16++ Maximum penalty for failing to report money laundering information

Home » money laundering Info » 16++ Maximum penalty for failing to report money laundering informationYour Maximum penalty for failing to report money laundering images are available in this site. Maximum penalty for failing to report money laundering are a topic that is being searched for and liked by netizens now. You can Find and Download the Maximum penalty for failing to report money laundering files here. Download all free photos and vectors.

If you’re searching for maximum penalty for failing to report money laundering pictures information linked to the maximum penalty for failing to report money laundering interest, you have visit the right blog. Our website always gives you hints for viewing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

Maximum Penalty For Failing To Report Money Laundering. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

Pdf International Anti Money Laundering Programs From researchgate.net

Pdf International Anti Money Laundering Programs From researchgate.net

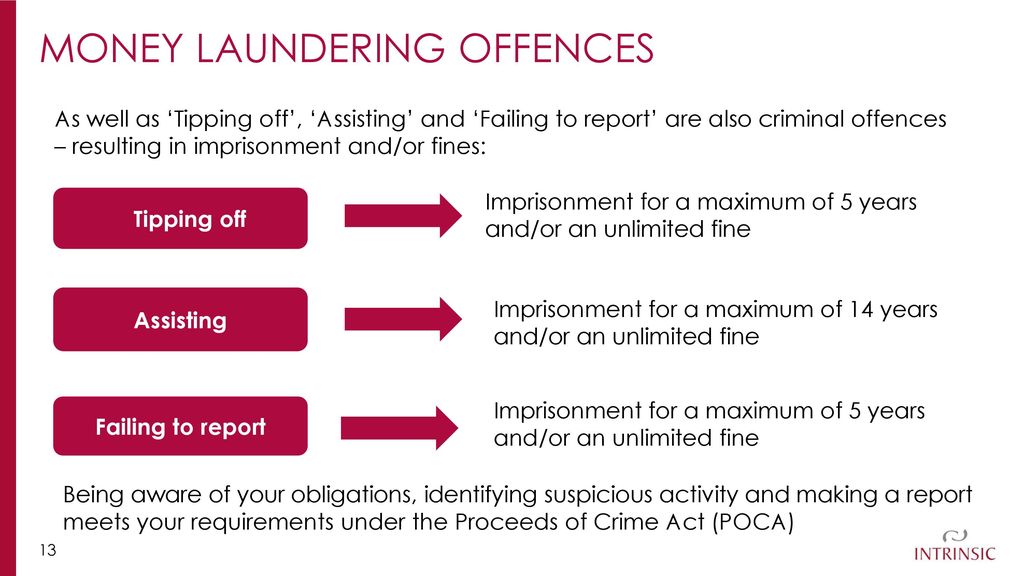

The maximum penalty for the three principal money laundering offences on conviction on indictment is fourteen years imprisonment. To read more about these sections of the legislation please follow this link to the Hong Kong E-Legislation. What is the penalty for failing to report money laundering. What Is The Penalty For Tipping Off A Money Launderer. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone.

Maximum penalty for failing to report a suspicion of money laundering. For a legal entity the maximum penalty is an unlimited fine. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. An acquittal for all parties. In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. Money laundering offencesacquisition use and possession.

Source: wikiwand.com

Source: wikiwand.com

Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. An acquittal for all parties. The offence of failing to report a suspicion of money laundering by another person carries a maximum penalty of 5 years imprisonment andor a fine. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. This was the first attempt at a prosecution in Jersey for failure to report potential money laundering since the provisions requiring such reports were brought in over 15 years ago.

Source: wikiwand.com

Source: wikiwand.com

Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone. What Is The Penalty For Tipping Off A Money Launderer. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone. As a result FINTRACs AMP policy has been updated to reflect the change to mandatory publication at specific stages in the penalty process.

Source: researchgate.net

Source: researchgate.net

Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. The proceedings are said to have arisen from a visit by. Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering.

Source: researchgate.net

Source: researchgate.net

Anti-Money Laundering and Counter-Terrorist Financing Ordinance Cap 615. The offence of failing to report a suspicion of money laundering by another person carries a maximum penalty of 5 years imprisonment andor a fine. To read more about these sections of the legislation please follow this link to the Hong Kong E-Legislation. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Mens rea for money laundering.

Source: pliance.io

The offence is triable either way. Mens rea for money laundering. CBA is accused of failing to report cash transactions of 10000 or more made through intelligent deposit machines to AUSTRAC in time for assessment as required by anti-money laundering. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. An acquittal for all parties.

