15++ Maximum penalty for tipping off money laundering uk ideas in 2021

Home » money laundering Info » 15++ Maximum penalty for tipping off money laundering uk ideas in 2021Your Maximum penalty for tipping off money laundering uk images are ready. Maximum penalty for tipping off money laundering uk are a topic that is being searched for and liked by netizens today. You can Get the Maximum penalty for tipping off money laundering uk files here. Find and Download all free images.

If you’re searching for maximum penalty for tipping off money laundering uk pictures information related to the maximum penalty for tipping off money laundering uk topic, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Maximum Penalty For Tipping Off Money Laundering Uk. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Money Laundering Regulations 2007 Secondary regulation is provided by the Money Laundering Regulations 2007. Read more in section 682 of the Anti-money laundering guidance for the legal sector. 1 A person commits an offence if he a conceals criminal property.

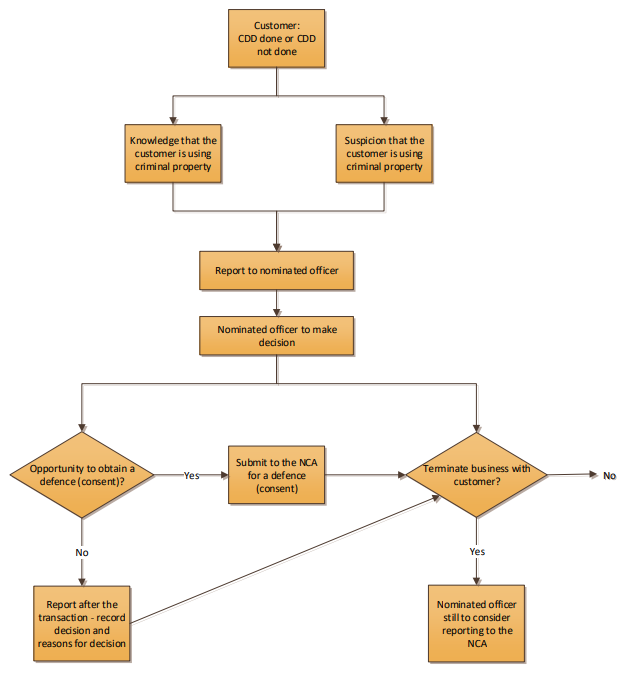

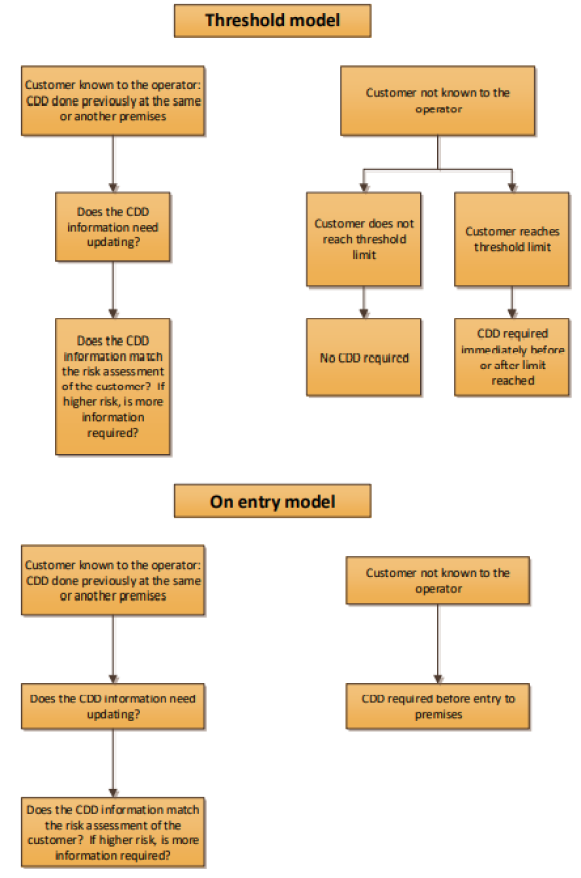

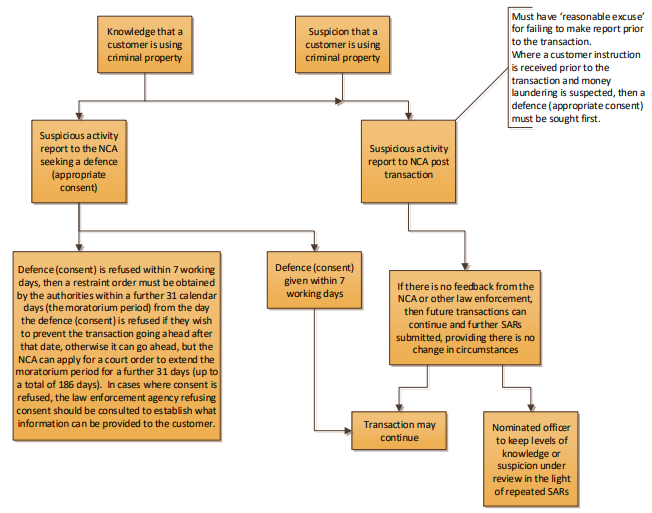

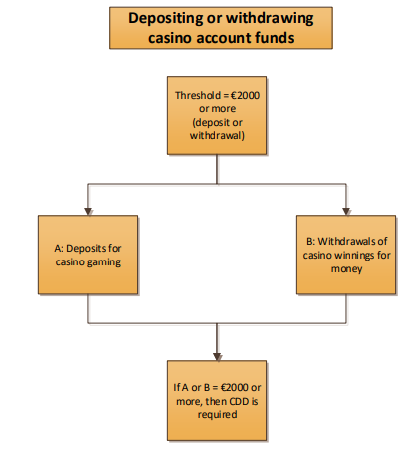

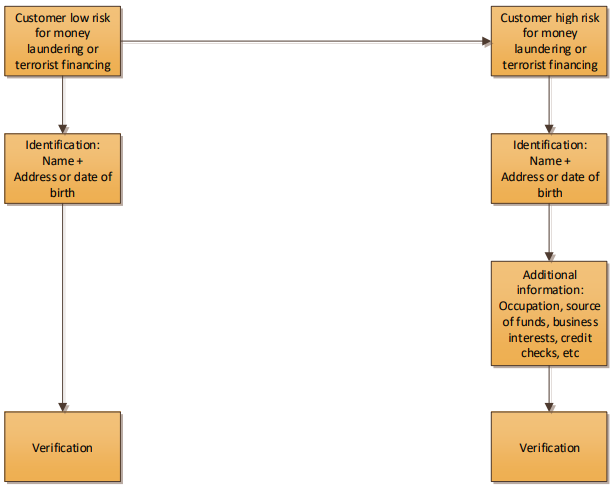

The Prevention Of Money Laundering And Combating The Financing Of Terrorism From gamblingcommission.gov.uk

The Prevention Of Money Laundering And Combating The Financing Of Terrorism From gamblingcommission.gov.uk

Tipping-off for the reporter to inform the subject of his report that a report has been made. What Is The Penalty For Tipping Off A Money Launderer. When making a decision between a handling stolen goods charge and a money laundering charge note that the mens rea for handling stolen goods offences is knowledge or belief while the mens rea for money laundering offences is knowledge or suspicion. These are known as the tipping off offences. On conviction on indictment you could face up to two years imprisonment or a fine or both. Read more in section 682 of the Anti-money laundering guidance for the legal sector.

The maximum penalty on conviction on indictment is five years imprisonment for the following offences.

Part 7 of the Act contains the primary UK anti-money laundering legislation. The maximum penalty for the s327 offence of money laundering is 14 years imprisonment. These serious crimes can involve the maximum prison sentence of 14 years. 2 But a person does not commit such an offence if a he makes an authorised. A similar offence applies to those who are not in the regulated sector where a person makes an unlawful disclosure which is likely to prejudice a money laundering investigation. These are known as the tipping off offences.

