11+ Main types of sanctions money laundering info

Home » money laundering Info » 11+ Main types of sanctions money laundering infoYour Main types of sanctions money laundering images are ready in this website. Main types of sanctions money laundering are a topic that is being searched for and liked by netizens now. You can Find and Download the Main types of sanctions money laundering files here. Get all royalty-free images.

If you’re searching for main types of sanctions money laundering images information related to the main types of sanctions money laundering topic, you have come to the right blog. Our site always provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

Main Types Of Sanctions Money Laundering. Protection from regulatory fines. Sectoral Sanctions Prohibit US. Persons from undertaking only limited specific transactions with listed entities Secondary Sanctions With Us or Against Us Risks US. To make provision for the purposes of the detection investigation and prevention of money laundering.

Anti Money Laundering 2021 Pakistan Iclg From iclg.com

Anti Money Laundering 2021 Pakistan Iclg From iclg.com

The United States plays an important role in the international fight against money laundering terrorism financing and other financial crimes and does so by imposing economic sanctions against the countries entities and individuals engaged in those activities. AML screening is performed to fulfil three main objectives. Sanctions the imposition of US. People having their names in sanctions or any other wanted lists are high-risk customer profiles for businesses especially those in. Money laundering offense conviction and proof that property was involved in the offense. Accordingly it applies to Relevant Persons but in different degrees as provided in Rule 1222.

The United States plays an important role in the international fight against money laundering terrorism financing and other financial crimes and does so by imposing economic sanctions against the countries entities and individuals engaged in those activities.

Sanctions imposed by Canada on specific countries organizations or individuals vary and can encompass a variety of measures including restricting or prohibiting trade financial transactions or other economic activity between Canada and the target state. Differentiating between US money laundering and sanctions offences is a futile exercise. As the entire US sanctions regime has integral money laundering offence types when extra-territorial actions involving foreign firms are investigated by US agencies it is highly likely that sanctions-related offences which typically carry the highest penalties are being scrutinised. A breach of sanctions is an offence in its own right and may also constitute a money laundering or terrorist financing offence. In September 2005 Treasury officials labeled Banco Delta Asia BDA a primary money-laundering concern alleging that the Macau-based bank was a. People having their names in sanctions or any other wanted lists are high-risk customer profiles for businesses especially those in.

