16+ Law society money laundering rules ideas

Home » money laundering idea » 16+ Law society money laundering rules ideasYour Law society money laundering rules images are available. Law society money laundering rules are a topic that is being searched for and liked by netizens now. You can Get the Law society money laundering rules files here. Find and Download all free images.

If you’re looking for law society money laundering rules images information related to the law society money laundering rules keyword, you have come to the ideal site. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Law Society Money Laundering Rules. The Law Society understands that members may face challenges in meeting their obligations under the anti-money laundering and terrorist financing rules. 2004 The Law Society of British Columbia becomes the first legal regulator in Canada to introduce a rule. The changes are based on the Federation of Law Societies of Canada Model Rules and are part of the Law Societys ongoing commitment to combat money laundering. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

The by-law amendments adopt changes that have been made to the Federation of Law Societies of Canadas Model Rules to combat money laundering and terrorist financing. B demonstrate such compliance to the Society. The changes are based on the Federation of Law Societies of Canada Model Rules and are part of the Law Societys ongoing commitment to combat money laundering. Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020. Law society money laundering regulations. 2004 The Law Society of British Columbia becomes the first legal regulator in Canada to introduce a rule.

The changes are based on the Federation of Law Societies of Canada Model Rules and are part of the Law Societys ongoing commitment to combat money laundering.

