20++ Law firm anti money laundering risk assessment information

Home » money laundering idea » 20++ Law firm anti money laundering risk assessment informationYour Law firm anti money laundering risk assessment images are available. Law firm anti money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Law firm anti money laundering risk assessment files here. Download all royalty-free vectors.

If you’re searching for law firm anti money laundering risk assessment pictures information linked to the law firm anti money laundering risk assessment topic, you have pay a visit to the right site. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

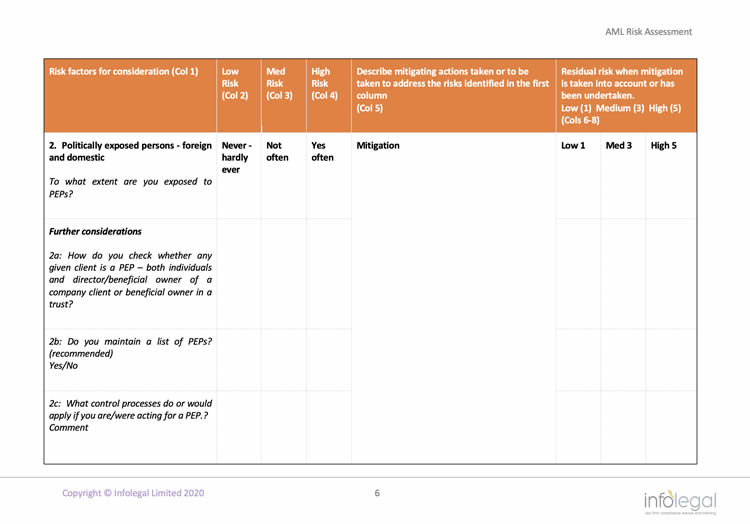

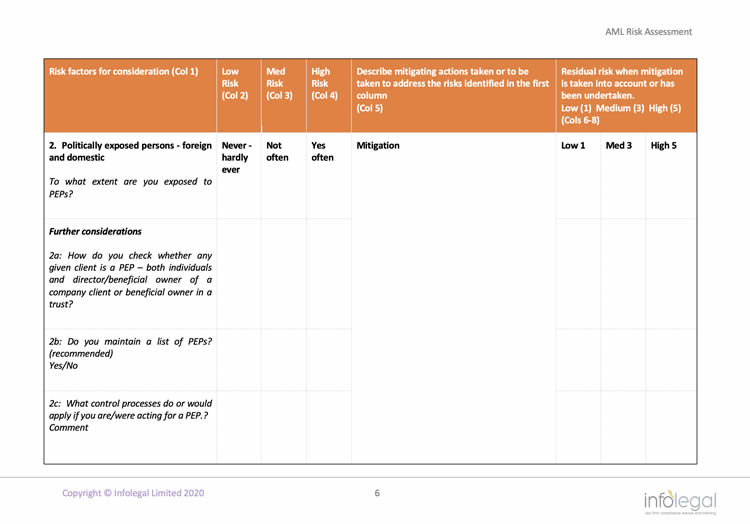

Law Firm Anti Money Laundering Risk Assessment. The SRAs latest guidance looks at some concerns that law firms may have about money laundering risks in the current climate. Take into account information we publish. Address the risk factors set out in the money laundering regulations namely. Risk assessment is the process of considering the circumstances of a particular client and of a particular matter and identifying factors that make it high or low risk for money laundering.