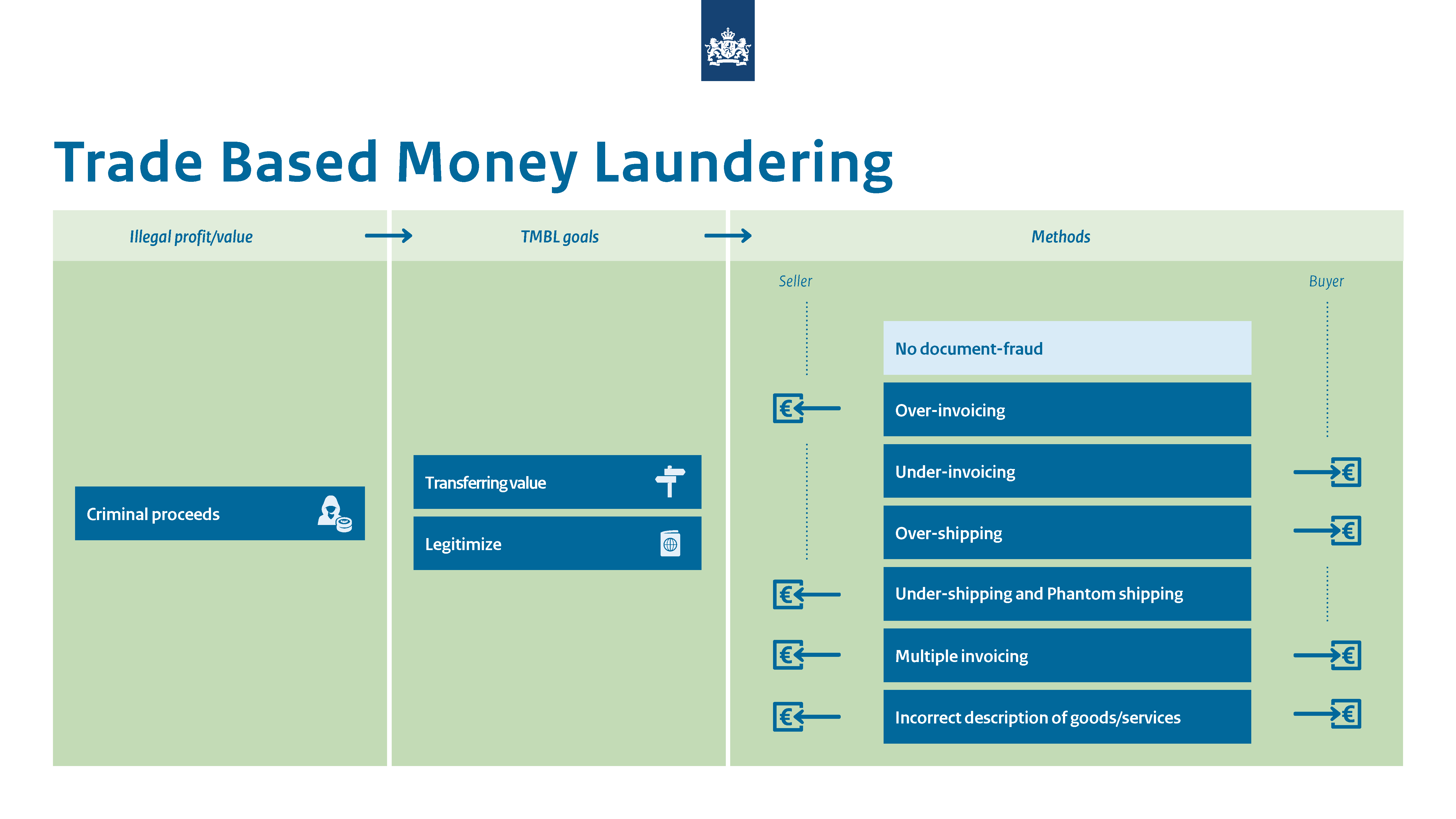

Source: businessforensics.nl

Source: businessforensics.nl

A proactive pre-emptive pragmatic and results-oriented approach to sanctions. A proactive pre-emptive pragmatic and results-oriented approach to sanctions. AML screening is performed to fulfil three main objectives. Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and Sanctions compliance in accordance with the scope of application outlined in Rule 121. People having their names in sanctions or any other wanted lists are high-risk customer profiles for businesses especially those in.

Source: complyadvantage.com

Source: complyadvantage.com

Types of sanctions. Types of sanctions. In September 2005 Treasury officials labeled Banco Delta Asia BDA a primary money-laundering concern alleging that the Macau-based bank was a. Sanctions the imposition of US. An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or for the purposes of national security or international peace and security or for the purposes of furthering foreign policy objectives.

Source: government.se

Differentiating between US money laundering and sanctions offences is a futile exercise. The United States plays an important role in the international fight against money laundering terrorism financing and other financial crimes and does so by imposing economic sanctions against the countries entities and individuals engaged in those activities. Persons from undertaking only limited specific transactions with listed entities Secondary Sanctions With Us or Against Us Risks US. In September 2005 Treasury officials labeled Banco Delta Asia BDA a primary money-laundering concern alleging that the Macau-based bank was a. Sanctions compliance is a formidable challenge for the financial services industry as the sanctions of multiple bodies may be in place at the same time may differ from each other and are often drafted in impenetrable.

Source: iclg.com

Source: iclg.com

To make provision for the purposes of the detection investigation and prevention of money laundering. Types of sanctions. The United States sanctions are implemented and enforced by. Persons from undertaking only limited specific transactions with listed entities Secondary Sanctions With Us or Against Us Risks US. A proactive pre-emptive pragmatic and results-oriented approach to sanctions.

