17++ Law society money laundering regulations information

Home » money laundering Info » 17++ Law society money laundering regulations informationYour Law society money laundering regulations images are ready. Law society money laundering regulations are a topic that is being searched for and liked by netizens now. You can Get the Law society money laundering regulations files here. Get all royalty-free images.

If you’re searching for law society money laundering regulations images information related to the law society money laundering regulations interest, you have visit the right site. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

Law Society Money Laundering Regulations. The Law Society understands that members may face challenges in meeting their obligations under the anti-money laundering and terrorist financing rules. Client care and complaints handling. The Legal Profession Amendment Bill was passed on 4 November 2014 and the new Part VA of the LPA on Prevention of Money Laundering and Financing of Terrorism came into effect together with the Legal Profession Prevention of Money Laundering and. Understanding anti-money laundering is critical.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

What does this mean for you. The EUs 5th Money Laundering Directive came into force on 10 January 2020 amending the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Law Society understands that members may face challenges in meeting their obligations under the anti-money laundering and terrorist financing rules. On January 1 2020 rule changes affecting client identification and verification and the receipt of cash will come into effect. The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law firm as low risk. If the communication was received in privileged circumstances and the crimefraud exception does not apply you are exempt from the relevant provisions of POCA which include making a disclosure to the NCA.

While we continue to expect that members will do everything possible to meet all of their obligations we recognize that it may be challenging.

Solicitors Money Laundering and Terrorist Financing Regulations 2020 The Law Society has issued a practice note relating to the introduction of a new statutory instrument SI 377 of 2020 with regard to solicitors statutory anti-money laundering AML obligations. This webinar provides an overview of the new money laundering regulations and their impact on your firm. New Anti-Money Laundering Rules December 9 2019. While we continue to expect that members will do everything possible to meet all of their obligations we recognize that it may be challenging. The introduction of further regulation places greater emphasis on money laundering compliance as firms strive to update their processes policies and procedures to comply with the new regulations. The amendments ensure that the Law Societys requirements aimed at fighting money laundering and terrorist financing are comprehensive effective and up-to-date.

Source: researchgate.net

Source: researchgate.net

The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law firm as low risk. The Legal Sector Affinity Groups Anti-money laundering guidance for the legal sector the guidance states at Chapter 7. Understanding anti-money laundering is critical. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person. The Law Society understands that members may face challenges in meeting their obligations under the anti-money laundering and terrorist financing rules.

Source: pinterest.com

Source: pinterest.com

The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law firm as low risk. On January 1 2020 rule changes affecting client identification and verification and the receipt of cash will come into effect. Firms must be compliant with the new regulations from 10 January 2020. The EUs 5th Money Laundering Directive came into force on 10 January 2020 amending the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Law Society Money Laundering Regulations 2017 August 08 2021.

Source: bi.go.id

Source: bi.go.id

The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law firm as low risk. New money laundering regulations will come into effect in 2020. New Anti-Money Laundering Rules December 9 2019. The Legal Profession Amendment Bill was passed on 4 November 2014 and the new Part VA of the LPA on Prevention of Money Laundering and Financing of Terrorism came into effect together with the Legal Profession Prevention of Money Laundering and. Law firms are frequently targeted by money launderers and it is a criminal offence to be involved in this process.

Source: pinterest.com

Source: pinterest.com

Solicitors Money Laundering and Terrorist Financing Regulations 2020 The Law Society has issued a practice note relating to the introduction of a new statutory instrument SI 377 of 2020 with regard to solicitors statutory anti-money laundering AML obligations. 2016 Law Society participates in new national working group to strengthen regulatory rules to fight money laundering 2017 Donald Franklin Gurney disciplined for using his trust account to receive and disburse over 25 million on behalf of a client without making reasonable inquiries about the funds and without providing any substantial. Preserve solicitor-client privilege and the independence of the bar by maintaining the Law Societys anti-money laundering AML rules separate from the federal governments AML regime. Firms must be compliant with the new regulations from 10 January 2020. What does this mean for you.

