13+ Laundering tax meaning information

Home » money laundering idea » 13+ Laundering tax meaning informationYour Laundering tax meaning images are ready in this website. Laundering tax meaning are a topic that is being searched for and liked by netizens now. You can Get the Laundering tax meaning files here. Get all royalty-free images.

If you’re searching for laundering tax meaning images information related to the laundering tax meaning keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Laundering Tax Meaning. However it can also be the Achilles heel of criminal activity. Well I just learned of one. Nothing too big but there is a little known loophole in the UK tax regime. Even if your total claim for work-related expenses is more than 300 including your laundry expenses.

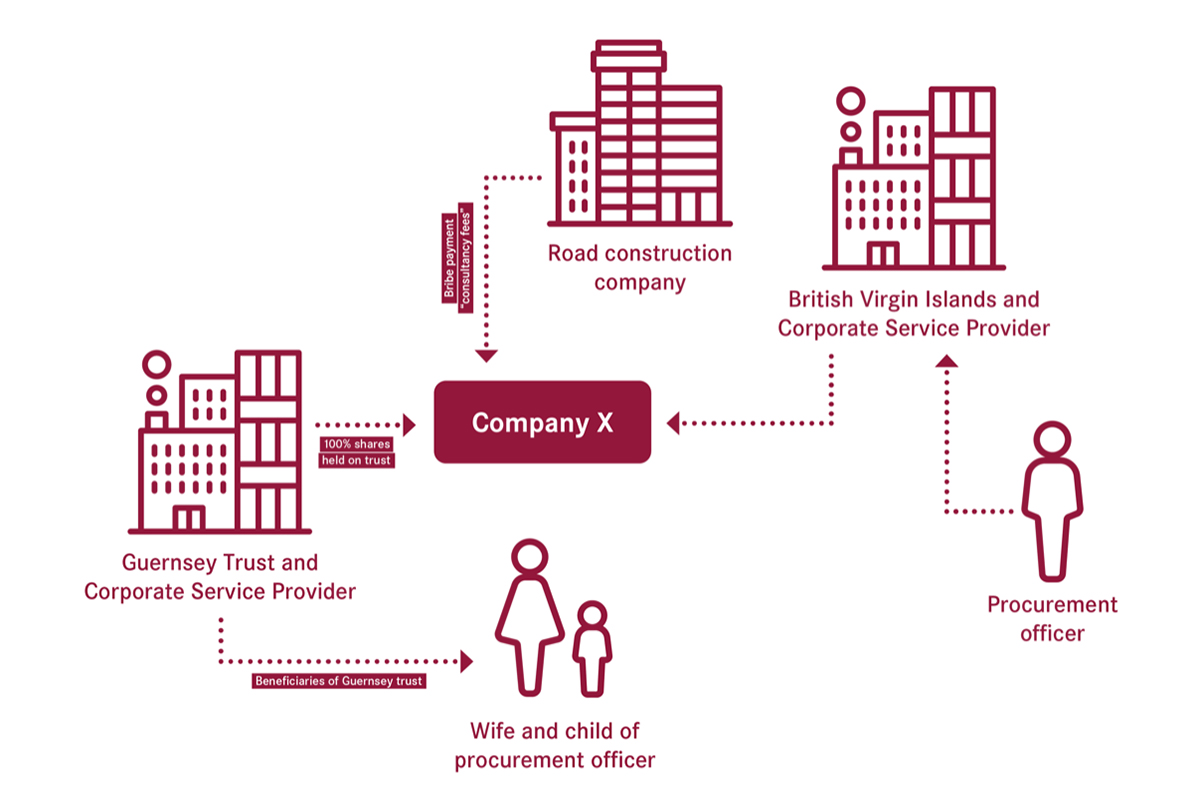

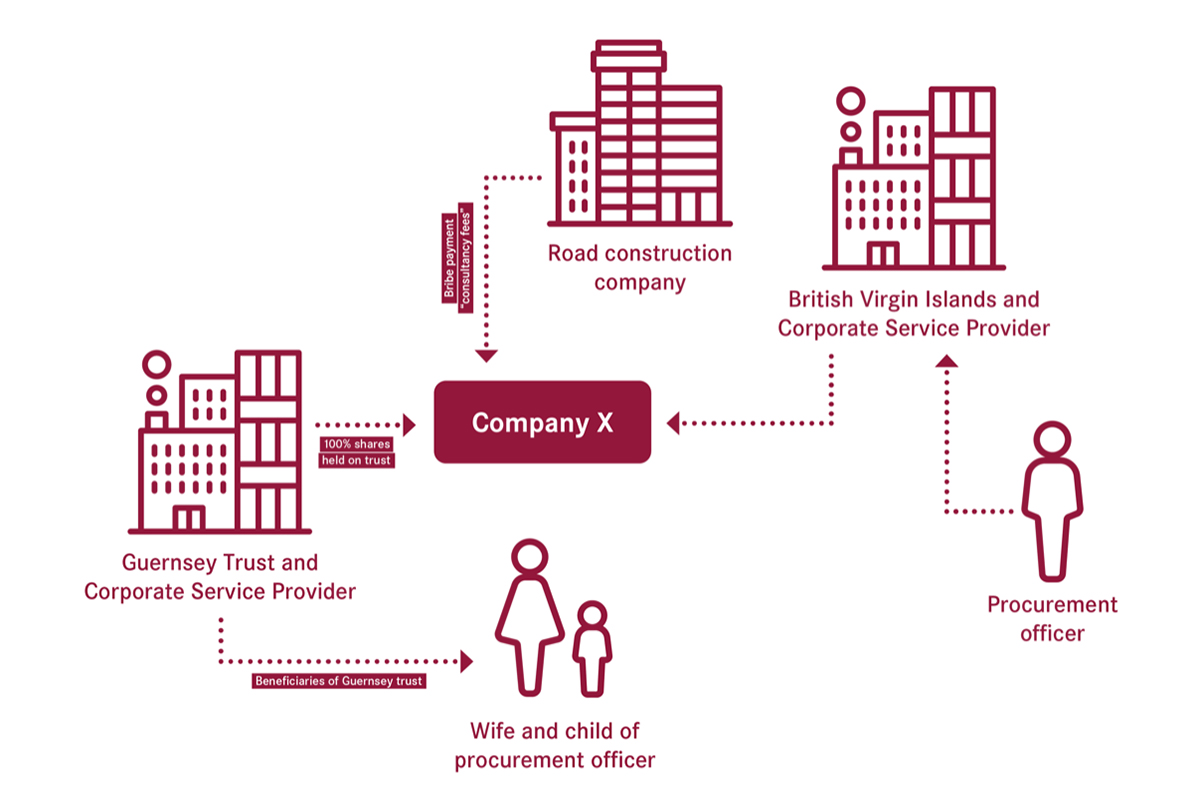

Phyllis Atkinson S Quick Guide To Offshore Structures And Beneficial Ownership Basel Institute On Governance From baselgovernance.org

Phyllis Atkinson S Quick Guide To Offshore Structures And Beneficial Ownership Basel Institute On Governance From baselgovernance.org

You can claim a deduction for occupation-specific clothing. If you are a US. It is also possible that tax crimes are not mentioned as a predicate offence. Citizen permanent resident the law requires you to report your income and pay taxes on the same. Non reported sales might not be considered as money laundering. Buying land for money and then selling it making the profits legal by paying tax on such profit.

You can claim tax relief if you wash the uniform given to you by your employer unless your employer provides a laundering service and you choose not to.

