12++ Layering in banking terms information

Home » money laundering idea » 12++ Layering in banking terms informationYour Layering in banking terms images are available in this site. Layering in banking terms are a topic that is being searched for and liked by netizens now. You can Get the Layering in banking terms files here. Download all free photos and vectors.

If you’re searching for layering in banking terms pictures information related to the layering in banking terms interest, you have pay a visit to the ideal site. Our site frequently gives you hints for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

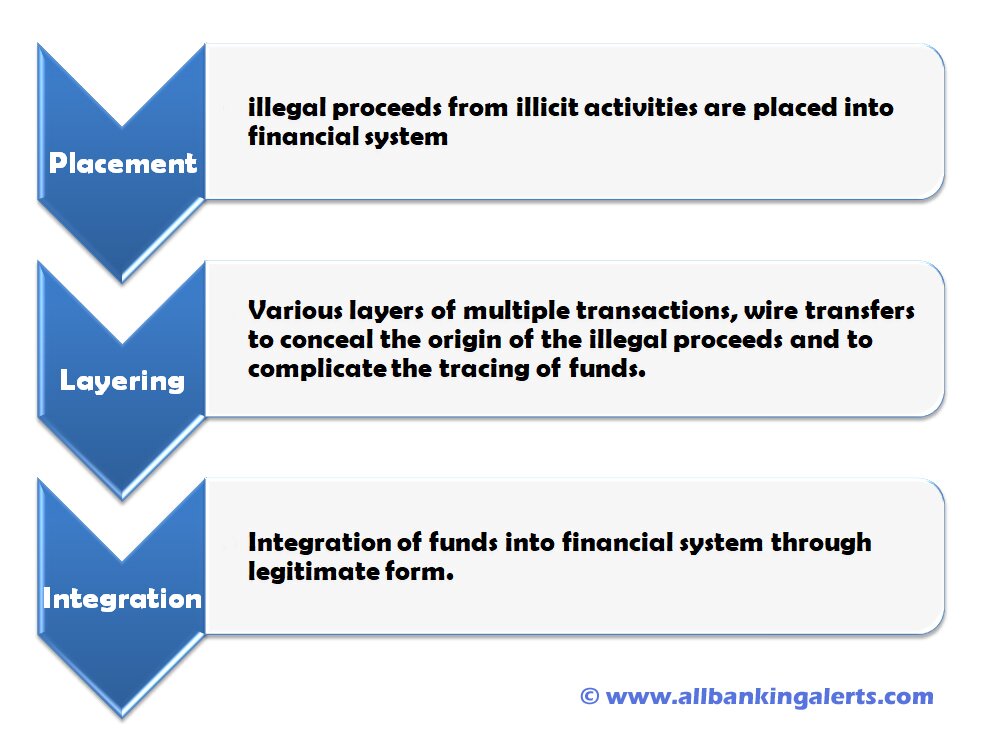

Layering In Banking Terms. The primary purpose of this stage is to separate the illicit money from its source. Teams proliferate with each manager having only a few direct reports. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. Every banking institution tries to find out the future performance in order to take corrective measures at an early stage in case of any probable crisis in future.

Layering Aml Anti Money Laundering From amlbot.com

Layering Aml Anti Money Laundering From amlbot.com

Term and Reversion approach example. Most companies start out lean but over time they find complexity creeps inespecially in spans and layers. The primary purpose of this stage is to separate the illicit money from its source. Below is an architecture of a deep neural network where we can see that there are multiple hidden layers between the input layer and the output layer. The layering stage is the most complex and often entails the international movement of the funds. The presentation layer prepares data for the application layer.

The final stage is getting the money out so it can be used without attracting attention from law enforcement or.

Generally the term tiers is used to describe physical distribution of components of a system on separate servers computers or networks processing nodes. Depending on a companys needs business banks can offer fixed-term loans short- and long-term loans lines of credit and asset-based loans. Streamlining spans and layers. Integration This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. This is essentially a no-cheating rule and is only used in senior subordinated deals. Structuring may be done in the context of money laundering fraud and other financial.

Source: youtube.com

Source: youtube.com

The layering stage involves the separation of proceeds from their illegal source by using multiple complex financial transactions eg wire transfers monetary instruments to obscure the audit trail and hide the proceeds. Layering is the process of making the source of illegal money as difficult to detect as possible by progressively adding legitimacy to it. The presentation layer prepares data for the application layer. After placement comes the layering stage sometimes referred to as structuring. The layering stage is the most complex and often entails the international movement of the funds.

Source: amlbot.com

Source: amlbot.com

The layering stage is the most complex and often entails the international movement of the funds. The final stage is getting the money out so it can be used without attracting attention from law enforcement or. Most companies start out lean but over time they find complexity creeps inespecially in spans and layers. We can either use the standard approach which we will discuss shortly or the layer method. Term and Reversion approach example.

