18+ Law society money laundering high risk countries information

Home » money laundering idea » 18+ Law society money laundering high risk countries informationYour Law society money laundering high risk countries images are available in this site. Law society money laundering high risk countries are a topic that is being searched for and liked by netizens today. You can Get the Law society money laundering high risk countries files here. Download all free photos.

If you’re looking for law society money laundering high risk countries pictures information linked to the law society money laundering high risk countries interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

Law Society Money Laundering High Risk Countries. It is always going to be difficult to estimate the true scale of money laundering through law firms as we cannot know how much goes undetected. Find out more about money laundering warning signs. That the New Zealand Law Society in its submission dated 20. It is intended as a guide only and should be adapted to take into account a law firms.

October 2016 eZine - The Law Society published information regarding the introduction of SI No. The 5th Anti-money Laundering Directive 5AMLD came into effect in the UK on 10 January. Risk Assessment BRAs new section 30A ii the development of policies which introduce controls to mitigate money laundering risk substituted section 54 which include iii Customer Risk Assessments CRAs new section 30B on every customerlegal service in order to determine the level of CDD to be undertaken. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. 40 firms did not send us a firm risk assessment instead sending us something else.

However evidence suggests it is a significant risk.

Introduction The legal profession is potentially at risk of being misused for money laundering and financing of terrorism activities. 1 The first public document the statement High-Risk Jurisdictions subject to a Call for Action previously called Public Statement identifies countries or jurisdictions with serious strategic deficiencies to counter money laundering terrorist financing and financing of proliferationFor all countries identified as high-risk the FATF calls on all members and urges all jurisdictions. Anti-money laundering in the property market 09 Sep 2019. The Law Society Regulation 33 - Changes on High Risk Third Countries Must apply Enhanced Due Diligence when either the client or the counterparty is established in a high-risk third country. Anti-money laundering guidance for the legal sector 20 Jan 2021. Anti-money laundering after Brexit 28 Jul 2021.

Source: ec.europa.eu

Source: ec.europa.eu

About The Law Society. 40 firms did not send us a firm risk assessment instead sending us something else. The Law Society itself is regulated by the Office for Professional Body AML Supervisors OPBAS and in order for us to meet our statutory obligations as a Professional Body Supervisor we employ a range of tools to assess the risk of our population and of. Introduction The legal profession is potentially at risk of being misused for money laundering and financing of terrorism activities. You should also require additional information on the purpose funding and beneficiaries of the club or society.

Source: iclg.com

Source: iclg.com

Anti-money laundering after Brexit 28 Jul 2021. When assessing the risks of money laundering andor terrorist financing the factors of potentially higher risk of money laundering andor terrorist financing referred to in Article 14 10 of the Law on the Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania must be assessed. It is always going to be difficult to estimate the true scale of money laundering through law firms as we cannot know how much goes undetected. This is a sample document only which has been produced for the New Zealand Law Society to assist lawyers with Anti- Money Laundering and Countering Financing of Terrorism Act 2009 AMLCFT compliance requirements. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: pinterest.com

Source: pinterest.com

The risk assessment must be tailored to the money laundering and terrorist financing risk that each firm is likely to face in its sphere of operations. MONEY LAUNDERING POLICY OF JAMES DICKINSON CO. Find out more about money laundering warning signs. 1 The first public document the statement High-Risk Jurisdictions subject to a Call for Action previously called Public Statement identifies countries or jurisdictions with serious strategic deficiencies to counter money laundering terrorist financing and financing of proliferationFor all countries identified as high-risk the FATF calls on all members and urges all jurisdictions. Anti-money laundering guidance for the legal sector.

Source: pideeco.be

Source: pideeco.be

The 5th Anti-money Laundering Directive 5AMLD came into effect in the UK on 10 January. 1 The first public document the statement High-Risk Jurisdictions subject to a Call for Action previously called Public Statement identifies countries or jurisdictions with serious strategic deficiencies to counter money laundering terrorist financing and financing of proliferationFor all countries identified as high-risk the FATF calls on all members and urges all jurisdictions. Notaries 20 Apr 2021. If youre involved with clients or matters based in high-risk jurisdictions your risk assessment should reflect this. The risk assessment must be tailored to the money laundering and terrorist financing risk that each firm is likely to face in its sphere of operations.

Source: ec.europa.eu

Source: ec.europa.eu

Countries Risk Assessment Guideline Designated Business Groups two guidelines. You should also require additional information on the purpose funding and beneficiaries of the club or society. The directive is the latest measure in the worldwide fight against money laundering and terrorism financing across all sectors. Anti-money laundering in the property market 09 Sep 2019. 40 firms did not send us a firm risk assessment instead sending us something else.