Source: slideplayer.com

Source: slideplayer.com

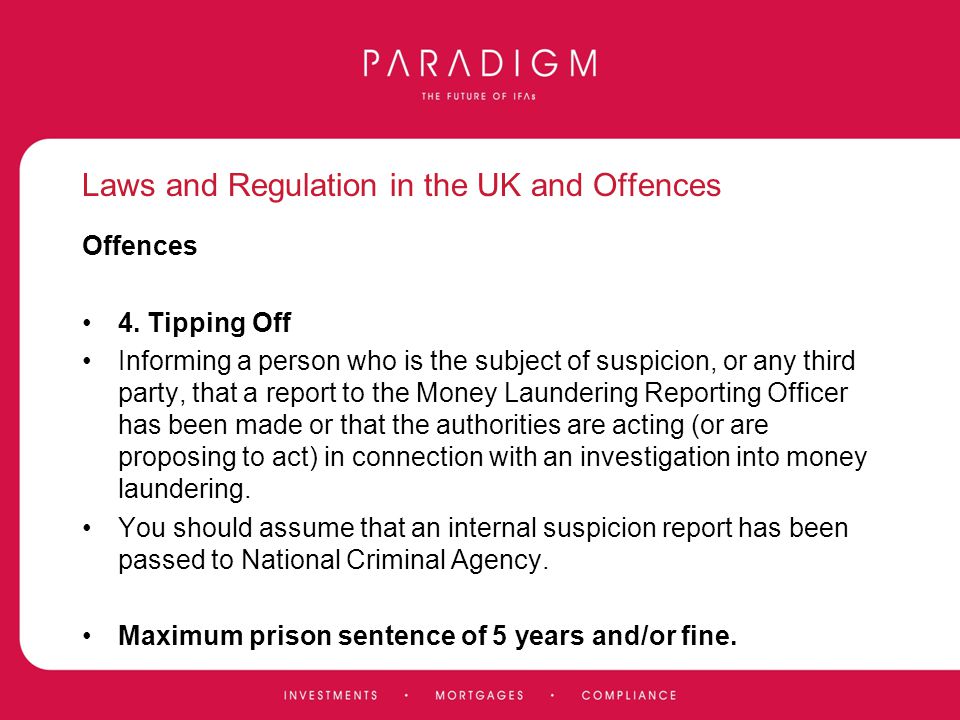

What Is The Penalty For Tipping Off A Money Launderer. What Is The Penalty For Tipping Off A Money Launderer. The maximum penalty on conviction on indictment is five years imprisonment for the following. Anti-Money Laundering and Counter-Terrorist Financing Ordinance Cap 615. Mens rea for money laundering.

Source: slideplayer.com

Source: slideplayer.com

Proceeds Of Crime Act 2002. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment. Maximum penalty for failing to report a suspicion of money laundering. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million to the higher of S1 million or twice the. On June 21 2019 the Proceeds of Crime Money Laundering and Terrorist Financing Act was amended requiring FINTRAC to make public all administrative monetary penalties AMPs imposed.

Source: researchgate.net

Source: researchgate.net

On June 21 2019 the Proceeds of Crime Money Laundering and Terrorist Financing Act was amended requiring FINTRAC to make public all administrative monetary penalties AMPs imposed. On June 21 2019 the Proceeds of Crime Money Laundering and Terrorist Financing Act was amended requiring FINTRAC to make public all administrative monetary penalties AMPs imposed. The maximum penalty on conviction on indictment is five years imprisonment for the following. Mens rea for money laundering. Money laundering regulations penalty for failure to report.

Source: slideplayer.com

Source: slideplayer.com

The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. What Is The Penalty For Tipping Off A Money Launderer. Proceeds Of Crime Act 2002. What Is The Penalty For Tipping Off A Money Launderer. Money laundering regulations penalty for failure to report.

Source: slideplayer.com

Source: slideplayer.com

The maximum penalty for the three principal money laundering offences on conviction on indictment is fourteen years imprisonment. This was the first attempt at a prosecution in Jersey for failure to report potential money laundering since the provisions requiring such reports were brought in over 15 years ago. In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million to the higher of S1 million or twice the. Failing to report is an offence which is liable to HK 50000 fine and 3-month imprisonment.

Source: iclg.com

Source: iclg.com

In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. To read more about these sections of the legislation please follow this link to the Hong Kong E-Legislation. What Is The Penalty For Tipping Off A Money Launderer. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016.

Source: slideplayer.com

Source: slideplayer.com

In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. The offence of failing to report a suspicion of money laundering by another person carries a maximum penalty of 5 years imprisonment andor a fine. What is the penalty for failing to report money laundering. For further information see Practice Note. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

Source: slideplayer.com

Source: slideplayer.com

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million to the higher of S1 million or twice the. Anti-Money Laundering and Counter-Terrorist Financing Ordinance Cap 615. As a result FINTRACs AMP policy has been updated to reflect the change to mandatory publication at specific stages in the penalty process. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title maximum penalty for failing to report money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.