15+ Major risk of money laundering ideas

Home » money laundering idea » 15+ Major risk of money laundering ideasYour Major risk of money laundering images are ready in this website. Major risk of money laundering are a topic that is being searched for and liked by netizens now. You can Find and Download the Major risk of money laundering files here. Find and Download all free photos.

If you’re searching for major risk of money laundering pictures information connected with to the major risk of money laundering interest, you have visit the ideal blog. Our website always provides you with hints for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Major Risk Of Money Laundering. When a country is considered a money laundering paradise it will. The risk assessment is designed to assist the public and private sectors in identifying the risks of money laundering in the country to understand the potential risk of these phenomena to. Allowing money laundering to take place through your business can leave you prone to challenges in managing your assets. With the liberalization of world trade millions of business transactions are carried out daily some of which involve the transfer of huge sums of money.

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business. You can decide which areas of. Money laundering with positive results helps improve the profitable aspects of criminal activities.

Money laundering with positive results helps improve the profitable aspects of criminal activities.

With the liberalization of world trade millions of business transactions are carried out daily some of which involve the transfer of huge sums of money. Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. When a country is considered a money laundering paradise it will. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or the beneficial owner is a foreign PEP and. In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers. The risk assessment is designed to assist the public and private sectors in identifying the risks of money laundering in the country to understand the potential risk of these phenomena to.

Source: pinterest.com

Source: pinterest.com

It is a process by which soiled money is transformed into clean money. In accordance with regulation 33 of the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 a relevant person must apply enhanced customer due diligence measures and enhanced ongoing monitoring in addition to the customer due diligence measures in order to manage and mitigate the risks of money laundering or terrorist financing. Inherent BSAAML risk falls into three main categories. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. Some of the effects of money laundering and terrorist financing are.

Source: pinterest.com

Source: pinterest.com

This document summarizes the main findings of the Money Laundering National Risk Assessment of Israel. Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. While insurance fraud and other crimes might be more common in. What are the 3 main factors to consider in determining AML risk. In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

You can decide which areas of. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. While insurance fraud and other crimes might be more common in. When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it. The clean money and dirty money intermingle often becoming indistinguishable.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Some of the effects of money laundering and terrorist financing are. The majority of global research focuses on two major money-laundering sectors. Inherently high risk for money laundering. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it.

Source: bi.go.id

Source: bi.go.id

The sources of the money in precise are criminal and the money is invested in a manner that makes it look like clean cash and hide the id of the legal part of the cash. 1 products and services 2 customers and entities and 3 geographic location. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or the beneficial owner is a foreign PEP and. The idea of money laundering is very important to be understood for those working in the monetary sector.

Source: bi.go.id

Source: bi.go.id

This Staff publication highlights the heightened risks of money laundering terrorist financing and cybercrime arising from the disruptive and uncertain COVID-19 environment and the implications for professional accountants in business and public practice including auditors and. Allowing money laundering to take place through your business can leave you prone to challenges in managing your assets. Increase in Crime and Corruption. While insurance fraud and other crimes might be more common in. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products.

Source: pinterest.com

Source: pinterest.com

This Staff publication highlights the heightened risks of money laundering terrorist financing and cybercrime arising from the disruptive and uncertain COVID-19 environment and the implications for professional accountants in business and public practice including auditors and. Money laundering with positive results helps improve the profitable aspects of criminal activities. This document summarizes the main findings of the Money Laundering National Risk Assessment of Israel. The sources of the money in precise are criminal and the money is invested in a manner that makes it look like clean cash and hide the id of the legal part of the cash. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products.

Source: worldbank.org

Source: worldbank.org

The majority of global research focuses on two major money-laundering sectors. Drug trafficking and terrorist organizations. The paper International Financial Institutions Risk of Money-Laundering is a great example of a report on finance and accounting. The majority of global research focuses on two major money-laundering sectors. Allowing money laundering to take place through your business can leave you prone to challenges in managing your assets.