Source: bi.go.id

Source: bi.go.id

On January 1 2020 rule changes affecting client identification and verification and the receipt of cash will come into effect. This webinar provides an overview of the new money laundering regulations and their impact on your firm. New Anti-Money Laundering Rules December 9 2019. Firms must be compliant with the new regulations from 10 January 2020. While we continue to expect that members will do everything possible to meet all of their obligations we recognize that it may be challenging.

Source: pideeco.be

Source: pideeco.be

All firms need to review and revise their processes to. Money Laundering Regulations 2020 OnDemand 2019-12-23T144000Z. Solicitors Money Laundering and Terrorist Financing Regulations 2020 The Law Society has issued a practice note relating to the introduction of a new statutory instrument SI 377 of 2020 with regard to solicitors statutory anti-money laundering AML obligations. New Anti-Money Laundering Rules December 9 2019. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person.

Source: yumpu.com

Source: yumpu.com

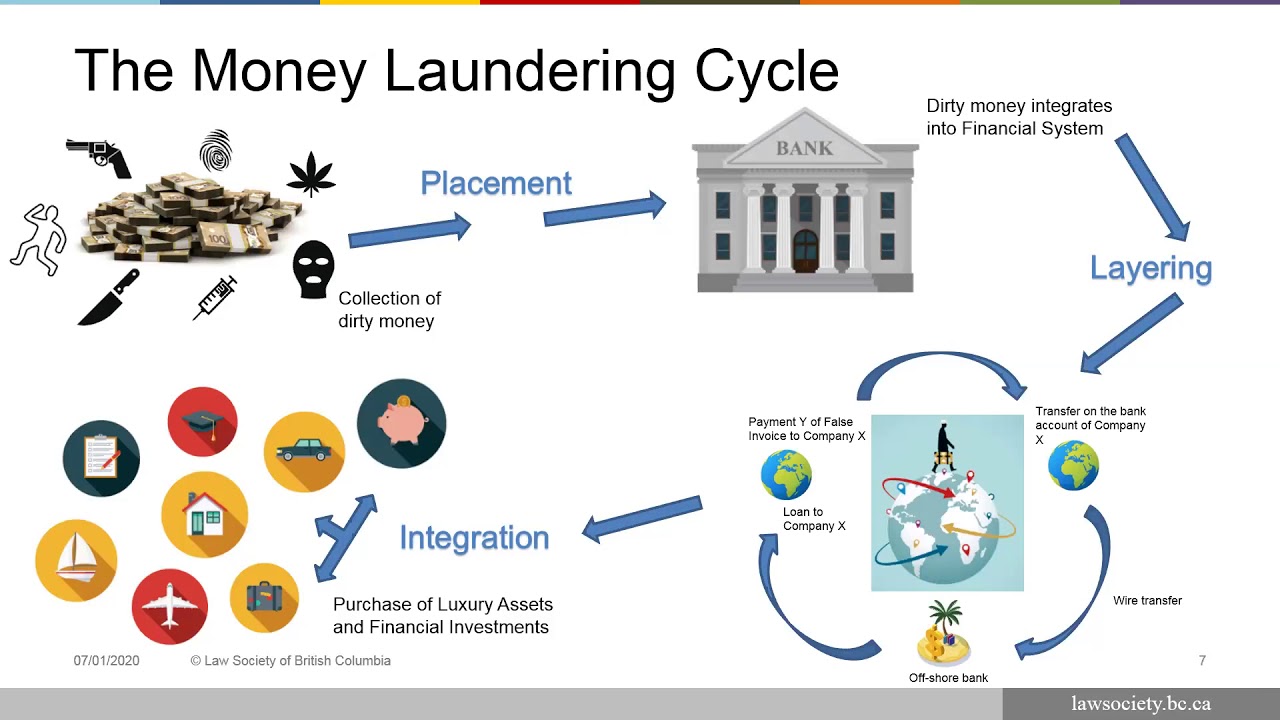

2016 Law Society participates in new national working group to strengthen regulatory rules to fight money laundering 2017 Donald Franklin Gurney disciplined for using his trust account to receive and disburse over 25 million on behalf of a client without making reasonable inquiries about the funds and without providing any substantial. The sources of the money in precise are criminal and the cash is invested in a manner that makes it seem like clear cash and conceal the id of the criminal part of the cash earned. Client care and complaints handling. New money laundering regulations will come into effect in 2020. Firms must be compliant with the new regulations from 10 January 2020.

