10+ Maximum penalty for tipping off money laundering information

Home » money laundering idea » 10+ Maximum penalty for tipping off money laundering informationYour Maximum penalty for tipping off money laundering images are available in this site. Maximum penalty for tipping off money laundering are a topic that is being searched for and liked by netizens today. You can Get the Maximum penalty for tipping off money laundering files here. Get all free vectors.

If you’re looking for maximum penalty for tipping off money laundering pictures information connected with to the maximum penalty for tipping off money laundering topic, you have come to the ideal blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

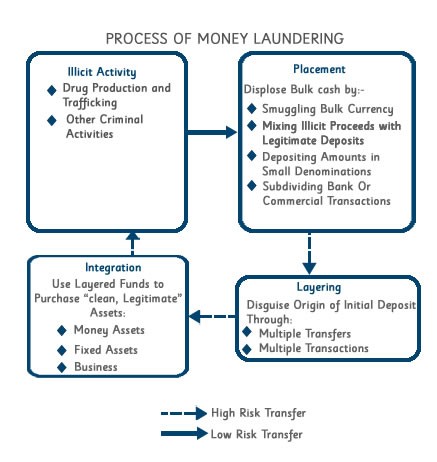

Maximum Penalty For Tipping Off Money Laundering. This offence carries a maximum penalty of five years imprisonment andor an unlimited fine. As with most federal financial crimes the exact sentence will be determined primarily by the amount of money. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field.

Tipping off Applies to bankers and other professionals Bankers and other professionals may also be liable for money laundering under the offence of tipping off. An offence under section 330 is punishable by a maximum penalty on indictment of up to 5 years imprisonment. Anti-money Laundering and Financial Crime Online Conference These are known as the tipping off offences. Https Rm Coe Int 2nd Regular Follow Up Progress Report 4th Round Mutual Evaluation Of S 1680716048. A similar offence applies to those who are not in the regulated sector where a person makes an unlawful disclosure which is likely to prejudice a money laundering investigation. Any instance where an individual within the Group including its Associates discloses information to someone outside of the approved reporting chain and in so doing the information could potentially prejudice an investigation into money-laundering.

An offence under section 330 is punishable by a maximum penalty on indictment of up to 5 years imprisonment.

The offence is triable either way. The maximum BSA civil penalty is generally 25000 or the amount of funds involved in the transaction not to exceed 100000 whichever is greater for each transaction involved. A person commits an offence if knowing or suspecting that a disclosure has been made he discloses to any other person any matter. Anti-money Laundering and Financial Crime Online Conference These are known as the tipping off offences. A maximum term of imprisonment of 3 months and a fine of 50000 upon conviction. There are three principal offences concealing arranging and acquisition use possession.

Typically the person is involved in money laundering fraud or other financial crime. Money laundering offencesacquisition use and possession. The penalty for tipping off is typically in line with penalties that would be given in a case of failing to tell the authorities if you suspect money laundering or terrorism is taking place. What is the maximum penalty for assisting a suspected money launderer. Tipping off would be a.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

1957 can result in a sentence of up to 10 years in prison. Https Rm Coe Int 2nd Regular Follow Up Progress Report 4th Round Mutual Evaluation Of S 1680716048. Into money laundering activities. Prevention of Crime Act No 24 of 1999 which stipulates criminal and civil offences tipping-off and penalties. Failure to report suspicious transactions where a person has the requisite knowledge or suspicion is a criminal offence.

Source: researchgate.net

Source: researchgate.net

The offence carries a maximum penalty of three months imprisonment and a fine of 50000. Https Rm Coe Int 2nd Regular Follow Up Progress Report 4th Round Mutual Evaluation Of S 1680716048. 313 The Organized and Serious Crimes Amendment Ordinance 2000 OSCAO came into operation on 1 June 2000. Anti-Money Laundering Laws and Regulations covering issues in USA of The Crime of Money Laundering and Criminal Enforcement General. A violation of 18 USC.

Source: sinexhk.com

Source: sinexhk.com

A similar offence applies to those who are not in the regulated sector where a person makes an unlawful disclosure which is likely to prejudice a money laundering investigation. Anti-money Laundering and Financial Crime Online Conference These are known as the tipping off offences. Failure to report suspicious transactions where a person has the requisite knowledge or suspicion is a criminal offence. Anti-Money Laundering Laws and Regulations covering issues in USA of The Crime of Money Laundering and Criminal Enforcement General. This offence carries a maximum penalty of five years imprisonment andor an unlimited fine.

Source: yumpu.com

Source: yumpu.com

Https Rm Coe Int 2nd Regular Follow Up Progress Report 4th Round Mutual Evaluation Of S 1680716048. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. The offence is triable either way. Tipping off would be a. The maximum level of reduction is just 20 or one-fifth of.

Source: researchgate.net

Source: researchgate.net

1956 can result in a sentence of up to 20 years in prison. What are the three main money laundering. The maximum level of reduction is just 20 or one-fifth of. Money laundering offencesacquisition use and possession. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years in prison.

Source: researchgate.net

Source: researchgate.net

Is a person making an STR protected from prosecution when they have reported knowledge or suspicion of money laundering. A violation of 18 USC. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. As with most federal financial crimes the exact sentence will be determined primarily by the amount of money. Money laundering offencesacquisition use and possession.

This offence carries a maximum penalty of five years imprisonment andor an unlimited fine. Also what are the three main money laundering Offences. Among other things OSCAO requires. What Is The Penalty For Tipping Off A Money Launderer. The offence is triable either way.

Source: dslalawfirm.com

Source: dslalawfirm.com

Also what are the three main money laundering Offences. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. For further information see Practice Note. A person commits an offence if knowing or suspecting that a disclosure has been made he discloses to any other person any matter. S25A DTROP OSCO s12 14 UNATMO 122 Tipping off is another offence under the DTROP the OSCO and the UNATMO.

Source: researchgate.net

Source: researchgate.net

The penalty for tipping off is typically in line with penalties that would be given in a case of failing to tell the authorities if you suspect money laundering or terrorism is taking place. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. For further information see Practice Note. The maximum BSA civil penalty is generally 25000 or the amount of funds involved in the transaction not to exceed 100000 whichever is greater for each transaction involved. The offence carries a maximum penalty of three months imprisonment and a fine of 50000.

Source: yumpu.com

Source: yumpu.com

The maximum level of reduction is just 20 or one-fifth of. 1957 can result in a sentence of up to 10 years in prison. There are three principal offences concealing arranging and acquisition use possession. A person commits an offence if knowing or suspecting that a disclosure has been made he discloses to any other person any matter. Tipping off would be a.

Source: slideplayer.com

Source: slideplayer.com

Into money laundering activities. What are the three main money laundering. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. Into money laundering activities. Tipping off would be a.

Source: wikiwand.com

Source: wikiwand.com

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. Tipping off would be a. On summary conviction you could face up to three months imprisonment or a fine not exceeding level five or both. 1957 can result in a sentence of up to 10 years in prison. What Is The Penalty For Tipping Off A Money Launderer.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title maximum penalty for tipping off money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.