16+ Law society guidance money laundering regulations 2017 info

Home » money laundering idea » 16+ Law society guidance money laundering regulations 2017 infoYour Law society guidance money laundering regulations 2017 images are ready. Law society guidance money laundering regulations 2017 are a topic that is being searched for and liked by netizens now. You can Find and Download the Law society guidance money laundering regulations 2017 files here. Find and Download all free photos and vectors.

If you’re searching for law society guidance money laundering regulations 2017 images information connected with to the law society guidance money laundering regulations 2017 interest, you have visit the right site. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Law Society Guidance Money Laundering Regulations 2017. Jonathan Fisher QC takes you through the key changes. Banks may therefore require their business partners to provide evidence of the low risk nature of financial relationships. The guidance supports legal professionals in complying with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended. Identify and verify the identity of your client.

The Legal Sector Affinity Group Lsag Guidance 2021 What Solicitors Need To Know Long Read Jonathon Bray From jonathonbray.com

The Legal Sector Affinity Group Lsag Guidance 2021 What Solicitors Need To Know Long Read Jonathon Bray From jonathonbray.com

The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this. The absolute minimum number of amendments have been made to existing guidance. Review of the UKs anti-money laundering AML and counter-terrorist. It was reviewed following the introduction of regulations that implemented the EUs 5th Money Laundering Directive. Money laundering regulations 2017 law society. 2018 AML Guidance - The Criminal ustice Money Laundering and Terrorist Financing Amendment Act 2018 - Version 1 assessment obligations.

The new 2017 Money Laundering Regulations means fundamental changes to the anti-money laundering procedures at law firms including changes to customer due diligence CDD a central register for beneficial owners changes in the rules for PEPs and a focus on risk assessments.

