15+ Maximum penalty for failing to comply with money laundering regulations ideas in 2021

Home » money laundering Info » 15+ Maximum penalty for failing to comply with money laundering regulations ideas in 2021Your Maximum penalty for failing to comply with money laundering regulations images are available. Maximum penalty for failing to comply with money laundering regulations are a topic that is being searched for and liked by netizens now. You can Get the Maximum penalty for failing to comply with money laundering regulations files here. Find and Download all free photos and vectors.

If you’re searching for maximum penalty for failing to comply with money laundering regulations images information related to the maximum penalty for failing to comply with money laundering regulations interest, you have visit the right site. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Maximum Penalty For Failing To Comply With Money Laundering Regulations. Failure to provide assistance or provide information during compliance examination. Maximum penalty is a HK 5000000 fine and 14-year imprisonment. The value of fines imposed by HMRC for failures to comply with anti-money laundering obligations jumped 91 last year says fscom the financial services regulatory consultancy. Research by fscom says the value of fines imposed on businesses increased to 23m last year up from 12m in 201617 see graph below.

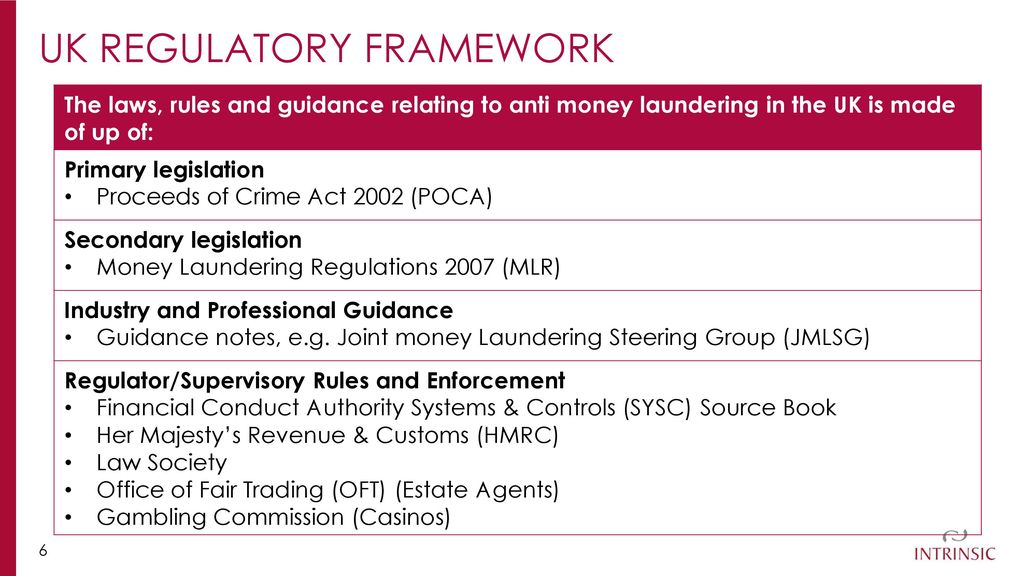

Anti Money Laundering Bribery Awareness Ppt Download From slideplayer.com

Anti Money Laundering Bribery Awareness Ppt Download From slideplayer.com

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. The maximum penalty under Sections 43 44 46 and 47 of the CDSA is. Charges and offences of money laundering Subject. Sentencing - Legal Guidance. Money laundering offencesacquisition use and possession. Maximum Penalty For A Breach Of The Money Laundering Regulations 2017 on August 07 2021.

Mens rea for money laundering.

16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. Research by fscom says the value of fines imposed on businesses increased to 23m last year up from 12m in 201617 see graph below. The value of fines imposed by HMRC for failures to comply with anti-money laundering obligations jumped 91 last year says fscom the financial services regulatory consultancy. Section 45 47. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. For an individual a fine not exceeding S500000 or imprisonment not exceeding 10 years or both.

Source: mhc.ie

Source: mhc.ie

31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. Charges and offences of money laundering Subject. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Crown Prosecution Service CPS.

Source: slideplayer.com

Source: slideplayer.com

Failure to provide assistance or provide information during compliance examination. Maximum Penalty For A Breach Of The Money Laundering Regulations 2017 on August 07 2021. 1 A person may be convicted of a money laundering. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering.

