14+ List of effects of money laundering info

Home » money laundering Info » 14+ List of effects of money laundering infoYour List of effects of money laundering images are ready. List of effects of money laundering are a topic that is being searched for and liked by netizens now. You can Download the List of effects of money laundering files here. Get all royalty-free vectors.

If you’re looking for list of effects of money laundering pictures information connected with to the list of effects of money laundering keyword, you have pay a visit to the right site. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

List Of Effects Of Money Laundering. Enables criminal to enjoy benefits of such funds without bringing attention to himself. The strategic deficiencies of those countries in particular in relation to the legal and institutional anti-money laundering and counter-terrorist financing framework such as. Effect on money demand It occurs more frequently in countries where the risk of money laundering is minimal. It increased the outflow of capital exchange rate fluctuation.

Pdf Money Laundering Effects From researchgate.net

Pdf Money Laundering Effects From researchgate.net

The Decrease in Government Revenues. People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. Furthermore organisations laundering money have a fundamental unfair businesses advantage. Of money transfer companies in the US the UK and Australia have lost access to banking services as a result of banks desire to reduce their exposure to regulatory risk potentially leading to a reduction to a decrease in formal remittances to developing countries a critical. As a large amount of money is transferred to a bank this can artificially inflate the demand in whichever industry or economic sector the money launderers are eyeing. As money laundering leads to huge amounts of money remaining unaccounted for and untaxed this also means higher tax rates in general than would normally be.

The professional skills internal auditors Suit for the war against money laundering.

Furthermore organisations laundering money have a fundamental unfair businesses advantage. As a large amount of money is transferred to a bank this can artificially inflate the demand in whichever industry or economic sector the money launderers are eyeing. 1 Challenges in implementing economic policies. One of the most serious microeconomic effects of money laundering falls on the private sector. Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Government-linked economists have noted the significant negative effects of money laundering on economic development including undermining domestic capital formation depressing growth and diverting capital away from development.

Source: researchgate.net

Source: researchgate.net

People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. It stops the economic growth of a country. 1 Challenges in implementing economic policies. For starters money laundering can cause massive fluctuations in the financial sector. Unchecked money laundering changes the demand for money risks to bank soundness contamination effects on legal financial transactions and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers.

Source: jagranjosh.com

Source: jagranjosh.com

As for the potential negative macroeconomic consequences of unchecked money laundering one can cite inexplicable changes in money demand prudential risks to bank soundness contamination effects on legal financial transactions and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers. Money laundering is the criminals way of trying to ensure that in the end crime pays McDowell. Effects on the Economy. Laundered money leads to a rise in. Of money transfer companies in the US the UK and Australia have lost access to banking services as a result of banks desire to reduce their exposure to regulatory risk potentially leading to a reduction to a decrease in formal remittances to developing countries a critical.

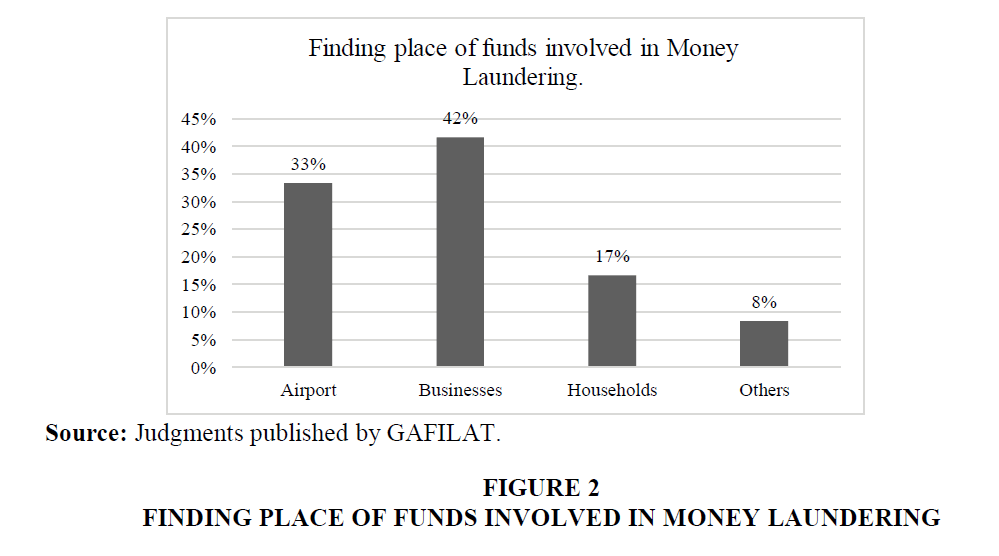

Source: redalyc.org

Source: redalyc.org

Individuals may turn enterprises which were initially productive into sterile ones just to launder money. Money laundering creates unpredictable changes in money demand as well as causing large fluctuations in international capital flows and exchange rates. Consequently the meager government revenues bring fiscal deficit leading to domestic and foreign debt. As money laundering leads to huge amounts of money remaining unaccounted for and untaxed this also means higher tax rates in general than would normally be. For starters money laundering can cause massive fluctuations in the financial sector.