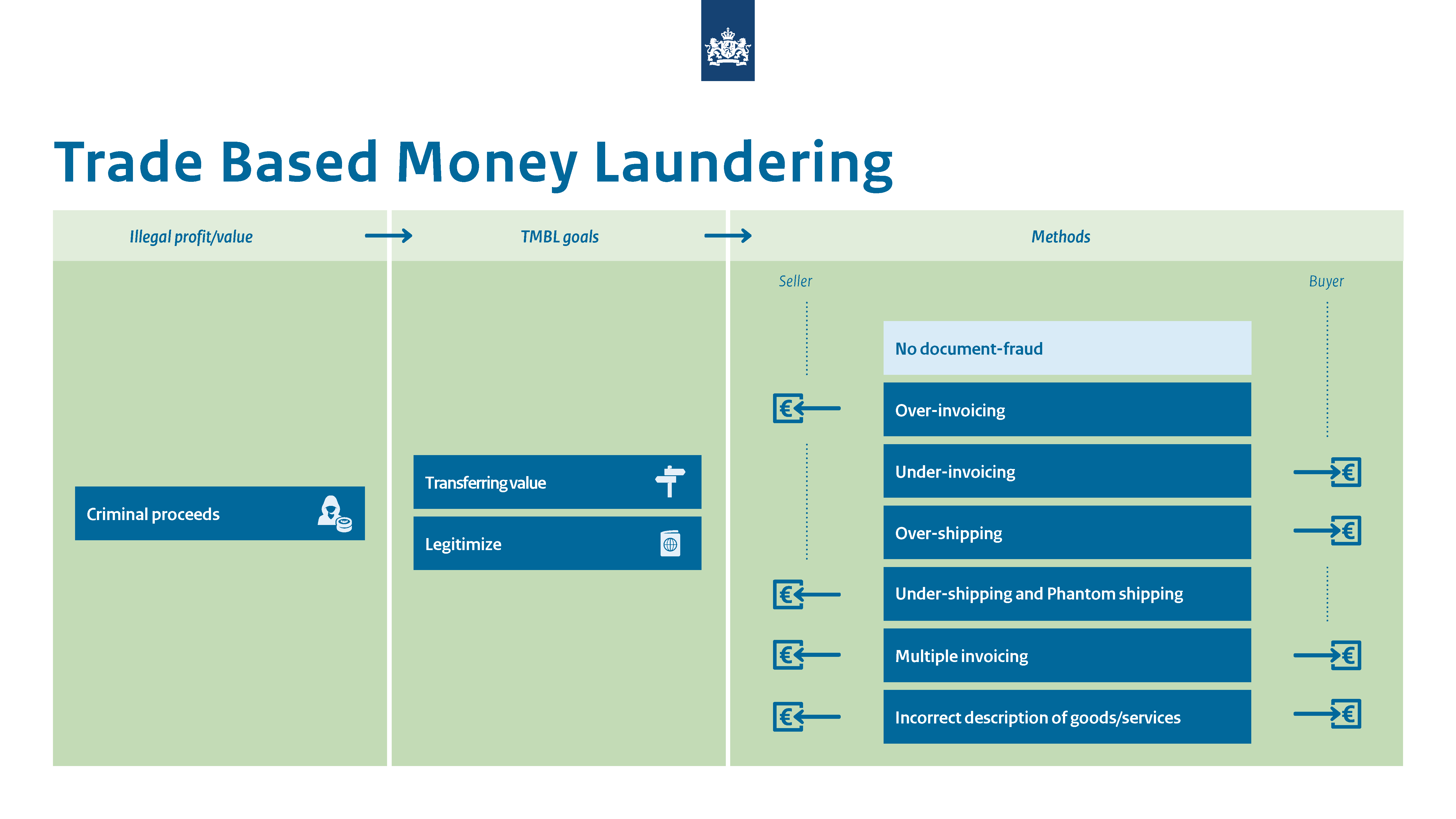

Investing in Real estate ie. Or 2 assisting any person involved in the commission of the predicate offence to evade the legal consequences of such offence. Money laundering is a threat to the good functioning of a financial system. Buying land for money and then selling it making the profits legal by paying tax on such profit. This honors project will focus on tax fraud and money laundering as they relate to the financing of organized crime syndicates. If your laundry expenses are 150 or less you can claim the amount you incur on laundry without providing written evidence of your laundry expenses.