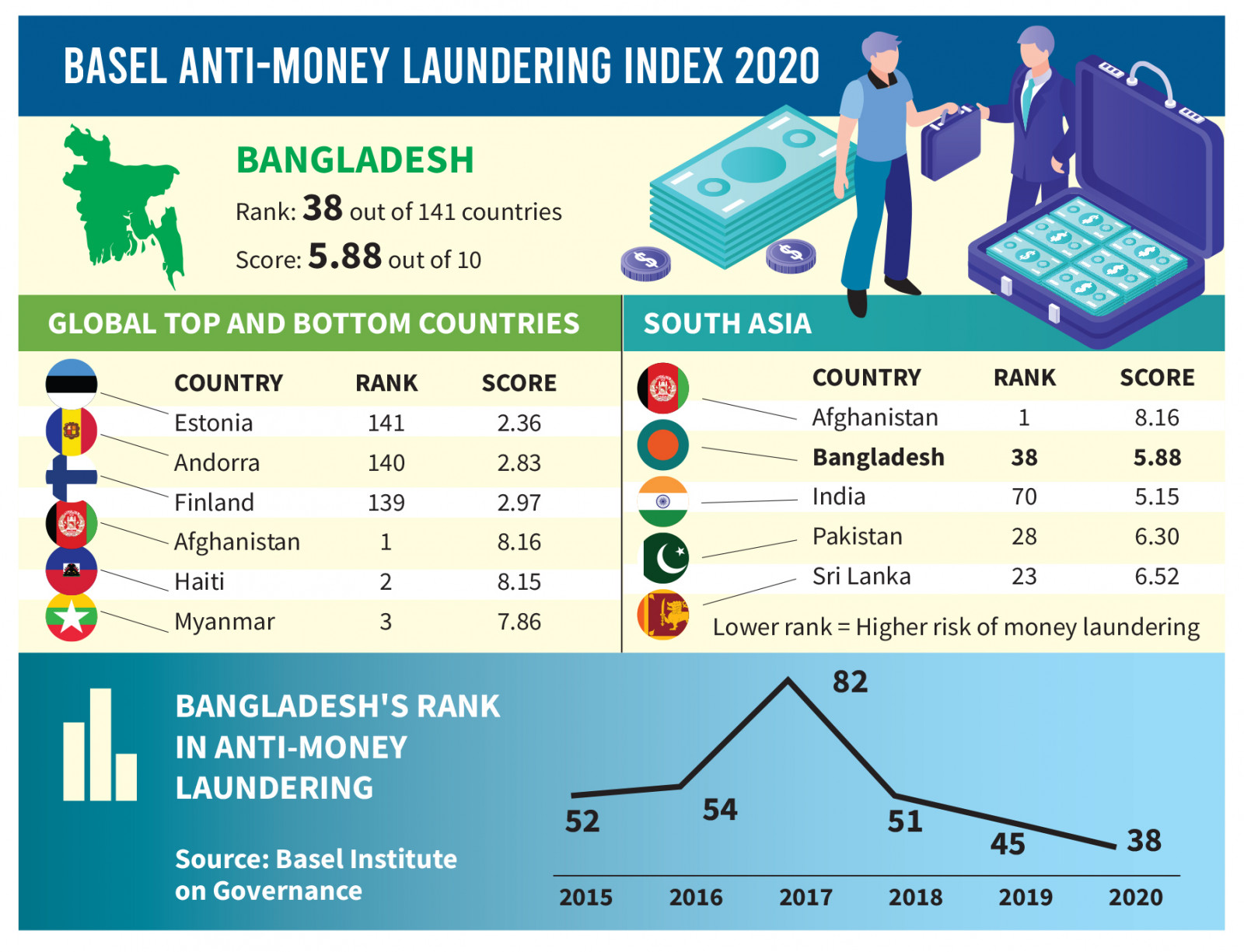

Source: tbsnews.net

Source: tbsnews.net

Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. Inherent BSAAML risk falls into three main categories. Understanding risk within the Recommendation 12 context is important for two reasons. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK National risk assessment of money laundering.

Source: lki.lk

Source: lki.lk

Understanding risk within the Recommendation 12 context is important for two reasons. While insurance fraud and other crimes might be more common in. 1 products and services 2 customers and entities and 3 geographic location. This document summarizes the main findings of the Money Laundering National Risk Assessment of Israel. With the liberalization of world trade millions of business transactions are carried out daily some of which involve the transfer of huge sums of money.

Source: ft.lk

Source: ft.lk

The majority of global research focuses on two major money-laundering sectors. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. This document summarizes the main findings of the Money Laundering National Risk Assessment of Israel. You can decide which areas of. When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it.

Source: bi.go.id

Allowing money laundering to take place through your business can leave you prone to challenges in managing your assets. The paper International Financial Institutions Risk of Money-Laundering is a great example of a report on finance and accounting. Some of the effects of money laundering and terrorist financing are. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK National risk assessment of money laundering. You can decide which areas of.

Source: bi.go.id

Source: bi.go.id

This Staff publication highlights the heightened risks of money laundering terrorist financing and cybercrime arising from the disruptive and uncertain COVID-19 environment and the implications for professional accountants in business and public practice including auditors and. When a country is considered a money laundering paradise it will. This Staff publication highlights the heightened risks of money laundering terrorist financing and cybercrime arising from the disruptive and uncertain COVID-19 environment and the implications for professional accountants in business and public practice including auditors and. The idea of money laundering is very important to be understood for those working in the monetary sector. Allowing money laundering to take place through your business can leave you prone to challenges in managing your assets.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title major risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.