15++ Maximum punishment prescribed for the offence of money laundering is information

Home » money laundering Info » 15++ Maximum punishment prescribed for the offence of money laundering is informationYour Maximum punishment prescribed for the offence of money laundering is images are ready. Maximum punishment prescribed for the offence of money laundering is are a topic that is being searched for and liked by netizens now. You can Get the Maximum punishment prescribed for the offence of money laundering is files here. Find and Download all free photos and vectors.

If you’re searching for maximum punishment prescribed for the offence of money laundering is pictures information related to the maximum punishment prescribed for the offence of money laundering is keyword, you have visit the ideal blog. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

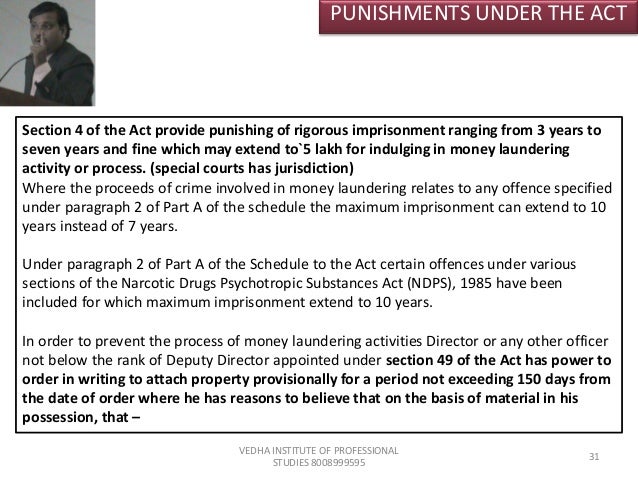

Maximum Punishment Prescribed For The Offence Of Money Laundering Is. If the offender is a company the maximum fine is S100000000. Section 4 8 of the Act provides for a rigorous imprisonment 9 for term of not less than three years and which may extend to seven years to anyone who commits the offence of money laundering. For an individual a fine not exceeding S150000 or imprisonment not exceeding three years or both. Punishment for Money Laundering.

Brunei Darussalam The Asia Pacific Group On Money Laundering From yumpu.com

Brunei Darussalam The Asia Pacific Group On Money Laundering From yumpu.com

In case if it its related to narcotics drugs or any psychotropic substance then Imprisonment maximum 3 to 10 years and fine maxim. Maximum 3 to 7 Years and fine Rs 500000. There is an exception where some of the criminals may be punished with 10 years of imprisonment. In PMLA the punishment prescribed in section 4 is rigorous imprisonment not less than 3 years but which may extend to 7 years and also fine which may extend to Rs 5 lakh. Punishment for Money Laundering. Does money laundering only affect big businesses and banks.

The maximum penalty under Section 47AA of the CDSA is.

And for a non-individual a fine not exceeding S300000. For an individual a fine not exceeding S150000 or imprisonment not exceeding three years or both. The maximum penalty under Section 47AA of the CDSA is. Its a process by which dirty money is converted into clean cash. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. Punishment for Money Laundering.

Source: academia.edu

Source: academia.edu

In PMLA the punishment prescribed in section 4 is rigorous imprisonment not less than 3 years but which may extend to 7 years and also fine which may extend to Rs 5 lakh. As money laundering shall be. The minimum punishment in case of money laundering is 3 years and the maximum punishment is restricted to 7 years. The sources of the cash in precise are prison and the cash is invested in a means that makes it appear like clean money and hide the id of the prison part of the money earned. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments.

Source: docplayer.net

Source: docplayer.net

Offence of money laundering is a grave felony and provides for a punishment apart from the punishment prescribed under the scheduled offence. And for a non-individual a fine not exceeding S300000. For an individual a fine not exceeding S150000 or imprisonment not exceeding three years or both. There is an exception where some of the criminals may be punished with 10 years of imprisonment. Its a process by which dirty money is converted into clean cash.

Source: slideshare.net

Source: slideshare.net

This note also considers the provisions of the Money Laundering Terrorist Financing and. A of Directive 200560EC on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. The concept of money laundering is essential to be understood for those working within the monetary sector. As money laundering shall be. In PMLA the punishment prescribed in section 4 is rigorous imprisonment not less than 3 years but which may extend to 7 years and also fine which may extend to Rs 5 lakh.

