13++ Maximum punishment under money laundering act ideas in 2021

Home » money laundering idea » 13++ Maximum punishment under money laundering act ideas in 2021Your Maximum punishment under money laundering act images are ready. Maximum punishment under money laundering act are a topic that is being searched for and liked by netizens now. You can Find and Download the Maximum punishment under money laundering act files here. Find and Download all royalty-free photos.

If you’re looking for maximum punishment under money laundering act images information related to the maximum punishment under money laundering act topic, you have come to the ideal site. Our site always gives you suggestions for refferencing the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

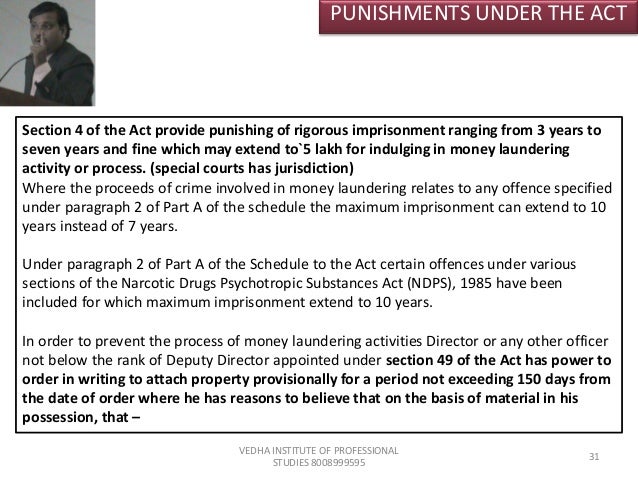

Maximum Punishment Under Money Laundering Act. Section 4 of PMLA prescribes the Punishment for Money-Laundering as under. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. Rigorous Imprisonment for a term which shall not be less than Three years but which may extend to 7.

Prevention Of Money Laundering Act 2002 An Inherently Flawed Legislation From livelaw.in

Prevention Of Money Laundering Act 2002 An Inherently Flawed Legislation From livelaw.in

Money laundering offenses can also give rise to a civil action under Section 1956. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. Federal Money Laundering Penalties. However the maximum punishment may extend to ten years where the proceeds of crime relate to an offence specified in Part IV of the Schedule ie. Money laundering is a serious offence and its highest punishment of 12 years imprisonment under the Money Laundering Prevention Act is insufficient the bench of Justice Md Nazrul Islam Talukder. Maximum 3 to 7 Years and fine Rs 500000.

Federal Money Laundering Penalties.

Money laundering offenses can also give rise to a civil action under Section 1956. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. The offender might have to pay the greater of 500000 or twice the value of the financial transaction in question whichever is greater. Punishment under the Act. Section 4 8 of the Act provides for a rigorous imprisonment 9 for term of not less than three years and which may extend to seven years to anyone who commits the offence of money laundering.

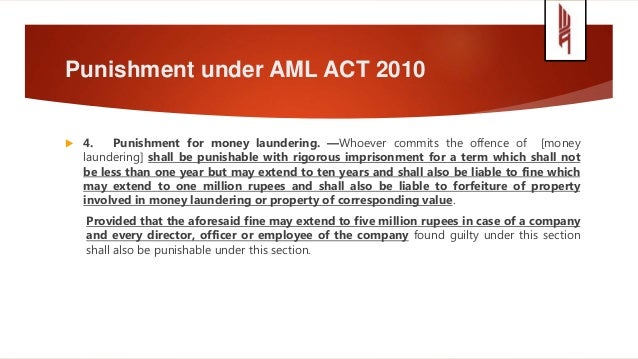

Source: slideshare.net

Source: slideshare.net

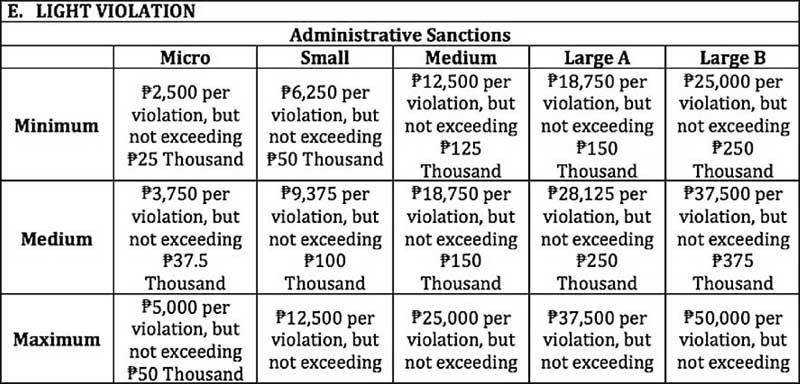

In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. As per this section a person who. In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. The penalty of imprisonment from four 4 to seven 7 years and a fine of not less than One million five hundred thousand Philippine pesos Php150000000 but not more than Three million Philippine pesos Php300000000 shall be imposed upon a person convicted under Section 4 b of this Act. Penalties for money laundering differ based on the specifics of the crime.

