20+ Letters of credit money laundering risk ideas

Home » money laundering idea » 20+ Letters of credit money laundering risk ideasYour Letters of credit money laundering risk images are available. Letters of credit money laundering risk are a topic that is being searched for and liked by netizens today. You can Get the Letters of credit money laundering risk files here. Download all free images.

If you’re searching for letters of credit money laundering risk pictures information linked to the letters of credit money laundering risk interest, you have visit the right blog. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

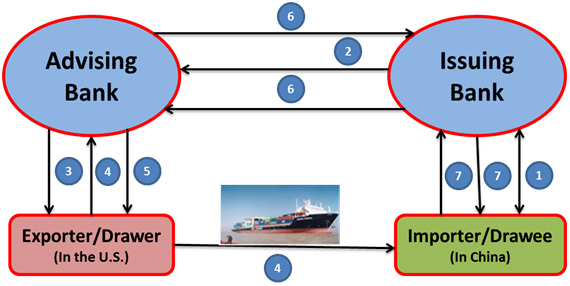

Letters Of Credit Money Laundering Risk. The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question. The Advising Bank may also be a Confirming Bank. On February 18 2010 FinCEN issued an advisory to inform and assist the financial industry in reporting instances of suspected trade-based money laundering TBML 245. The money laundering risk in each transaction is considered and evidence of the assessment made is.

Anti Money Laundering Shulman Rogers Gandal Pordy Ecker Pa From yumpu.com

Anti Money Laundering Shulman Rogers Gandal Pordy Ecker Pa From yumpu.com

Letters of credit. Managing money laundering risks in commercial letters of credit Managing money laundering risks in commercial letters of credit Chhina Ramandeep Kaur 2016-05-03 000000 PurposeThe purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to. Provide training around trade specific money laundering sanctions and terrorist financing risks. A new report out today by international NGO Global Witness says Libya appears to be losing millions of dollars a year through fraudulent use of its Letters of Credit LC system run by the Tripoli Central Bank of Libya. Are Banks in danger of Non-Compliance. A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met.

The report says these deals are passing through correspondent banks in the heart of the City of London with weaknesses in.

A formal consideration of money laundering risk is written into the operating procedures governing LCs. Do the banks comply with the regulations but the regulations are inadequate if so is more stringent regulation compatible with the commercial world of trade. Where amount representing full value of goods exported less any. The money laundering risk in each transaction is considered and evidence of the assessment made is. Letters of Credit LCs are commonly used to finance exports. There may be more than one Advising Bank in a letter of credit transaction.

Source: pinterest.com

Source: pinterest.com

A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met. The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question. Understanding Back-To-Back Letters of Credit Laundering Risks. Goods are misrepresented on letters of credit The value of shipped goods is inaccurate Shipments may include prohibited goods Goods may be unloaded at sanctioned ports of calls. The report says these deals are passing through correspondent banks in the heart of the City of London with weaknesses in.

Source: researchgate.net

Source: researchgate.net

Managing money laundering risks in commercial letters of credit Managing money laundering risks in commercial letters of credit Chhina Ramandeep Kaur 2016-05-03 000000 PurposeThe purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to. A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met. Significantly amended letters of credit without reasonable justification or changes to the beneficiary or location of payment. A new report out today by international NGO Global Witness says Libya appears to be losing millions of dollars a year through fraudulent use of its Letters of Credit LC system run by the Tripoli Central Bank of Libya. For this reason the use of letters of credit has become a.

Source: researchgate.net

Source: researchgate.net

Some MSBs even raise heightened risks of money laundering for drug cartels and terrorist groups. Letters of credit at risk in money laundering operations By Mark Ford on September 18 2015 0 Accuity a provider of payment efficiency and compliance solutions including anti-money laundering and counter terrorist financing is highlighting the risk of letters of credit LC being used by money launderers. Obviously anonymity as a risk factor could be mitigated by implementing robust identification and verification procedures. Any changes in the names of parties also should prompt additional OFAC review. The risk indicators are designed to enhance the ability of public and private entities to identify suspicious activity associated with this form of money laundering.

Source: pinterest.com

Source: pinterest.com

Some MSBs even raise heightened risks of money laundering for drug cartels and terrorist groups. FMU means Financial Monitoring Unit established under Anti-Money Laundering Ordinance 2007. Obviously anonymity as a risk factor could be mitigated by implementing robust identification and verification procedures. Credit unions with only a few million dollars of assets could end up processing billions of dollars worth of money services transactions. A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met.

