20+ Life cycle of money laundering ideas in 2021

Home » money laundering Info » 20+ Life cycle of money laundering ideas in 2021Your Life cycle of money laundering images are ready. Life cycle of money laundering are a topic that is being searched for and liked by netizens today. You can Download the Life cycle of money laundering files here. Find and Download all royalty-free photos.

If you’re searching for life cycle of money laundering pictures information linked to the life cycle of money laundering keyword, you have pay a visit to the right blog. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

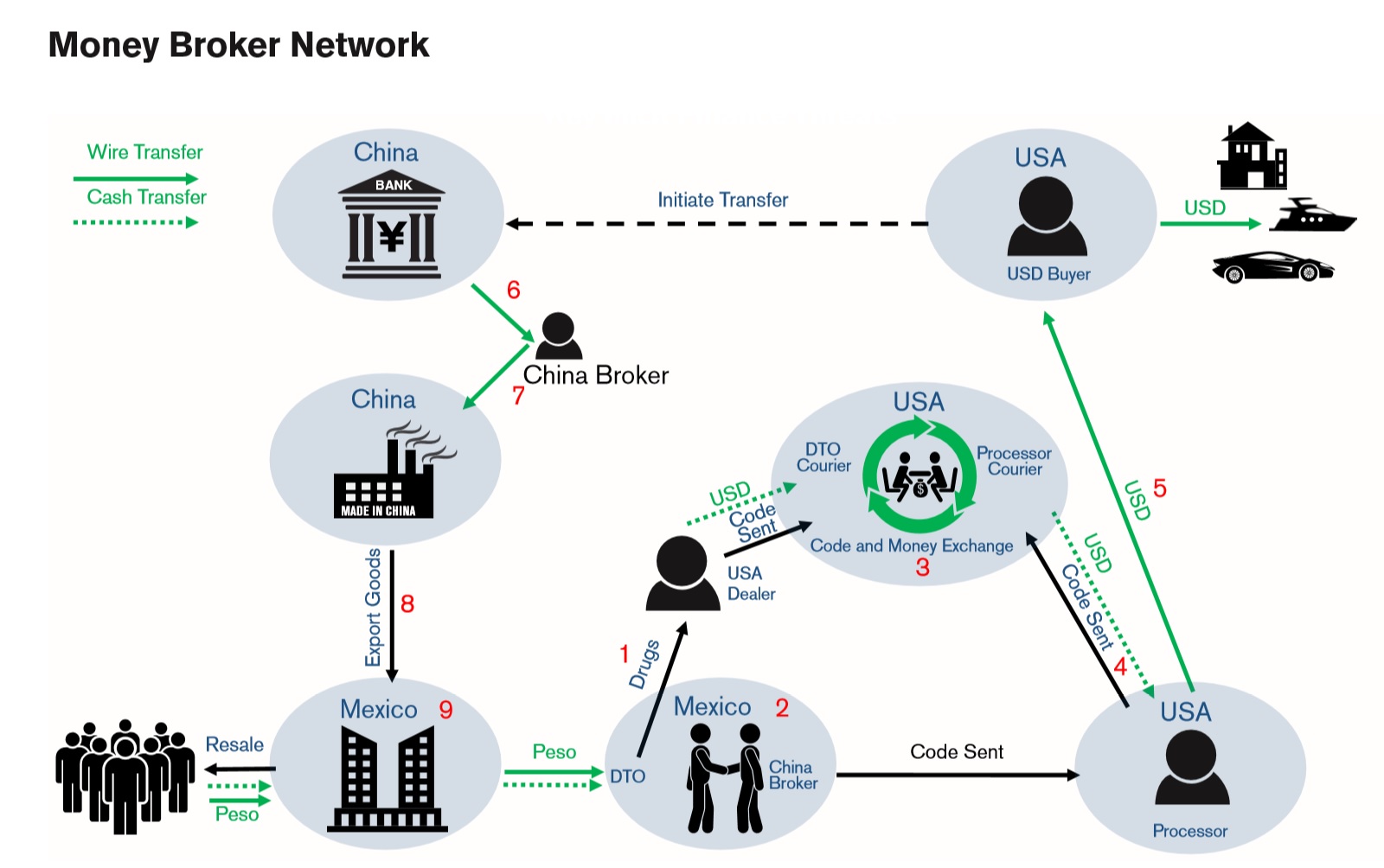

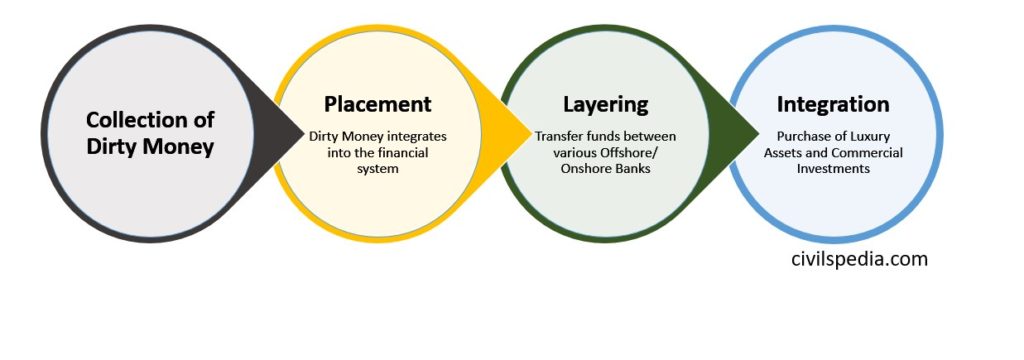

Life Cycle Of Money Laundering. The Anti-Money Laundering Compliance Alert Life Cycle Management Process and System invention is a dynamically active tool for aiding analysts in reaching decisions to cancel or release financial transactions so that money laundering and fraud may be easily and efficiently prevented. Placement The physical disposal of cash or other assets derived from criminal activity. But the act of hiding money is thousands of years old and it is the nature of money launderers to attempt to remain undetected by changing their approach keeping one step ahead of law. The money laundering cycle can be broken down into three distinct stages.

What Is Anti Money Laundering Aml Anti Money Laundering From letstalkaml.com

What Is Anti Money Laundering Aml Anti Money Laundering From letstalkaml.com

Placement layering and integration. Risk Assessment Client Due Diligence. How Money Laundering Works. The Anti-Money Laundering Compliance Alert Life Cycle Management Process and System invention is a dynamically active tool for aiding analysts in reaching decisions to cancel or release financial transactions so that money laundering and fraud may be easily and efficiently prevented. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial.