Source: slideplayer.com

Source: slideplayer.com

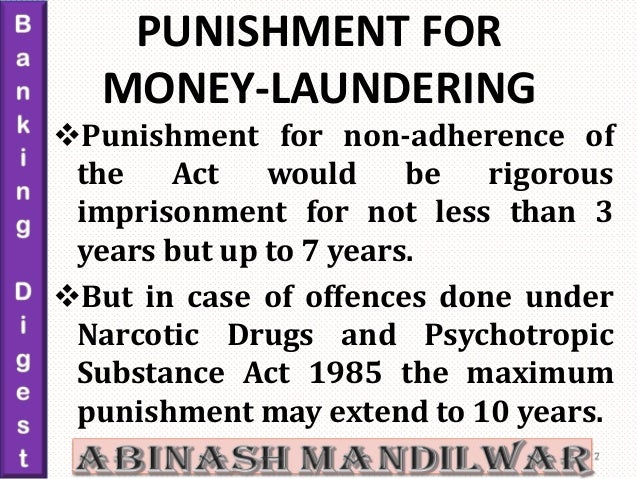

The offence of money laundering is defined in section 3 of the Prevention of Money Laundering Act 2002 PMLA. In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. Provided that where the proceeds of crime involved in money-laundering relates to any offence specified under. Punishment for money-launderingWhoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to fine which may extend to five lakh rupees. The Act prescribes that any person found guilty of money-laundering shall be punishable with rigorous imprisonment from three years to seven years and where the proceeds of crime involved relate to any offense under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 the maximum punishment may extend to 10 years.

Source: slideshare.net

Source: slideshare.net

Federal Money Laundering Penalties. Mens rea for money laundering. There is an exception where some of the criminals may be punished with 10 years of imprisonment. In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. However the maximum punishment may extend to ten years where the proceeds of crime relate to an offence specified in Part IV of the Schedule ie.

Source: academia.edu

Source: academia.edu

Federal Money Laundering Penalties. Money laundering offenses can also give rise to a civil action under Section 1956. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. Here the term Person includes an individual a Hindu Undivided Family a firm a company or association of persons. Speaking generally large fines and jail time are possible.

Source: slideplayer.com

Source: slideplayer.com

Mens rea for money laundering. For further information see Practice Note. Penalties for money laundering differ based on the specifics of the crime. For an individual a fine not exceeding S500000 or imprisonment not exceeding 10 years or both. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering.

Source: indiafilings.com

Source: indiafilings.com

As per this section a person who. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. Here the term Person includes an individual a Hindu Undivided Family a firm a company or association of persons. The minimum punishment in case of money laundering is 3 years and the maximum punishment is restricted to 7 years.

Source: philstar.com

Source: philstar.com

The maximum penalty under Sections 43 44 46 and 47 of the CDSA is. Section 4 8 of the Act provides for a rigorous imprisonment 9 for term of not less than three years and which may extend to seven years to anyone who commits the offence of money laundering. For further information see Practice Note. In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. Provided that where the proceeds of crime involved in money-laundering relates to any offence specified under.

Source: slideshare.net

Source: slideshare.net

The Act prescribes that any person found guilty of money-laundering shall be punishable with rigorous imprisonment from three years to seven years and where the proceeds of crime involved relate to any offense under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 the maximum punishment may extend to 10 years. Section 4 of PMLA prescribes the Punishment for Money-Laundering as under. Maximum 3 to 7 Years and fine Rs 500000. Mens rea for money laundering. For further information see Practice Note.

Source: taxguru.in

Source: taxguru.in

Mens rea for money laundering. The penalty of imprisonment from four 4 to seven 7 years and a fine of not less than One million five hundred thousand Philippine pesos Php150000000 but not more than Three million Philippine pesos Php300000000 shall be imposed upon a person convicted under Section 4 b of this Act. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. Here the term Person includes an individual a Hindu Undivided Family a firm a company or association of persons. As per this section a person who.

Source: slideplayer.com

Source: slideplayer.com

The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. Here the term Person includes an individual a Hindu Undivided Family a firm a company or association of persons. The maximum penalty under Sections 43 44 46 and 47 of the CDSA is. Fines can range up to 500000 or be based upon the value of the property involved in a money laundering transaction. Maximum 3 to 7 Years and fine Rs 500000.

Source: livelaw.in

Source: livelaw.in

For an individual a fine not exceeding S500000 or imprisonment not exceeding 10 years or both. Section 4 of PMLA prescribes the Punishment for Money-Laundering as under. The offender might have to pay the greater of 500000 or twice the value of the financial transaction in question whichever is greater. Federal Money Laundering Penalties. For further information see Practice Note.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

The offence of money laundering is defined in section 3 of the Prevention of Money Laundering Act 2002 PMLA. Money laundering is a serious offence and its highest punishment of 12 years imprisonment under the Money Laundering Prevention Act is insufficient the bench of Justice Md Nazrul Islam Talukder. Maximum 3 to 7 Years and fine Rs 500000. Criminal offences relating to this field include. The offence of money laundering is defined in section 3 of the Prevention of Money Laundering Act 2002 PMLA.

Source: slideshare.net

Source: slideshare.net

Section 4 8 of the Act provides for a rigorous imprisonment 9 for term of not less than three years and which may extend to seven years to anyone who commits the offence of money laundering. For further information see Practice Note. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Criminal offences relating to this field include. There is an exception where some of the criminals may be punished with 10 years of imprisonment.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title maximum punishment under money laundering act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.