Source: mdpi.com

Source: mdpi.com

On February 18 2010 FinCEN issued an advisory to inform and assist the financial industry in reporting instances of suspected trade-based money laundering TBML 245. The money laundering risk in each transaction is considered and evidence of the assessment made is. In this case the seller is exposed to a number of risks such as credit risk and legal risk. A formal consideration of money laundering risk is written into the operating procedures governing LCs. Letters of credit.

Source: acamstoday.org

Source: acamstoday.org

A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met. A new report out today by international NGO Global Witness says Libya appears to be losing millions of dollars a year through fraudulent use of its Letters of Credit LC system run by the Tripoli Central Bank of Libya. By no means is this a conclusive list. Any changes in the names of parties also should prompt additional OFAC review. For this reason the use of letters of credit has become a.

Source: iccindonesia.org

Source: iccindonesia.org

Where amount representing full value of goods exported less any. Any changes in the names of parties also should prompt additional OFAC review. In this case the seller is exposed to a number of risks such as credit risk and legal risk. Significantly amended letters of credit without reasonable justification or changes to the beneficiary or location of payment. Credit unions with only a few million dollars of assets could end up processing billions of dollars worth of money services transactions.

Source: acamstoday.org

Source: acamstoday.org

The money laundering ML and terrorist financing TF risks posed by NPMs can be effectively mitigated by several countermeasures taken by NPM service providers. Money Laundering and Financing of Terrorism or MLTF has the same meaning as ascribed to them in AML Act. A Case Study of the United Kingdom. A letter of credit provides the seller with a guarantee that they will get paid as long as certain delivery conditions have been met. The report says these deals are passing through correspondent banks in the heart of the City of London with weaknesses in.

Source: yumpu.com

Source: yumpu.com

Are Banks in danger of Non-Compliance. In this case the seller is exposed to a number of risks such as credit risk and legal risk. The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question. Do the banks comply with the regulations but the regulations are inadequate if so is more stringent regulation compatible with the commercial world of trade. The money laundering ML and terrorist financing TF risks posed by NPMs can be effectively mitigated by several countermeasures taken by NPM service providers.

Source: eumcc.eu

Source: eumcc.eu

The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question. The Advising Bank authenticates the credit and advises it to the Beneficiary. Goods are misrepresented on letters of credit The value of shipped goods is inaccurate Shipments may include prohibited goods Goods may be unloaded at sanctioned ports of calls. A new report out today by international NGO Global Witness says Libya appears to be losing millions of dollars a year through fraudulent use of its Letters of Credit LC system run by the Tripoli Central Bank of Libya. The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question.

Source: yumpu.com

Source: yumpu.com

Obviously anonymity as a risk factor could be mitigated by implementing robust identification and verification procedures. The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question. The purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to answer the central question. Any changes in the names of parties also should prompt additional OFAC review. Significantly amended letters of credit without reasonable justification or changes to the beneficiary or location of payment.

Source: researchgate.net

Source: researchgate.net

Some MSBs even raise heightened risks of money laundering for drug cartels and terrorist groups. The paper relies heavily on the findings of the recent study conducted by the Financial Conduct Authority UK to analyse the actual practice followed by UK banks in controlling money laundering risks in transactions involving commercial letters of creditFindingsThe paper establishes that considering the formal nature of commercial letters of credit which makes them independent from the underlying. By no means is this a conclusive list. Managing money laundering risks in commercial letters of credit Managing money laundering risks in commercial letters of credit Chhina Ramandeep Kaur 2016-05-03 000000 PurposeThe purpose of this paper is to critically examine the role of banks in detecting and mitigating money laundering risks in trade finance activities especially in commercial letters of credit and to. Money Laundering and Financing of Terrorism or MLTF has the same meaning as ascribed to them in AML Act.

Source: yumpu.com

Source: yumpu.com

Provide training around trade specific money laundering sanctions and terrorist financing risks. Overdue shall mean and include. Credit unions with only a few million dollars of assets could end up processing billions of dollars worth of money services transactions. The paper relies heavily on the findings of the recent study conducted by the Financial Conduct Authority UK to analyse the actual practice followed by UK banks in controlling money laundering risks in transactions involving commercial letters of creditFindingsThe paper establishes that considering the formal nature of commercial letters of credit which makes them independent from the underlying. Goods are misrepresented on letters of credit The value of shipped goods is inaccurate Shipments may include prohibited goods Goods may be unloaded at sanctioned ports of calls.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title letters of credit money laundering risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.