The objective of the KYC rule is to reduce the possibility of the financial system being used for money laundering and terrorist financing activities.

A Textbook Money Laundering Example. During the placement phase illicit proceeds are introduced by the money launderer into the financial system. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. The objective of the KYC rule is to reduce the possibility of the financial system being used for money laundering and terrorist financing activities. But the act of hiding money is thousands of years old and it is the nature of money launderers to attempt to remain undetected by changing their approach keeping one step ahead of law. Let us look at the individual stages.

Source: regtechconsulting.net

Source: regtechconsulting.net

Risk Assessment Client Due Diligence. Understanding Money Laundering European Institute Of Management And Finance. With a supplement on customer due diligence. Government money laundering taxation or redistribution of wealth is public sector organised crime but a necessary evil. Risk Assessment Client Due Diligence.

Source: slideshare.net

Source: slideshare.net

It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. Notable Examples of Money Laundering. The Anti-Money Laundering Compliance Alert Life Cycle Management Process and System invention is a dynamically active tool for aiding analysts in reaching decisions to cancel or release financial transactions so that money laundering and fraud may be easily and efficiently prevented. I do agree in basic human privileges ie. The Anti-Money Laundering Compliance Alert Life Cycle Management Process and System invention is a dynamically active tool for aiding analysts in reaching decisions to cancel or release financial transactions so that money laundering and fraud may be easily and efficiently prevented.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