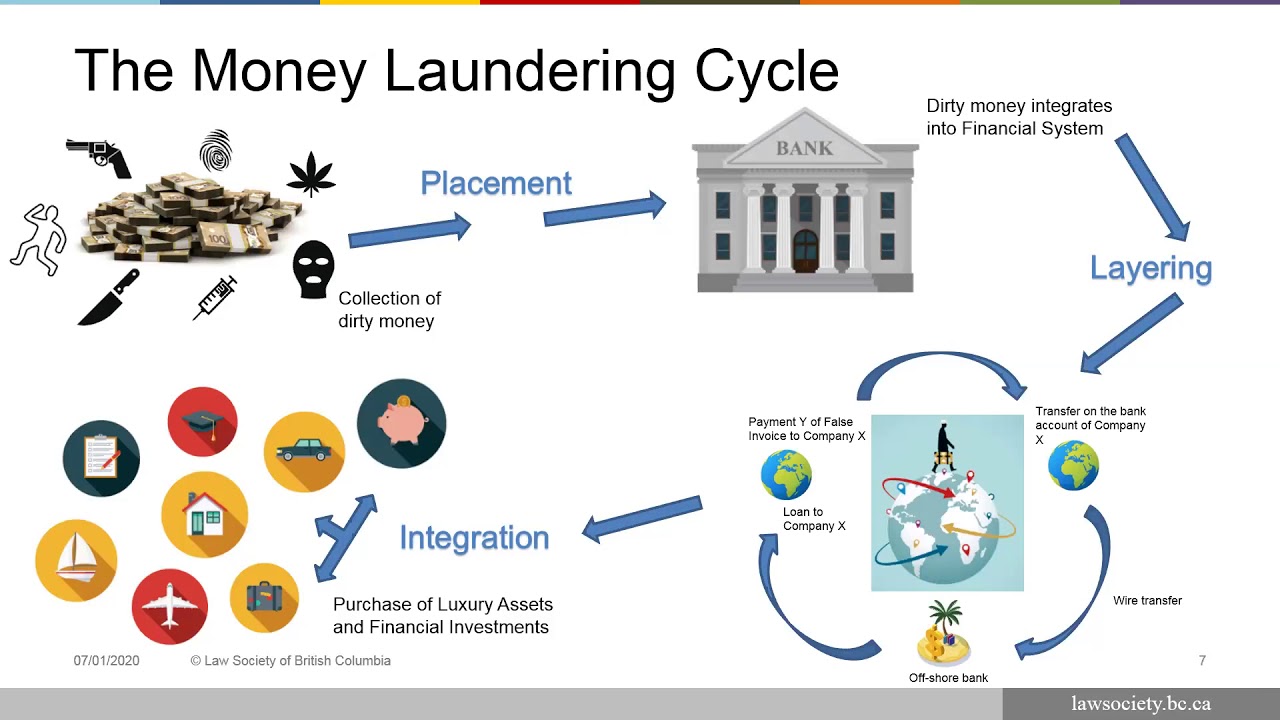

The limit applies despite the number of clients. As Canadian and international concerns over money laundering and terrorism financing have grown Canadian law societies have tightened rules on the receipt of cash by lawyers as well as client identification and verification. LSAG is made up of the legal sectors regulatory and representative bodies including the Law Society of England and Wales. All lawyers and firms must review and revise their processes to ensure they comply with the existing and new rules. At the May 27 2021 meeting of Convocation Benchers approved amendments to the Law Society of Ontarios by-laws on anti-money laundering and terrorist financing provisions. The ownership and control of proceeds of criminal conduct including tax offences is disguised or altered through apparently-legitimate transactions and processes so that the money appears to originate from a legitimate source.

Source: bi.go.id

Source: bi.go.id

Money Laundering and Terrorist Financing Amendment Regulations 2019. A comply with the provisions of the Money Laundering Regulations. Money-laundering is a process whereby the identity of dirty money ie. Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020. All firms need to review and revise their processes to ensure compliance with the existing and new rules.

Source: researchgate.net

Source: researchgate.net

Pre-2001 General obligation under the Legal Profession Act and Law Society Rules for lawyers to act honestly with integrity and to uphold the rule of law. These amendments come into force on May 1 2021. More than 7500 in cash from clients or prospective clients in respect to any one client matter. The Money Laundering Regulations 2017 have been amended by the. Law society money laundering regulations.

While we continue to expect that members will do everything possible to meet all of their obligations we recognize that it may be challenging to verify a clients identity where the member and hisher client are unable to meet in person. As Canadian and international concerns over money laundering and terrorism financing have grown Canadian law societies have tightened rules on the receipt of cash by lawyers as well as client identification and verification. What is Anti-Money Laundering AML. More than 7500 in cash from clients or prospective clients in respect to any one client matter. To assist the legal profession in following the model rules the Federation of Law Societies has developed the booklet Guidance for the Legal Profession which details the professional responsibility to avoid facilitating or participating in money laundering or terrorist financing activities.

Source: bi.go.id

Source: bi.go.id

Money Laundering and Terrorist Financing Amendment Regulations 2019. What is Anti-Money Laundering AML. Money-laundering is a process whereby the identity of dirty money ie. Money Laundering and Terrorist Financing Amendment Regulations 2019. While we continue to expect that members will do everything possible to meet all of their obligations we recognize that it may be challenging to verify a clients identity where the member and hisher client are unable to meet in person.

Source: youtube.com

Source: youtube.com

To assist the legal profession in following the model rules the Federation of Law Societies has developed the booklet Guidance for the Legal Profession which details the professional responsibility to avoid facilitating or participating in money laundering or terrorist financing activities. The Law Society of British Columbia introduced a no-cash rule in 2004 which prohibits lawyers except in very limited circumstances from receiving 7500 or more in cash from a client. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week. The changes are based on the Federation of Law Societies of Canada Model Rules and are part of the Law Societys ongoing commitment to combat money laundering. B demonstrate such compliance to the Society.

B demonstrate such compliance to the Society. Preserve solicitor-client privilege and the independence of the bar by maintaining the Law Societys anti-money laundering AML rules separate from the federal governments AML regime Require licensees to conduct sufficient diligence on client transactions to ensure that they do not unwittingly become involved in illegal activity or act recklessly with respect to money laundering. The No Cash Rule means lawyers must not accept. More than 7500 in cash from clients or prospective clients in respect to any one client matter. Lawyers are also to have regard to the Law Societys anti-money laundering practice note published on 6 October 2011 and the Solicitors Regulation Authoritys warning cards on money laundering December 2014 property fraud April 2009 and bogus law firms and identity theft March 2012.

Source: yumpu.com

Source: yumpu.com

Law Society amends Rules to help prevent money laundering. As Canadian and international concerns over money laundering and terrorism financing have grown Canadian law societies have tightened rules on the receipt of cash by lawyers as well as client identification and verification. More than 7500 in cash from clients or prospective clients in respect to any one client matter. More than 7500 in cash on a client matter even if there is more than one client. All firms need to review and revise their processes to ensure compliance with the existing and new rules.