Source: forcamabogados.com

Source: forcamabogados.com

An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or for the purposes of national security or international peace and security or for the purposes of furthering foreign policy objectives. What are the main types of sanctions in money laundering. In September 2005 Treasury officials labeled Banco Delta Asia BDA a primary money-laundering concern alleging that the Macau-based bank was a. As the entire US sanctions regime has integral money laundering offence types when extra-territorial actions involving foreign firms are investigated by US agencies it is highly likely that sanctions-related offences which typically carry the highest penalties are being scrutinised. Sectoral Sanctions Prohibit US.

Source: acamstoday.org

Source: acamstoday.org

Persons for engaging in transactions with targeted entities In reality all US. Or the seizure or freezing of property situated in Canada. Differentiating between US money laundering and sanctions offences is a futile exercise. Types of sanctions. The AML Rulebook takes into consideration the fact that Relevant.

Source: amlc.eu

Source: amlc.eu

Accordingly it applies to Relevant Persons but in different degrees as provided in Rule 1222. Sanctions the imposition of US. Money laundering offense conviction and proof that property was involved in the offense. The AML Rulebook takes into consideration the fact that Relevant. As the entire US sanctions regime has integral money laundering offence types when extra-territorial actions involving foreign firms are investigated by US agencies it is highly likely that sanctions-related offences which typically carry the highest penalties are being scrutinised.

Source: youtube.com

Source: youtube.com

What are the main types of sanctions in money laundering. To make provision for the purposes of the detection investigation and prevention of money laundering. The United States sanctions are implemented and enforced by. Sanctions are used for a number of purposes including pressurising a particular country or regime to change their behaviour or to prevent terrorist financing. Types of sanctions.