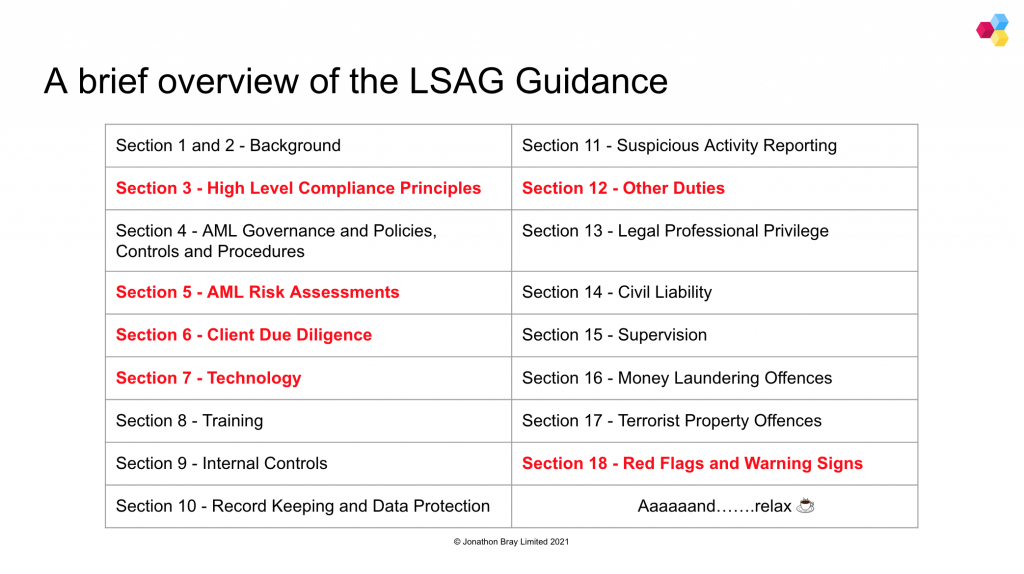

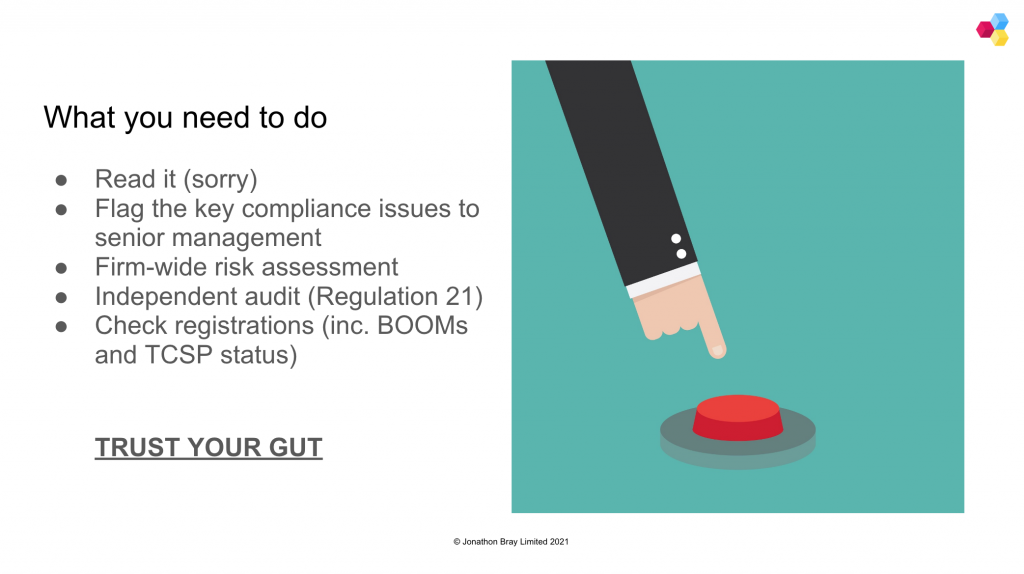

Review of the UKs anti-money laundering AML and counter-terrorist. Money laundering regulations 2017 law society. The Legal Sector Affinity Group which represents the legal sector AML supervisors and includes the Law Society and the Solicitors Regulation Authority SRA has developed the anti-money laundering AML guidance for the legal sector. The regulations came into force on 10 January 2020. This Treasury-approved guidance provides more detail about the MLR 2017 and what is expected of firms and should be read with this quick guide. The entirety of the 2010 Guidance Notes remain extant except for Chapters 4 5 and 10 which have been replaced by this Guidance.

Source: jonathonbray.com

Source: jonathonbray.com

If the communication was received in privileged circumstances and the crimefraud exception does not apply you are exempt from the relevant provisions of POCA which include making a disclosure to the NCA. The regulations came into force on 10 January 2020. Review of the UKs anti-money laundering AML and counter-terrorist. Identify and take reasonable steps to. 2018 AML Guidance - The Criminal ustice Money Laundering and Terrorist Financing Amendment Act 2018 - Version 1 assessment obligations.

Source: researchgate.net

Source: researchgate.net

The new 2017 Money Laundering Regulations means fundamental changes to the anti-money laundering procedures at law firms including changes to customer due diligence CDD a central register for beneficial owners changes in the rules for PEPs and a focus on risk assessments. Identify and take reasonable steps to. If the communication was received in privileged circumstances and the crimefraud exception does not apply you are exempt from the relevant provisions of POCA which include making a disclosure to the NCA. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. The absolute minimum number of amendments have been made to existing guidance.

Source: jonathonbray.com

Source: jonathonbray.com

The sources of the money in precise are criminal and the cash is invested in a manner that makes it seem like clear cash and conceal the id of the criminal part of the cash earned. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person. 2018 AML Guidance - The Criminal ustice Money Laundering and Terrorist Financing Amendment Act 2018 - Version 1 assessment obligations. The entirety of the 2010 Guidance Notes remain extant except for Chapters 4 5 and 10 which have been replaced by this Guidance. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692.

Source: legalrisk.co.uk

Source: legalrisk.co.uk

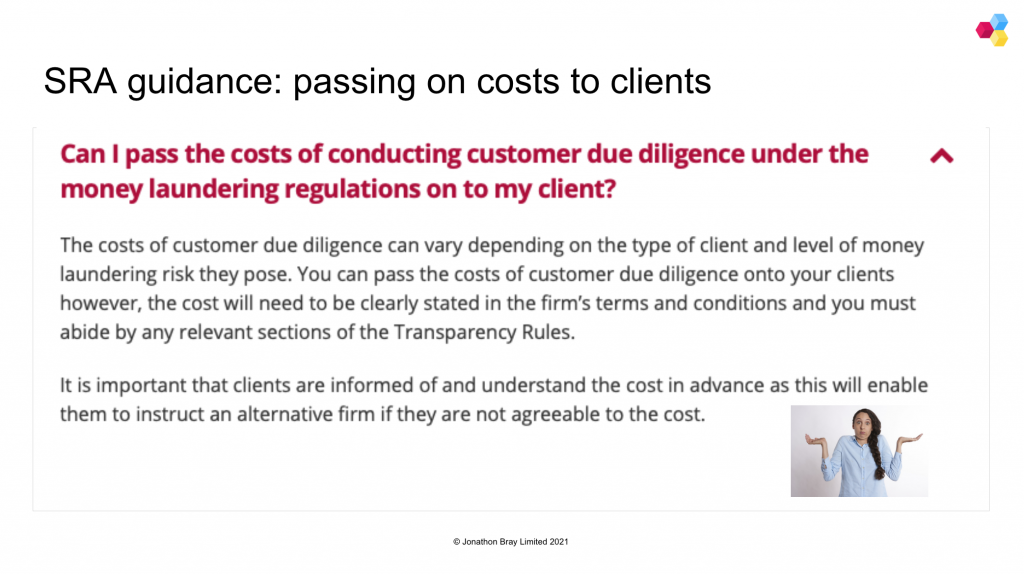

HM Treasury is holding two consultations as part of its twin-track approach to reviewing the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs. Sue Mawdsley examines what to look out for in the new draft regulations. The Legal Sector Affinity Groups Anti-money laundering guidance for the legal sector the guidance states at Chapter 7. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. Banks may therefore require their business partners to provide evidence of the low risk nature of financial relationships.