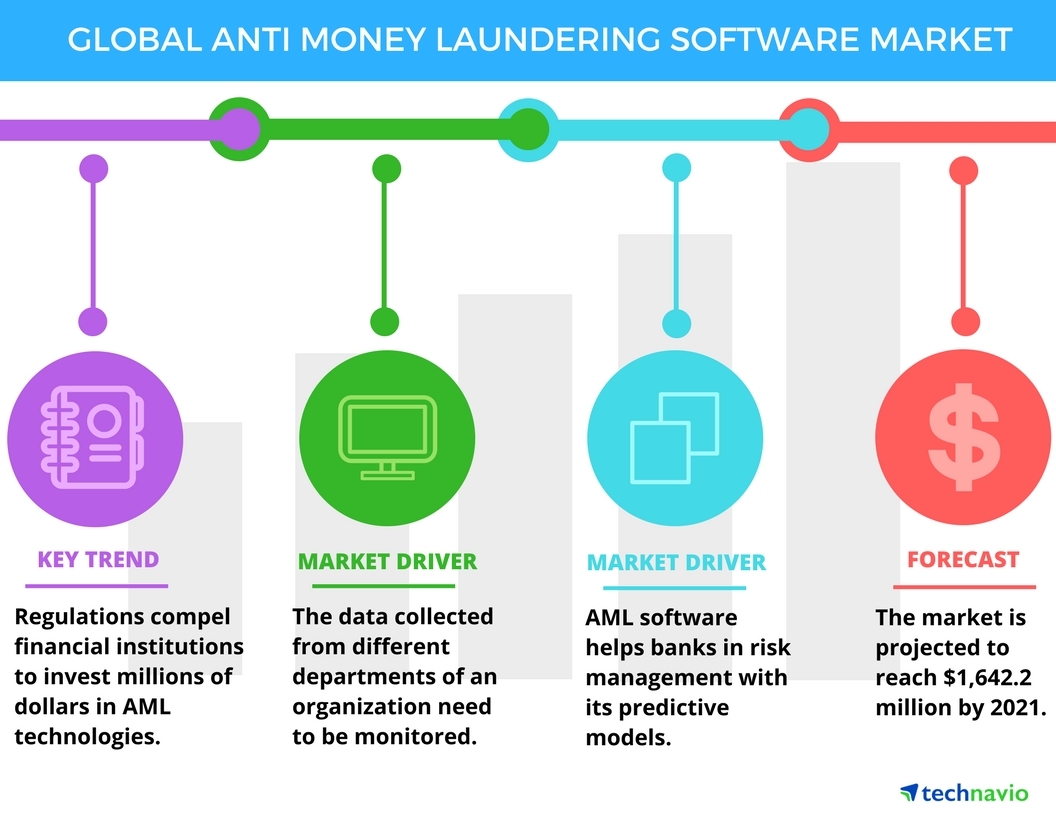

CUSTOMER DUE DILIGENCE AND FINANCIAL INCLUSION. Fundamental concepts of Anti-Money Laundering and Terrorist Financing Have an overall understanding of AML Be aware of the relevant legal and regulatory frameworks The AML lifecycle Be familiar with the AML life cycle and know how to apply the AML life cycle in your industry. With a few exceptions the AML KYC onboarding lifecycle involves three distinct phases-Customer Identification Program CIP-Customer due diligence CDD-Enhanced due diligence EDD. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. SUPPLEMENT TO THE 2013 FATF GUIDANCE ON AMLCFT MEASURES AND FINANCIAL INCLUSION.

Source: calert.info

Source: calert.info

However it is important to remember that money laundering is a single process. The six most common examples of crime. Hygiene indoor plumbing. Well this has nothing to do with money laundering so the three stages of money laundering are NOT. During the placement phase illicit proceeds are introduced by the money launderer into the financial system.

Source: researchgate.net

Source: researchgate.net

1 placement 2 layering and 3 integration. Risk Assessment Client Due Diligence. Fundamental concepts of Anti-Money Laundering and Terrorist Financing Have an overall understanding of AML Be aware of the relevant legal and regulatory frameworks The AML lifecycle Be familiar with the AML life cycle and know how to apply the AML life cycle in your industry. Let us look at the individual stages. With a supplement on customer due diligence.

Source: letstalkaml.com

Source: letstalkaml.com

Notable Examples of Money Laundering. The Placement Stage Filtering. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. With a few exceptions the AML KYC onboarding lifecycle involves three distinct phases-Customer Identification Program CIP-Customer due diligence CDD-Enhanced due diligence EDD. Government money laundering taxation or redistribution of wealth is public sector organised crime but a necessary evil.

Source: researchgate.net

Source: researchgate.net

Risk Assessment Client Due Diligence. The Placement Stage Filtering. However it is important to remember that money laundering is a single process. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. Fundamental concepts of Anti-Money Laundering and Terrorist Financing Have an overall understanding of AML Be aware of the relevant legal and regulatory frameworks The AML lifecycle Be familiar with the AML life cycle and know how to apply the AML life cycle in your industry.

Source: calert.info

Source: calert.info

A Textbook Money Laundering Example. How Money Laundering Works. But the act of hiding money is thousands of years old and it is the nature of money launderers to attempt to remain undetected by changing their approach keeping one step ahead of law. The FATF is committed to financial inclusion. The estimated amount of money laundered globally in one year is 2 to 5 of global GDP or US800 billion to US2 trillion and thats a low estimate.

Source: complyadvantage.com

Source: complyadvantage.com

Anti-money laundering and terrorist financing measures and financial inclusion. SUPPLEMENT TO THE 2013 FATF GUIDANCE ON AMLCFT MEASURES AND FINANCIAL INCLUSION. Risk Assessment Client Due Diligence. Methods and Markets And money laundering. The six most common examples of crime.

Source: piranirisk.com

Source: piranirisk.com

Money laundering often accompanies activities like smuggling illegal arms sales embezzlement insider trading bribery and computer fraud schemes. Anti-money laundering and terrorist financing measures and financial inclusion. Risk Assessment Client Due Diligence. Let us look at the individual stages. But the act of hiding money is thousands of years old and it is the nature of money launderers to attempt to remain undetected by changing their approach keeping one step ahead of law.

Source: businesswire.com

Source: businesswire.com

The money laundering cycle can be broken down into three distinct stages. Well this has nothing to do with money laundering so the three stages of money laundering are NOT. 1 placement 2 layering and 3 integration. Understanding Money Laundering European Institute Of Management And Finance. SUPPLEMENT TO THE 2013 FATF GUIDANCE ON AMLCFT MEASURES AND FINANCIAL INCLUSION.

Source: civilspedia.com

Source: civilspedia.com

In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. The final stage of the money laundering process is termed the integration stage. The money laundering process is divided into 3 segments. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources.

Source: researchgate.net

Source: researchgate.net

The money laundering process is divided into 3 segments. The Placement Stage Filtering. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. I do agree in basic human privileges ie. The final stage of the money laundering process is termed the integration stage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life cycle of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.