Source: docplayer.net

Source: docplayer.net

If the offender is a company the maximum fine is S100000000. As money laundering shall be. If the offender is a company the maximum fine is S100000000. Section 4 8 of the Act provides for a rigorous imprisonment 9 for term of not less than three years and which may extend to seven years to anyone who commits the offence of money laundering. The sources of the cash in precise are prison and the cash is invested in a means that makes it appear like clean money and hide the id of the prison part of the money earned.

Source: wikiwand.com

Source: wikiwand.com

The maximum penalty for the section 337 offence and for the other two principal money laundering offences at sections 328 and 329 is 14 years imprisonment as set out at section 334. The sources of the cash in precise are prison and the cash is invested in a means that makes it appear like clean money and hide the id of the prison part of the money earned. In PMLA the punishment prescribed in section 4 is rigorous imprisonment not less than 3 years but which may extend to 7 years and also fine which may extend to Rs 5 lakh. And for a non-individual a fine not exceeding S300000. Section 4 8 of the Act provides for a rigorous imprisonment 9 for term of not less than three years and which may extend to seven years to anyone who commits the offence of money laundering.

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million to. The punishment for any of these offences is up to 10 years imprisonment andor a fine of up to S500000. The Act prescribes that any person found guilty of money-laundering shall be punishable with rigorous imprisonment from three years to seven years and where the proceeds of crime involved relate to any offence under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 the maximum punishment may extend to 10 years instead of 7. Does money laundering only affect big businesses and banks. This note also considers the provisions of the Money Laundering Terrorist Financing and.

Source: cupdf.com

Source: cupdf.com

In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. Its a process by which dirty money is converted into clean cash. The Act prescribes that any person found guilty of money-laundering shall be punishable with rigorous imprisonment from three years to seven years and where the proceeds of crime involved relate to any offence under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 the maximum punishment may extend to 10 years instead of 7. The sources of the cash in precise are prison and the cash is invested in a means that makes it appear like clean money and hide the id of the prison part of the money earned. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily.

Source: yumpu.com

Source: yumpu.com

In PMLA the punishment prescribed in section 4 is rigorous imprisonment not less than 3 years but which may extend to 7 years and also fine which may extend to Rs 5 lakh. Money laundering offencesacquisition use and possession. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million to. Its a process by which dirty money is converted into clean cash. Mens rea for money laundering.

Source: slideplayer.com

Source: slideplayer.com

The sources of the cash in precise are prison and the cash is invested in a means that makes it appear like clean money and hide the id of the prison part of the money earned. Money laundering offencesacquisition use and possession. A of Directive 200560EC on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. The minimum punishment in case of money laundering is 3 years and the maximum punishment is restricted to 7 years. This amount appears disproportionately low given the gravity of the offence of money laundering.

Source: docplayer.net

Source: docplayer.net

Offence of money laundering is a grave felony and provides for a punishment apart from the punishment prescribed under the scheduled offence. Whoever commits the offence of money laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extent to seven years and shall also be liable to fine which may extent to Ten lakh rupees. The punishment for any of these offences is up to 10 years imprisonment andor a fine of up to S500000. 17 What is the statute of limitations for money laundering crimes. There is an exception where some of the criminals may be punished with 10 years of imprisonment.

Source: academia.edu

Source: academia.edu

Its a process by which dirty money is converted into clean cash. In India Money Laundering is dealt with The Act Prevention of Money Laundering Act 2002 The Punishment related to Money Laundering is specified below. A of Directive 200560EC on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. For further information see Practice Note. The concept of money laundering is essential to be understood for those working within the monetary sector.

For an individual a fine not exceeding S150000 or imprisonment not exceeding three years or both. 17 What is the statute of limitations for money laundering crimes. Mens rea for money laundering. Punishment for Money Laundering. For further information see Practice Note.

Source: researchgate.net

Source: researchgate.net

The maximum penalty under Section 47AA of the CDSA is. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million to. In PMLA the punishment prescribed in section 4 is rigorous imprisonment not less than 3 years but which may extend to 7 years and also fine which may extend to Rs 5 lakh. Mens rea for money laundering. In case if it its related to narcotics drugs or any psychotropic substance then Imprisonment maximum 3 to 10 years and fine maxim.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title maximum punishment prescribed for the offence of money laundering is by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.