Financial Crime Concerns For Solicitors Infolegal From infolegal.co.uk

Financial Crime Concerns For Solicitors Infolegal From infolegal.co.uk

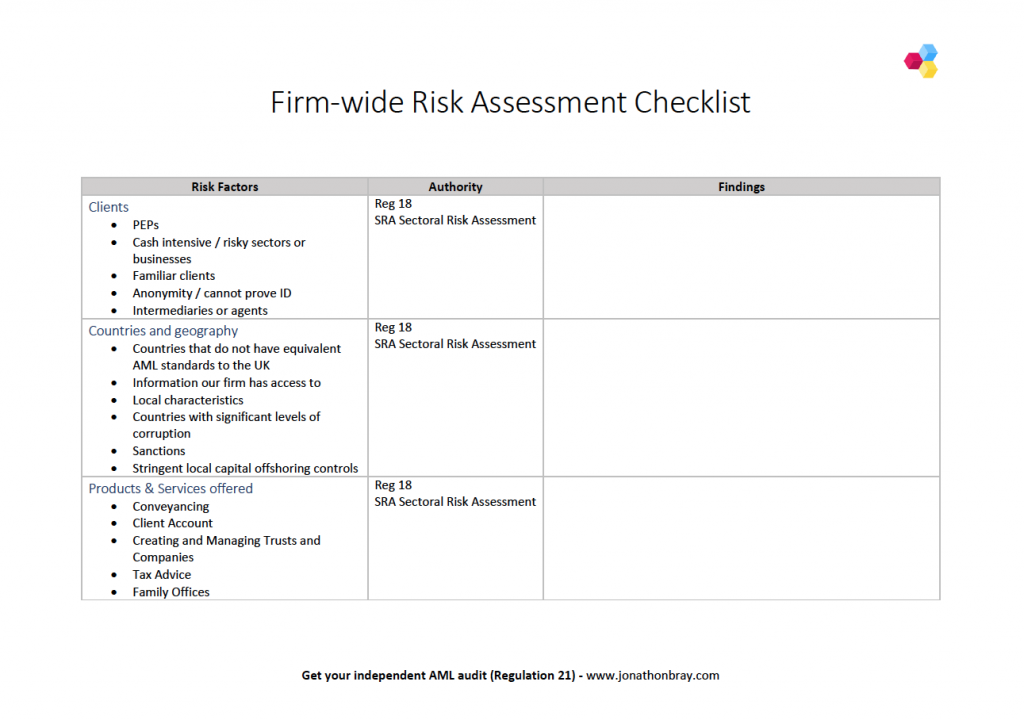

Assess the money laundering and terrorism financing risks related to those countries determine whether a country has insufficient AMLCFT systems or measures in place determine whether another entity is resident in a country with sufficient AMLCFT systems in place and supervised or regulated for AMLCFT purposes for the purpose of forming a designated business group. All organizations at risk of money laundering including law firms must establish and comply with AML compliance programs. The scope of global Anti-Money Laundering AML scrutiny and enforcement for financial institutions is broad far-reaching and increasing. Address the risk factors set out in the money laundering regulations namely. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment.

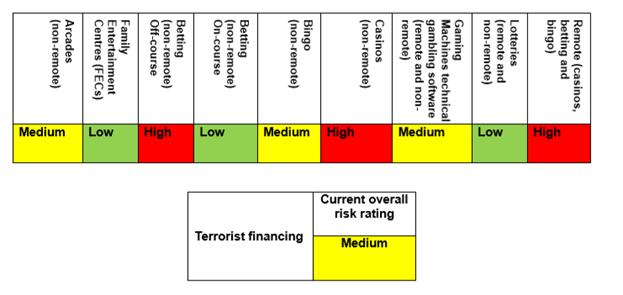

High risk of being used for money laundering although low risk of being used for terrorist financing.

Address the risk factors set out in the money laundering regulations namely. Its difficult to categorise the clients that may need to be checked simply by their nationality or country of residence. The risk assessment must. Take into account information we publish. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. In particular the risk assessment identifies solicitors as being at a high risk of money laundering because of the range of high risk services they may offer.

Source: infolegal.co.uk

Source: infolegal.co.uk

The conclusion should include a short narrative in support of the conclusion. High risk of being used for money laundering although low risk of being used for terrorist financing. The National Risk Assessment rated the legal profession as. It proposes a risk-based approach for regulators such as the FATF and the European Union to enable liable entities to combat financial crime effectively. The requirement to produce a firm risk assessment is set out at Regulation 18 of the money laundering regulations.

Source: dia.govt.nz

Your firms risk assessment should form the backbone of your policies controls and procedures required under the money laundering regulations 18 19 20 and 21 to prevent money laundering. Its difficult to categorise the clients that may need to be checked simply by their nationality or country of residence. The requirement to produce a firm risk assessment is set out at Regulation 18 of the money laundering regulations. New anti-money laundering risk assessment form available to firms. High risk of being used for money laundering although low risk of being used for terrorist financing.

Source: slideplayer.com

Source: slideplayer.com

Take into account information we publish. The program should be tested regularly to. To discharge that obligation the firm conducts and documents in a manual a business risk assessment. Long term absences of key officers Queries have arisen regarding staff illnesses as a result of Covid-19 and in particular in the event that a law firms money laundering reporting officer MLRO andor their money. Your risk assessment will determine the approach you take to Client Due Diligence in general and ongoing monitoring in particular.