Source: complyadvantage.com

Source: complyadvantage.com

Term and Reversion approach example. The presentation layer prepares data for the application layer. The primary purpose of this stage is to separate the illicit money from its source. Term and Reversion approach example. Streamlining spans and layers.

Source: allbankingalerts.com

Source: allbankingalerts.com

Logical layers are merely a way of organizing your code. And finally acquiring wealth generated from the transactions of the illicit funds integration. Structuring also known as smurfing in banking jargon is the practice of executing financial transactions such as making bank deposits in a specific pattern calculated to avoid triggering financial institutions to file reports required by law such as the United States Bank Secrecy Act and Internal Revenue Code section 6050I. Teams proliferate with each manager having only a few direct reports. Under the layer method we continue to value the entire property at the old contract rent but at the same time add another layer which is the increase or decrease in the contract rent that is expected.

Source: amlbot.com

Source: amlbot.com

More management layers means a slower flow of ideas and decisions. The layering stage is the most complex and often entails the international movement of the funds. Layering is essentially the use of placement and extraction over and over again using varying amounts each time to make tracing transactions as hard as possible. Term and Reversion approach example. Typical layers include Presentation Business and Data the same as the traditional 3-tier model.

Source: calert.info

Source: calert.info

Integration This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. The second involves carrying out complex financial transactions to camouflage the illegal source of the cash layering. Layers accumulate increasing the distance between the companys. Typical layers include Presentation Business and Data the same as the traditional 3-tier model. Under the layer method we continue to value the entire property at the old contract rent but at the same time add another layer which is the increase or decrease in the contract rent that is expected.

Source: amlbot.com

Source: amlbot.com

The primary purpose of this stage is to separate the illicit money from its source. Below is an architecture of a deep neural network where we can see that there are multiple hidden layers between the input layer and the output layer. Money laundering typically involves three steps. A Covenant that prohibits an Issuer from layering in another series of debt between the Senior Debt and the Subordinated Debt. Term and Reversion approach example.

Source: allbankingalerts.com

Source: allbankingalerts.com

The most common architecture pattern is the layered architecture pattern otherwise known as the n-tier architecture pattern. The second involves carrying out complex financial transactions to camouflage the illegal source of the cash layering. The layering stage involves the separation of proceeds from their illegal source by using multiple complex financial transactions eg wire transfers monetary instruments to obscure the audit trail and hide the proceeds. Layers accumulate increasing the distance between the companys. A Covenant that prohibits an Issuer from layering in another series of debt between the Senior Debt and the Subordinated Debt.

Source: kyc2020.com

Source: kyc2020.com

The presentation layer takes any data transmitted by the application layer and prepares it for transmission over the session layer. Term and Reversion approach example. We can either use the standard approach which we will discuss shortly or the layer method. Structuring also known as smurfing in banking jargon is the practice of executing financial transactions such as making bank deposits in a specific pattern calculated to avoid triggering financial institutions to file reports required by law such as the United States Bank Secrecy Act and Internal Revenue Code section 6050I. And finally acquiring wealth generated from the transactions of the illicit funds integration.

Source: calert.info

Source: calert.info

The term layers refers to a logical grouping of components which may or may not be physically located on one processing node. Banks provide equipment financing either through. Most companies start out lean but over time they find complexity creeps inespecially in spans and layers. The primary purpose of this stage is to separate the illicit money from its source. The presentation layer takes any data transmitted by the application layer and prepares it for transmission over the session layer.

Source: vskills.in

Source: vskills.in

A three-tier architecture then will have three processing nodes. Layering is the process of making the source of illegal money as difficult to detect as possible by progressively adding legitimacy to it. The presentation layer takes any data transmitted by the application layer and prepares it for transmission over the session layer. Logical layers are merely a way of organizing your code. Most companies start out lean but over time they find complexity creeps inespecially in spans and layers.

Source: pinterest.com

Source: pinterest.com

The presentation layer prepares data for the application layer. After placement comes the layering stage sometimes referred to as structuring. A Covenant that prohibits an Issuer from layering in another series of debt between the Senior Debt and the Subordinated Debt. Streamlining spans and layers. Layered Architecture - Software Architecture Patterns Book Chapter 1.

Source: amlbot.com

Source: amlbot.com

This is essentially a no-cheating rule and is only used in senior subordinated deals. This pattern is the de facto standard for most Java EE applications and therefore is widely known by most architects. The presentation layer prepares data for the application layer. More management layers means a slower flow of ideas and decisions. After placement comes the layering stage sometimes referred to as structuring.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title layering in banking terms by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.