Source: gov.si

Source: gov.si

Unchecked money laundering changes the demand for money risks to bank soundness contamination effects on legal financial transactions and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers. Unchecked money laundering changes the demand for money risks to bank soundness contamination effects on legal financial transactions and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers. Unchecked money laundering can erode the integrity of a nations financial institutions. Furthermore organisations laundering money have a fundamental unfair businesses advantage. The professional skills internal auditors Suit for the war against money laundering.

Source: redalyc.org

Source: redalyc.org

Money launderings effects on the economy. Individuals may turn enterprises which were initially productive into sterile ones just to launder money. Money laundering has catastrophic effects on economies. Weakening of the Legitimate Private Sector. Enables criminal to distance the funds from criminal activities.

Of money transfer companies in the US the UK and Australia have lost access to banking services as a result of banks desire to reduce their exposure to regulatory risk potentially leading to a reduction to a decrease in formal remittances to developing countries a critical. Apart from this severe sanctions such as the closure of criminal institutions and fines of up to 5 million Euros were imposed. Ultimately laundered money flows into global financial systems where it can undermine national economies and currencies. The professional skills internal auditors Suit for the war against money laundering. Individuals may turn enterprises which were initially productive into sterile ones just to launder money.

Source: redalyc.org

Source: redalyc.org

The professional skills internal auditors Suit for the war against money laundering. Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. The Decrease in Government Revenues. The strategic deficiencies of those countries in particular in relation to the legal and institutional anti-money laundering and counter-terrorist financing framework such as. Purpose of Money Laundering.

Source: researchgate.net

Source: researchgate.net

N Loss of tax revenue is the natural macroeconomic effect of money laundering. Individuals may turn enterprises which were initially productive into sterile ones just to launder money. Laundered money leads to a rise in. Ultimately laundered money flows into global financial systems where it can undermine national economies and currencies. Weakening of the Legitimate Private Sector.

Source: wikiwand.com

Source: wikiwand.com

1 Challenges in implementing economic policies. As for the potential negative macroeconomic consequences of unchecked money laundering one can cite inexplicable changes in money demand prudential risks to bank soundness contamination effects on legal financial transactions and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers. Enables criminal to enjoy benefits of such funds without bringing attention to himself. As a large amount of money is transferred to a bank this can artificially inflate the demand in whichever industry or economic sector the money launderers are eyeing. Implications of Botswanas Anti-Money Laundering Blacklisting by the EU On 13 February 2020 Botswana along with 23 other jurisdictions was included on an updated list of high-risk third jurisdictions with strategic deficiencies in their anti-money laundering counter financing of terrorism AMLCFT regimes published by the European Commission of the European Union EU.

Source: yumpu.com

Source: yumpu.com

It stops the economic growth of a country. Government-linked economists have noted the significant negative effects of money laundering on economic development including undermining domestic capital formation depressing growth and diverting capital away from development. The strategic deficiencies of those countries in particular in relation to the legal and institutional anti-money laundering and counter-terrorist financing framework such as. Unchecked money laundering can erode the integrity of a nations financial institutions. Enables criminal to enjoy benefits of such funds without bringing attention to himself.

Source: youtube.com

Source: youtube.com

Government-linked economists have noted the significant negative effects of money laundering on economic development including undermining domestic capital formation depressing growth and diverting capital away from development. The strategic deficiencies of those countries in particular in relation to the legal and institutional anti-money laundering and counter-terrorist financing framework such as. Money laundering is the criminals way of trying to ensure that in the end crime pays McDowell. The first of these is their international footprint since anti-money laundering regulations are still markedly local Arbizu saidUnder this scenario banks have to make a decision whether to just observe each countrys regulations or - as BBVA does - develop a global anti-money. Laundered money leads to a rise in.

Source: abacademies.org

Source: abacademies.org

Purpose of Money Laundering. The professional skills internal auditors Suit for the war against money laundering. As money laundering leads to huge amounts of money remaining unaccounted for and untaxed this also means higher tax rates in general than would normally be. According to Arbizu banks face six major challenges when tackling their anti-money laundering duties. The government is left constrained in carrying out its welfare and development projects.

Source: intosaijournal.org

Source: intosaijournal.org

As a large amount of money is transferred to a bank this can artificially inflate the demand in whichever industry or economic sector the money launderers are eyeing. It is basically illegal money. People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. Enables criminal to enjoy benefits of such funds without bringing attention to himself. Money laundering has negative side effects in the development of a country.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title list of effects of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.