

This type of laundering. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Immigration and Customs Enforcement officials say that millions and millions of dollars are laundered through micro structuring every year. Rather than taking the traditional route and structuring cash deposits into accounts criminals have become savvier and began laundering in the cyber arena.

Attendees will learn how to identify the red flags of money laundering in an account within your institution. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Some of the more popular money laundering techniques include. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities.

Source: goldinglawyers.com

Source: goldinglawyers.com

This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. An unknown number of third parties anywhere between the hundreds or thousands are directly controlled by Organised Crime Gangs OCG and professional money launderers. Some of the more popular money laundering techniques include. An important factor within money is micro-structuring also known as smurfing or digital smurfing This operates on the same concept and system of using mules in drug-trafficking networks eg. A customer provides an individual taxpayer identification number after having previously used a Social Security number.

Source: slideshare.net

Source: slideshare.net

This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. A method of money laundering in which larger transactions are broken down into multiple smaller transactions to evade detection by authorities. Potentially Suspicious Activity That May Indicate Money Laundering Customers Who Provide Insufficient or Suspicious Information. The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency. A customer uses unusual or suspicious identification documents that cannot be readily verified.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title micro structuring money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.