Source: academia.edu

Source: academia.edu

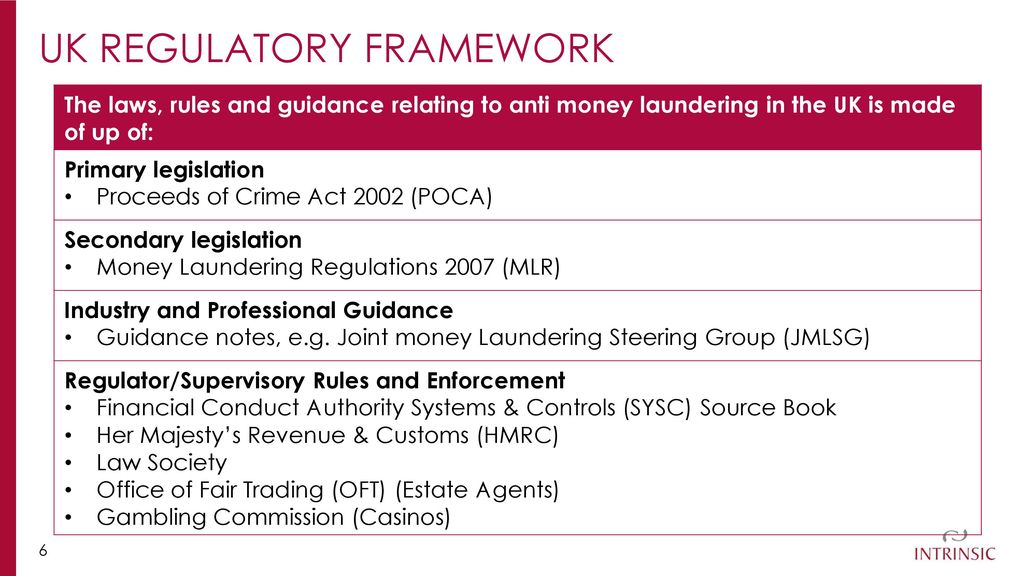

Maximum penalty for failing to report a suspicion of money laundering. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. The maximum penalty under Sections 43 44 46 and 47 of the CDSA is. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

Source: iclg.com

Source: iclg.com

Maximum Penalty For A Breach Of The Money Laundering Regulations 2017 on August 07 2021. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. The maximum penalty is 5-years imprisonment andor a fine. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

Source: slideplayer.com

Source: slideplayer.com

Section 45 47. Failure to meet record keeping requirements. Individuals in the regulated sector commit an offence if they fail to disclose knowledge or suspicion or grounds for suspicion that money laundering is occurring or has occurred. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie. Section 45 47.

Source: slideplayer.com

Source: slideplayer.com

Money laundering offencesacquisition use and possession. Failure to comply with Money Laundering Regulations. The value of fines imposed by HMRC for failures to comply with anti-money laundering obligations jumped 91 last year says fscom the financial services regulatory consultancy. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily.

Source: slideplayer.com

Source: slideplayer.com

250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. Maximum penalty for failing to report a suspicion of money laundering. Individuals in the regulated sector commit an offence if they fail to disclose knowledge or suspicion or grounds for suspicion that money laundering is occurring or has occurred. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily.

Source: slideplayer.com

Source: slideplayer.com

Money laundering regulations penalty for failure to report. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Failure to comply with Money Laundering Regulations. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million.

Source: roaring.io

Source: roaring.io

Maximum penalty for failing to report a suspicion of money laundering. Failure to provide assistance or provide information during compliance examination. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. Sentencing - Legal Guidance.

Source: complyadvantage.com

Source: complyadvantage.com

For further information see Practice Note. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Money laundering offencesacquisition use and possession.

Source: slideplayer.com

Source: slideplayer.com

The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. The Money Laundering Regulations 2007.

Source: researchgate.net

Source: researchgate.net

16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. For further information see Practice Note. The maximum penalty is 5-years imprisonment andor a fine. Money laundering regulations penalty for failure to report. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering.

Source: slideplayer.com

Source: slideplayer.com

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. Failure to comply with Money Laundering Regulations. Research by fscom says the value of fines imposed on businesses increased to 23m last year up from 12m in 201617 see graph below. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. The Money Laundering Regulations 2007.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title maximum penalty for failing to comply with money laundering regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.