Source:

Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Address the risk factors set out in the money laundering regulations namely. It proposes a risk-based approach for regulators such as the FATF and the European Union to enable liable entities to combat financial crime effectively. To discharge that obligation the firm conducts and documents in a manual a business risk assessment. The countries or geographic areas in which you operate.

Source: dia.govt.nz

When you carry out your firms anti-money laundering AML risk assessment you should consider how likely it is that your clients may be on the sanctions lists. It proposes a risk-based approach for regulators such as the FATF and the European Union to enable liable entities to combat financial crime effectively. Law firms in the regulated sector are obliged under Regulation 19 to have written policies controls and procedures PCPs proportionate to the size and nature of the firm to limit the anti-money laundering any risks in the practices risk assessment. The firm recognises that it is under a continuing obligation to assess the money laundering and terrorist financing risks associated with the business and its client base. Your firms risk assessment should form the backbone of your policies controls and procedures required under the money laundering regulations 18 19 20 and 21 to prevent money laundering.

Source: pideeco.be

Source: pideeco.be

In common with many of their clients law firms face a number of regulatory challenges in demonstrating that the policies and procedures they use are properly risk-based and appropriate. New anti-money laundering risk assessment form available to firms. Take into account information we publish. High risk of being used for money laundering although low risk of being used for terrorist financing. The requirement to produce a firm risk assessment is set out at Regulation 18 of the money laundering regulations.

Source: lexology.com

Source: lexology.com

Your risk assessment will determine the approach you take to Client Due Diligence in general and ongoing monitoring in particular. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. The program should be tested regularly to. When you carry out your firms anti-money laundering AML risk assessment you should consider how likely it is that your clients may be on the sanctions lists. The countries or geographic areas in which you operate.

Source: dia.govt.nz

Its difficult to categorise the clients that may need to be checked simply by their nationality or country of residence. All organizations at risk of money laundering including law firms must establish and comply with AML compliance programs. Your risk assessment will determine the approach you take to Client Due Diligence in general and ongoing monitoring in particular. The program should be tested regularly to. Long term absences of key officers Queries have arisen regarding staff illnesses as a result of Covid-19 and in particular in the event that a law firms money laundering reporting officer MLRO andor their money.

Source:

The countries or geographic areas in which you operate. A fundamental prerequisite to a firms ability to demonstrate. The SRAs latest guidance looks at some concerns that law firms may have about money laundering risks in the current climate. Risk assessment is the process of considering the circumstances of a particular client and of a particular matter and identifying factors that make it high or low risk for money laundering. Assess the money laundering and terrorism financing risks related to those countries determine whether a country has insufficient AMLCFT systems or measures in place determine whether another entity is resident in a country with sufficient AMLCFT systems in place and supervised or regulated for AMLCFT purposes for the purpose of forming a designated business group.

Source: dia.govt.nz

The risk assessment must. Anti-Money Laundering Policies and Procedures. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. Your risk assessment will determine the approach you take to Client Due Diligence in general and ongoing monitoring in particular. Address the risk factors set out in the money laundering regulations namely.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

The program should be tested regularly to. Legal providers should furnish continuing education to make sure employees can spot red flags that indicate money laundering. Your risk assessment will determine the approach you take to Client Due Diligence in general and ongoing monitoring in particular. Numerous federal agencies regulate AML and penalties for non-compliance range from forfeitures fines and indictments loss of reputation stock value and licenses to participate in the market. The National Risk Assessment rated the legal profession as.

Source: lexology.com

Source: lexology.com

The risk assessment must. Anti-Money Laundering Policies and Procedures. In particular the risk assessment identifies solicitors as being at a high risk of money laundering because of the range of high risk services they may offer. To discharge that obligation the firm conducts and documents in a manual a business risk assessment. Address the risk factors set out in the money laundering regulations namely.

Source: dia.govt.nz

In particular the risk assessment identifies solicitors as being at a high risk of money laundering because of the range of high risk services they may offer. The risk assessment must. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. Legal providers should furnish continuing education to make sure employees can spot red flags that indicate money laundering. Numerous federal agencies regulate AML and penalties for non-compliance range from forfeitures fines and indictments loss of reputation stock value and licenses to participate in the market.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title law firm anti money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.