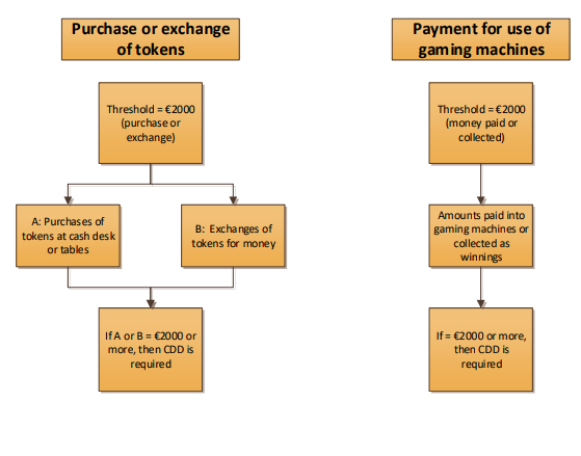

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. On summary conviction you could face up to three months imprisonment or a fine not exceeding level five or both. These serious crimes can involve the maximum prison sentence of 14 years. Money laundering offencesconcealing disguising converting transferring and removing.

Source: slideplayer.com

Source: slideplayer.com

Attempting to injure or alarm the Sovereign. Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine. Part 7 of the Act contains the primary UK anti-money laundering legislation. Section 333 has been replaced by Section 333A which applies only to the regulated sector. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million.

Source: researchgate.net

Source: researchgate.net

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. The maximum penalty for the section 337 offence and for the other two principal money laundering offences at sections 328 and 329 is 14 years imprisonment as set out at section 334. Part 7 of the Act contains the primary UK anti-money laundering legislation. Three principal money laundering offences on conviction on indictment is fourteen years imprisonment. Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine.

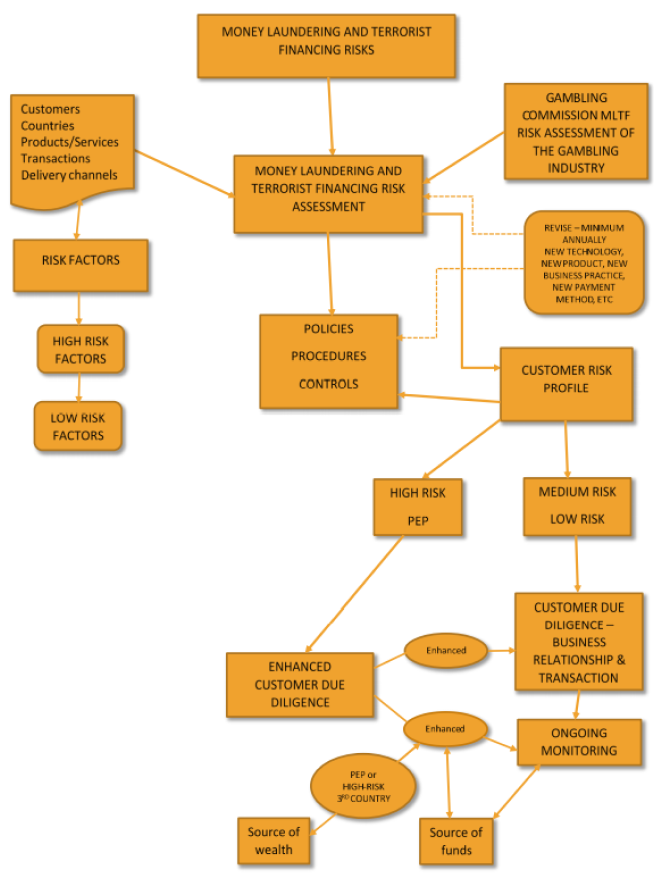

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. C converts criminal property. A similar offence applies to those who are not in the regulated sector where a person makes an unlawful disclosure which is likely to prejudice a money laundering investigation. This offence carries a maximum penalty of five years imprisonment andor an unlimited fine.