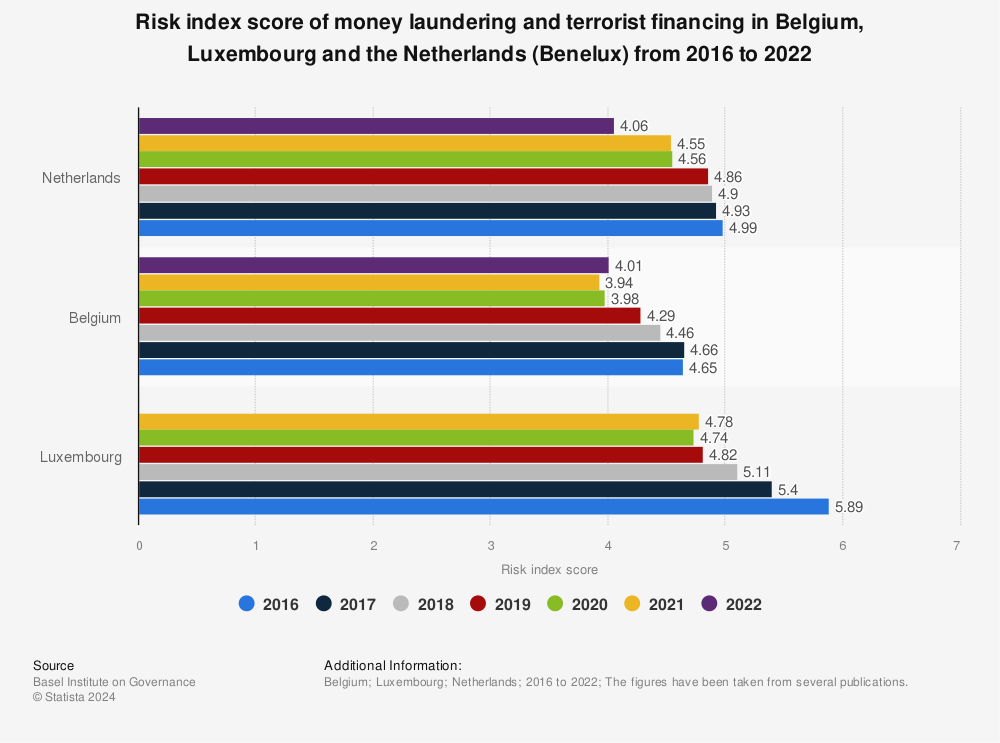

Source: statista.com

Source: statista.com

The Anti-Money Laundering Committee of the Law Society provides guidance to members on the anti-money laundering AML and countering the financing of terrorism CFT requirements that are applicable to lawyers. Find out more about money laundering warning signs. At a minimum youll need to consider how you deal with clients and matters that involve those listed on the EU list of high-risk third countries. The 5th Anti-money Laundering Directive 5AMLD came into effect in the UK on 10 January. Solicitors Money Laundering and Terrorist Financing Regulations 2016.

Source: ec.europa.eu

Source: ec.europa.eu

Management Manual issued under the Law Society of Kenya Act and other applicable legislation as set out in the Appendix IV to these guidelines PART IPRELIMINARY 1. October 2016 eZine - The Law Society published information regarding the introduction of SI No. Of the 400 firms we contacted. It is intended as a guide only and should be adapted to take into account a law firms. We found high levels of non-compliance with the money laundering regulations with 21 not compliant.

Source: pinterest.com

Source: pinterest.com

Legal status of the clubsociety. The 5th Anti-money Laundering Directive 5AMLD came into effect in the UK on 10 January. The risk assessment must be tailored to the money laundering and terrorist financing risk that each firm is likely to face in its sphere of operations. At a minimum youll need to consider how you deal with clients and matters that involve those listed on the EU list of high-risk third countries. Of the 400 firms we contacted.

Source: br.pinterest.com

Source: br.pinterest.com

If youre involved with clients or matters based in high-risk jurisdictions your risk assessment should reflect this. Legal status of the clubsociety. Notaries 20 Apr 2021. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. Of the 400 firms we contacted.

Management Manual issued under the Law Society of Kenya Act and other applicable legislation as set out in the Appendix IV to these guidelines PART IPRELIMINARY 1. Anti-money laundering guidance for the legal sector. You should also require additional information on the purpose funding and beneficiaries of the club or society. When assessing the risks of money laundering andor terrorist financing the factors of potentially higher risk of money laundering andor terrorist financing referred to in Article 14 10 of the Law on the Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania must be assessed. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process.

Source: pinterest.com

Source: pinterest.com

The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. Names of all the officers. The Committee also aims to increase awareness by disseminating to members information in relation to these requirements. 5 in economic or professional activities paying more attention to the business relationship or transaction whereby the customer is from a high-risk third country or a country or territory specified in subsection 4 of 37 of Act or whereby the customer is a citizen of such country or whereby the customers place of residence or seat or the seat of the payment service provider of the payee is in such country or territory. That the New Zealand Law Society in its submission dated 20.

Source: pinterest.com

Source: pinterest.com

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. In the cases indicated by the European. Anti-money laundering guidance for the legal sector. Or has its principal place of. If youre involved with clients or matters based in high-risk jurisdictions your risk assessment should reflect this.

Source: in.pinterest.com

Source: in.pinterest.com

The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. The 24 high-risk third countries are. The Law Society Regulation 33 - Changes on High Risk Third Countries Must apply Enhanced Due Diligence when either the client or the counterparty is established in a high-risk third country. 83 risk assessments were not compliant. Find out more about money laundering warning signs.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title law society money laundering high risk countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.