Source: bi.go.id

Source: bi.go.id

Client care and complaints handling. In addition the amendments. At the May 27 2021 meeting of Convocation Benchers approved amendments to the Law Society of Ontarios by-laws on anti-money laundering and terrorist financing provisions. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: researchgate.net

Source: researchgate.net

On January 1 2020 rule changes affecting client identification and verification and the receipt of cash will come into effect. All firms need to review and revise their processes to. Money Laundering Regulations 2020 OnDemand 2019-12-23T144000Z. Anti-Money Laundering and Suspicious Activity. The amendments ensure that the Law Societys requirements aimed at fighting money laundering and terrorist financing are comprehensive effective and up-to-date.

Source: bi.go.id

Preserve solicitor-client privilege and the independence of the bar by maintaining the Law Societys anti-money laundering AML rules separate from the federal governments AML regime. Anti-Money Laundering Requirements. The sources of the money in precise are criminal and the cash is invested in a manner that makes it seem like clear cash and conceal the id of the criminal part of the cash earned. 2016 Law Society participates in new national working group to strengthen regulatory rules to fight money laundering 2017 Donald Franklin Gurney disciplined for using his trust account to receive and disburse over 25 million on behalf of a client without making reasonable inquiries about the funds and without providing any substantial. Preserve solicitor-client privilege and the independence of the bar by maintaining the Law Societys anti-money laundering AML rules separate from the federal governments AML regime.

Source: bi.go.id

Source: bi.go.id

The introduction of further regulation places greater emphasis on money laundering compliance as firms strive to update their processes policies and procedures to comply with the new regulations. The Legal Profession Amendment Bill was passed on 4 November 2014 and the new Part VA of the LPA on Prevention of Money Laundering and Financing of Terrorism came into effect together with the Legal Profession Prevention of Money Laundering and. What does this mean for you. This webinar provides an overview of the new money laundering regulations and their impact on your firm. Understanding anti-money laundering is critical.

Source: youtube.com

Source: youtube.com

At the May 27 2021 meeting of Convocation Benchers approved amendments to the Law Society of Ontarios by-laws on anti-money laundering and terrorist financing provisions. 2016 Law Society participates in new national working group to strengthen regulatory rules to fight money laundering 2017 Donald Franklin Gurney disciplined for using his trust account to receive and disburse over 25 million on behalf of a client without making reasonable inquiries about the funds and without providing any substantial. The Legal Sector Affinity Group which represents the legal sector AML supervisors and includes the Law Society and the Solicitors Regulation Authority SRA has developed the anti-money laundering AML guidance for the legal sector. If the communication was received in privileged circumstances and the crimefraud exception does not apply you are exempt from the relevant provisions of POCA which include making a disclosure to the NCA. Anti-Money Laundering Requirements.

Source: pinterest.com

Source: pinterest.com

Money Laundering Regulations 2020 OnDemand 2019-12-23T144000Z. Money Laundering Regulations 2020 OnDemand 2019-12-23T144000Z. Law firms are frequently targeted by money launderers and it is a criminal offence to be involved in this process. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person. 2016 Law Society participates in new national working group to strengthen regulatory rules to fight money laundering 2017 Donald Franklin Gurney disciplined for using his trust account to receive and disburse over 25 million on behalf of a client without making reasonable inquiries about the funds and without providing any substantial.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title law society money laundering regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.