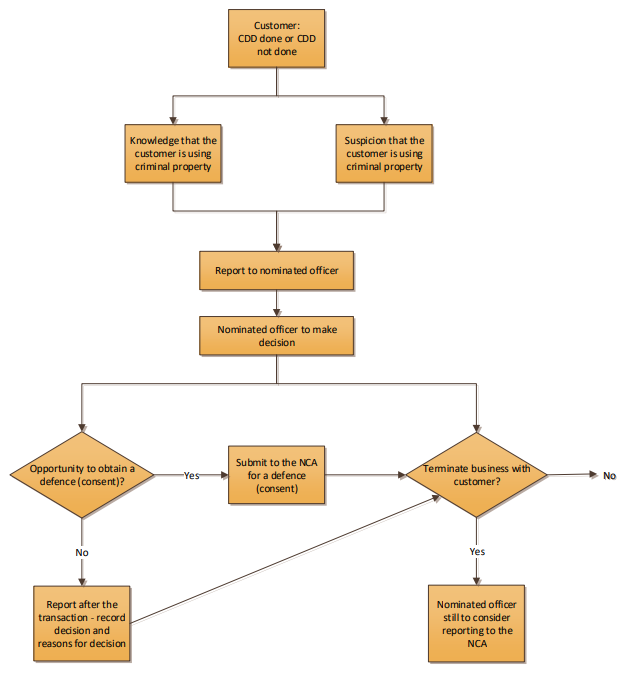

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

Section 333 has been replaced by Section 333A which applies only to the regulated sector. B disguises criminal property. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine. Money Laundering Regulations 2007 Secondary regulation is provided by the Money Laundering Regulations 2007.

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

E removes criminal property from England and Wales or from Scotland or from Northern Ireland. For further information see Practice Note. D transfers criminal property. Failure to disclose knowledge or suspicion of money laundering. When making a decision between a handling stolen goods charge and a money laundering charge note that the mens rea for handling stolen goods offences is knowledge or belief while the mens rea for money laundering offences is knowledge or suspicion.

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

On summary conviction you could face up to three months imprisonment or a fine not exceeding level five or both. The principal money laundering offences carry a maximum penalty of 14 years imprisonment. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Tipping off is considered a serious crime as it can prevent a police investigation from running its full length. D transfers criminal property.

The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine. The principal money laundering offences carry a maximum penalty of 14 years imprisonment. Punishment for money laundering uk. What Is The Penalty For Tipping Off A Money Launderer.

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

When making a decision between a handling stolen goods charge and a money laundering charge note that the mens rea for handling stolen goods offences is knowledge or belief while the mens rea for money laundering offences is knowledge or suspicion. Tipping off is considered a serious crime as it can prevent a police investigation from running its full length. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. The sentence given will depend on how serious the original investigation was that your tipping off prejudiced the sentence you get could be as much as five years imprisonment. E removes criminal property from England and Wales or from Scotland or from Northern Ireland.

Source: audleychaucer.com

Source: audleychaucer.com

E removes criminal property from England and Wales or from Scotland or from Northern Ireland. 327 Concealing etc UK. The offence of failing to report a suspicion of money laundering by another person carries a maximum penalty of 5 years imprisonment andor a fine. D transfers criminal property. Read more in section 682 of the Anti-money laundering guidance for the legal sector.

Source: views.gibraltarlaw.com

Source: views.gibraltarlaw.com

Tipping off is considered a serious crime as it can prevent a police investigation from running its full length. B disguises criminal property. The sentence given will depend on how serious the original investigation was that your tipping off prejudiced the sentence you get could be as much as five years imprisonment. 2 But a person does not commit such an offence if a he makes an authorised. What Is The Penalty For Tipping Off A Money Launderer.

Source: gamblingcommission.gov.uk

Source: gamblingcommission.gov.uk

The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. Ad Search for Uk. Drug Trafficking Offences Act 1986 s26B. Assaults on officers saving wrecks. The offence of failing to report a suspicion of money laundering by another person carries a maximum penalty of 5 years imprisonment andor a fine.

Source: researchgate.net

Source: researchgate.net

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. This offence carries a maximum penalty of five years imprisonment andor an unlimited fine. Attempting to injure or alarm the Sovereign. On conviction on indictment you could face up to two years imprisonment or a fine or both.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title maximum penalty for tipping off money laundering uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.