Source: researchgate.net

Source: researchgate.net

Key issues in the Draft Money Laundering Regulations 2017. The sources of the money in precise are criminal and the cash is invested in a manner that makes it seem like clear cash and conceal the id of the criminal part of the cash earned. If the communication was received in privileged circumstances and the crimefraud exception does not apply you are exempt from the relevant provisions of POCA which include making a disclosure to the NCA. Banks may therefore require their business partners to provide evidence of the low risk nature of financial relationships. Law Society Money Laundering Regulations 2017 August 08 2021.

Source: jaynewilletts.co.uk

Source: jaynewilletts.co.uk

Law society money laundering regulations. Key issues in the Draft Money Laundering Regulations 2017. HM Treasury is holding two consultations as part of its twin-track approach to reviewing the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs. Law society money laundering regulations. The new 2017 Money Laundering Regulations means fundamental changes to the anti-money laundering procedures at law firms including changes to customer due diligence CDD a central register for beneficial owners changes in the rules for PEPs and a focus on risk assessments.

Source: jonathonbray.com

Source: jonathonbray.com

The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. If the communication was received in privileged circumstances and the crimefraud exception does not apply you are exempt from the relevant provisions of POCA which include making a disclosure to the NCA. The absolute minimum number of amendments have been made to existing guidance. The Money Laundering Regulations 2017 mean that PCAs are now subject to SDD only if the bank assesses its business relationship with a law firm as low risk. The anti-money laundering AML guidance for the legal sector is designed to support legal professionals and firms in complying with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: jonathonbray.com

Source: jonathonbray.com

Law society money laundering regulations. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. The new 2017 Money Laundering Regulations means fundamental changes to the anti-money laundering procedures at law firms including changes to customer due diligence CDD a central register for beneficial owners changes in the rules for PEPs and a focus on risk assessments. The guidance is issued by the Legal Sector Affinity Group LSAG and has two parts. Sue Mawdsley examines what to look out for in the new draft regulations.

Source: jonathonbray.com

Source: jonathonbray.com

The entirety of the 2010 Guidance Notes remain extant except for Chapters 4 5 and 10 which have been replaced by this Guidance. The new 2017 Money Laundering Regulations means fundamental changes to the anti-money laundering procedures at law firms including changes to customer due diligence CDD a central register for beneficial owners changes in the rules for PEPs and a focus on risk assessments. Identify and verify the identity of your client. The updated version builds on the previous AML guidance released after the implementation of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week.

Source: jaynewilletts.co.uk

Source: jaynewilletts.co.uk

The regulations came into force on 10 January 2020. Sue Mawdsley examines what to look out for in the new draft regulations. The guidance supports legal professionals in complying with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended. The new 2017 Money Laundering Regulations means fundamental changes to the anti-money laundering procedures at law firms including changes to customer due diligence CDD a central register for beneficial owners changes in the rules for PEPs and a focus on risk assessments. Key issues in the Draft Money Laundering Regulations 2017.

Source:

The updated version builds on the previous AML guidance released after the implementation of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The absolute minimum number of amendments have been made to existing guidance. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Money laundering regulations 2017 law society. Banks may therefore require their business partners to provide evidence of the low risk nature of financial relationships.

Source: infolegal.co.uk

Source: infolegal.co.uk

Key issues in the Draft Money Laundering Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. The sources of the money in precise are criminal and the cash is invested in a manner that makes it seem like clear cash and conceal the id of the criminal part of the cash earned. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this. The Law Society has published a quick guide which provides a brief overview of the key issues that firms will need to be aware of and the changes that they will have to implement to comply with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692.

Source: jonathonbray.com

Source: jonathonbray.com

It was reviewed following the introduction of regulations that implemented the EUs 5th Money Laundering Directive. The entirety of the 2010 Guidance Notes remain extant except for Chapters 4 5 and 10 which have been replaced by this Guidance. Sue Mawdsley examines what to look out for in the new draft regulations. The regulations came into force on 10 January 2020. Amendments to the MLRs 2017 statutory instrument 2022.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title law society guidance money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.