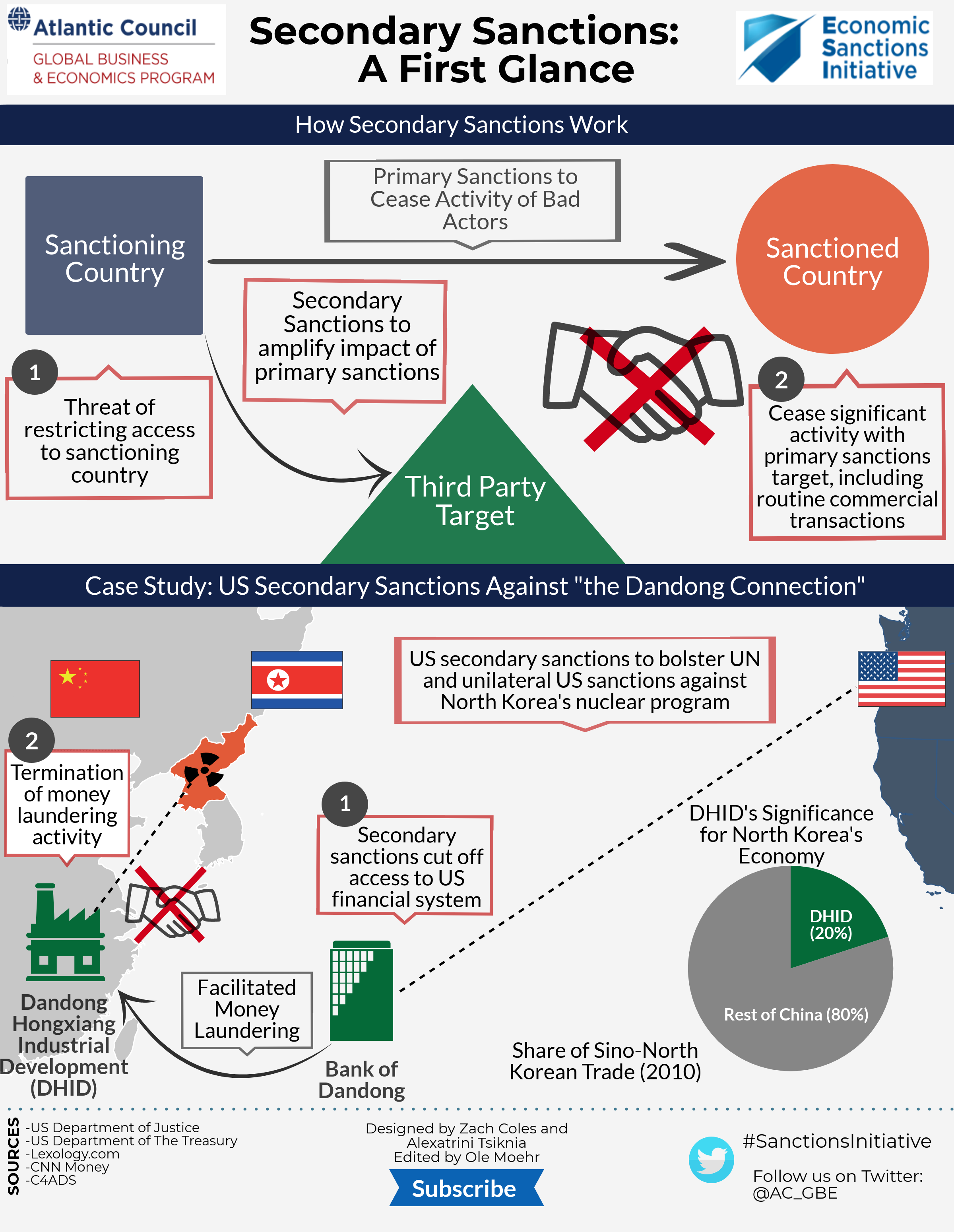

Source: atlanticcouncil.org

Source: atlanticcouncil.org

The United States sanctions are implemented and enforced by. AML screening is performed to fulfil three main objectives. Sanctions imposed by Canada on specific countries organizations or individuals vary and can encompass a variety of measures including restricting or prohibiting trade financial transactions or other economic activity between Canada and the target state. Sectoral Sanctions Prohibit US. Accordingly it applies to Relevant Persons but in different degrees as provided in Rule 1222.

Source: amlcompliance.ie

Source: amlcompliance.ie

The strictest sanctions enforcers require little in the way of proof and can issue substantial penalties based merely on apparent sanctions violations including suspected money laundering and terrorist financing. The strictest sanctions enforcers require little in the way of proof and can issue substantial penalties based merely on apparent sanctions violations including suspected money laundering and terrorist financing. Differentiating between US money laundering and sanctions offences is a futile exercise. As the entire US sanctions regime has integral money laundering offence types when extra-territorial actions involving foreign firms are investigated by US agencies it is highly likely that sanctions-related offences which typically carry the highest penalties are being scrutinised. The United States sanctions are implemented and enforced by.

Source: ec.europa.eu

Source: ec.europa.eu

Sanctions are used for a number of purposes including pressurising a particular country or regime to change their behaviour or to prevent terrorist financing. CIBCs USA PATRIOT Act Certification. The AML Rulebook takes into consideration the fact that Relevant. The United States sanctions are implemented and enforced by. There are many different types of sanctions including travel bans asset freezes trade embargoes and other restrictions.

Source: linkurio.us

Source: linkurio.us

Sanctions imposed by Canada on specific countries organizations or individuals vary and can encompass a variety of measures including restricting or prohibiting trade financial transactions or other economic activity between Canada and the target state. A breach of sanctions is an offence in its own right and may also constitute a money laundering or terrorist financing offence. Accordingly it applies to Relevant Persons but in different degrees as provided in Rule 1222. Sectoral Sanctions Prohibit US. People having their names in sanctions or any other wanted lists are high-risk customer profiles for businesses especially those in.

Source: allenovery.com

Source: allenovery.com

The AMLATF and Sanctions programs are delivered by employees in the Enterprise Anti-Money Laundering EAML group made up of teams of specialists who use analytics innovative technology and professional expertise to detect and deter MLTF and manage sanctions compliance. Persons for engaging in transactions with targeted entities In reality all US. The United States sanctions are implemented and enforced by. Differentiating between US money laundering and sanctions offences is a futile exercise. Money laundering offense conviction and proof that property was involved in the offense.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title main types of sanctions money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.