Source: pinterest.com

Source: pinterest.com

The Law Society of British Columbia introduced a no-cash rule in 2004 which prohibits lawyers except in very limited circumstances from receiving 7500 or more in cash from a client. More than 7500 in cash from clients or prospective clients in respect to any one client matter. The Law Society itself is regulated by the Office for Professional Body AML Supervisors OPBAS and in order for us to meet our statutory obligations as a Professional Body Supervisor we employ a range of tools to assess the risk of our population and of. These amendments come into force on May 1 2021. In particular the 2007 Regulations require that.

Source: pinterest.com

Source: pinterest.com

The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week. The Money Laundering Regulations 2017 have been amended by the. More than 7500 in cash on a client matter even if there is more than one client. All firms need to review and revise their processes to ensure compliance with the existing and new rules. In considering whether the risks of money laundering and the financing of terrorism are raised under Rule 12 4 and Rule 13 1 a of the Legal Profession Prevention of Money Laundering Financing of Terrorism Rules including determining whether the client is from or in any country or jurisdiction known to have inadequate measures to prevent money laundering and the financing of.

Source: bi.go.id

Source: bi.go.id

Lawyers are also to have regard to the Law Societys anti-money laundering practice note published on 6 October 2011 and the Solicitors Regulation Authoritys warning cards on money laundering December 2014 property fraud April 2009 and bogus law firms and identity theft March 2012. 2001 The Law Society takes a prominent role in a national working group for the development of model regulations to fight money laundering. The Law Society itself is regulated by the Office for Professional Body AML Supervisors OPBAS and in order for us to meet our statutory obligations as a Professional Body Supervisor we employ a range of tools to assess the risk of our population and of. A comply with the provisions of the Money Laundering Regulations. To assist the legal profession in following the model rules the Federation of Law Societies has developed the booklet Guidance for the Legal Profession which details the professional responsibility to avoid facilitating or participating in money laundering or terrorist financing activities.

Source: pinterest.com

Source: pinterest.com

Effective January 1 2020 the Law Society of Saskatchewan will implement new Rules related to client identification client verification and receipt of cash. At the May 27 2021 meeting of Convocation Benchers approved amendments to the Law Society of Ontarios by-laws on anti-money laundering and terrorist financing provisions. In considering whether the risks of money laundering and the financing of terrorism are raised under Rule 12 4 and Rule 13 1 a of the Legal Profession Prevention of Money Laundering Financing of Terrorism Rules including determining whether the client is from or in any country or jurisdiction known to have inadequate measures to prevent money laundering and the financing of. The by-law amendments adopt changes that have been made to the Federation of Law Societies of Canadas Model Rules to combat money laundering and terrorist financing. Law Society amends Rules to help prevent money laundering.

Source: pideeco.be

Source: pideeco.be

Law Society amends Rules to help prevent money laundering. The changes are based on the Federation of Law Societies of Canada Model Rules and are part of the Law Societys ongoing commitment to combat money laundering. All lawyers and firms must review and revise their processes to ensure they comply with the existing and new rules. The Law Society of British Columbia introduced a no-cash rule in 2004 which prohibits lawyers except in very limited circumstances from receiving 7500 or more in cash from a client. To assist the legal profession in following the model rules the Federation of Law Societies has developed the booklet Guidance for the Legal Profession which details the professional responsibility to avoid facilitating or participating in money laundering or terrorist financing activities.

Source: bi.go.id

Source: bi.go.id

The by-law amendments adopt changes that have been made to the Federation of Law Societies of Canadas Model Rules to combat money laundering and terrorist financing. On January 1 2020 rule changes affecting client identification and verification and the receipt of cash will come into effect. Lawyers are also to have regard to the Law Societys anti-money laundering practice note published on 6 October 2011 and the Solicitors Regulation Authoritys warning cards on money laundering December 2014 property fraud April 2009 and bogus law firms and identity theft March 2012. The Law Society understands that members may face challenges in meeting their obligations under the anti-money laundering and terrorist financing rules. To assist the legal profession in following the model rules the Federation of Law Societies has developed the booklet Guidance for the Legal Profession which details the professional responsibility to avoid facilitating or participating in money laundering or terrorist financing activities.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title law society money laundering rules by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.