Source: baselgovernance.org

Source: baselgovernance.org

That is the profits from most activities concerning a perso. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. Tax evasion to purchase or make investments in assets which transmute the original illegal tax-cheating proceeds into another asset. Citizen permanent resident the law requires you to report your income and pay taxes on the same. Occupation-specific clothing protective clothing and unique distinctive uniforms.

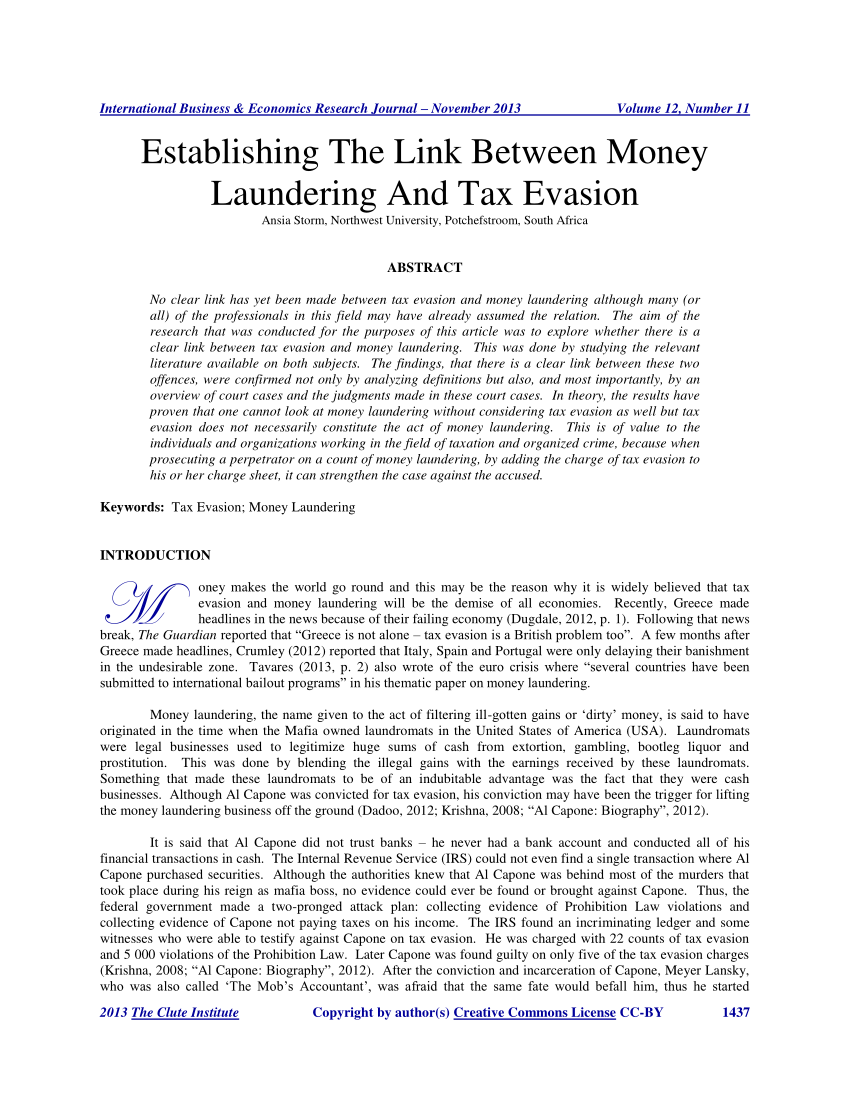

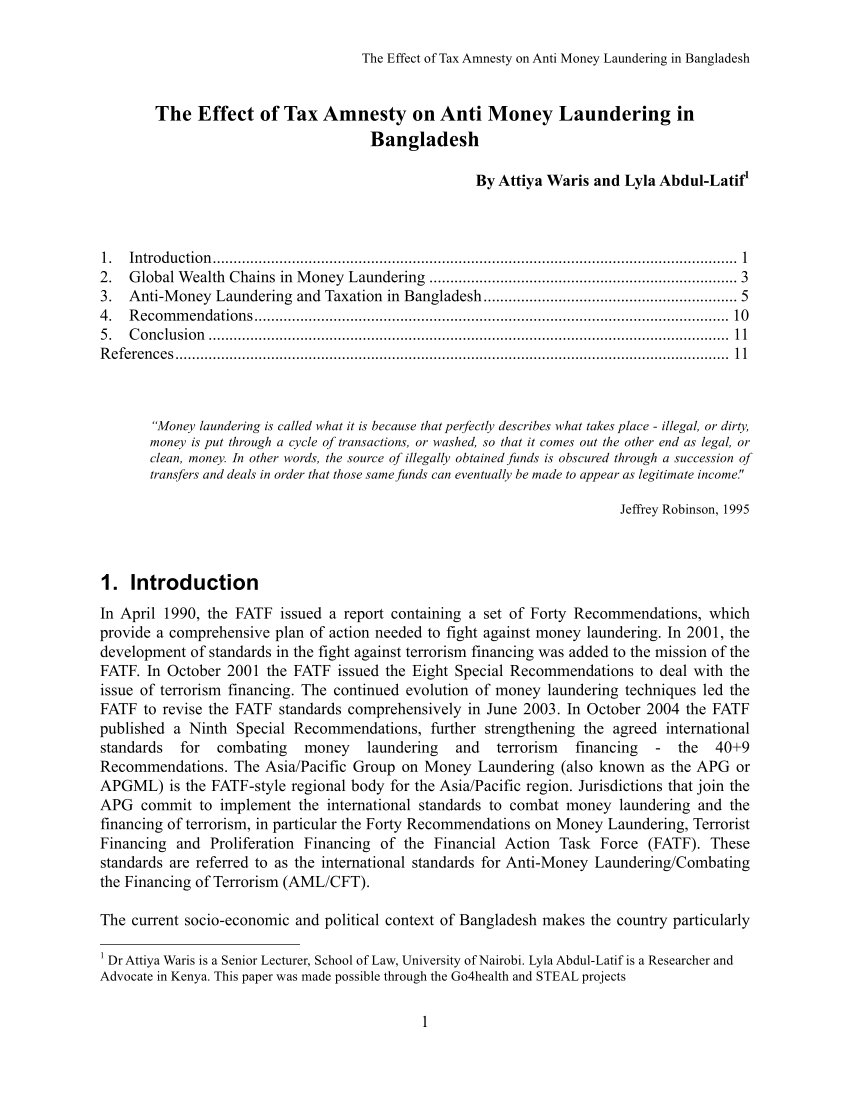

Source: researchgate.net

Source: researchgate.net

8 This section prohibits a variety of offenses that can be broadly classified as transaction money laundering transportation money laundering and sting operations where the crime involves property that a law enforcement officer represents to be the proceeds of unlawful activity. Buying land for money and then selling it making the profits legal by paying tax on such profit. This honors project will focus on tax fraud and money laundering as they relate to the financing of organized crime syndicates. The allowance is assessable income which you must include on your tax return. I had some guests at my house few days ago and one of them owned a forest in the UK.

Source: researchgate.net

Source: researchgate.net

Nothing too big but there is a little known loophole in the UK tax regime. If your laundry expenses are 150 or less you can claim the amount you incur on laundry without providing written evidence of your laundry expenses. Buying land for money and then selling it making the profits legal by paying tax on such profit. Tax Evasion failure to pay the tax due. He was convicted of money laundering and tax.

Source: businesstoday.in

Source: businesstoday.in

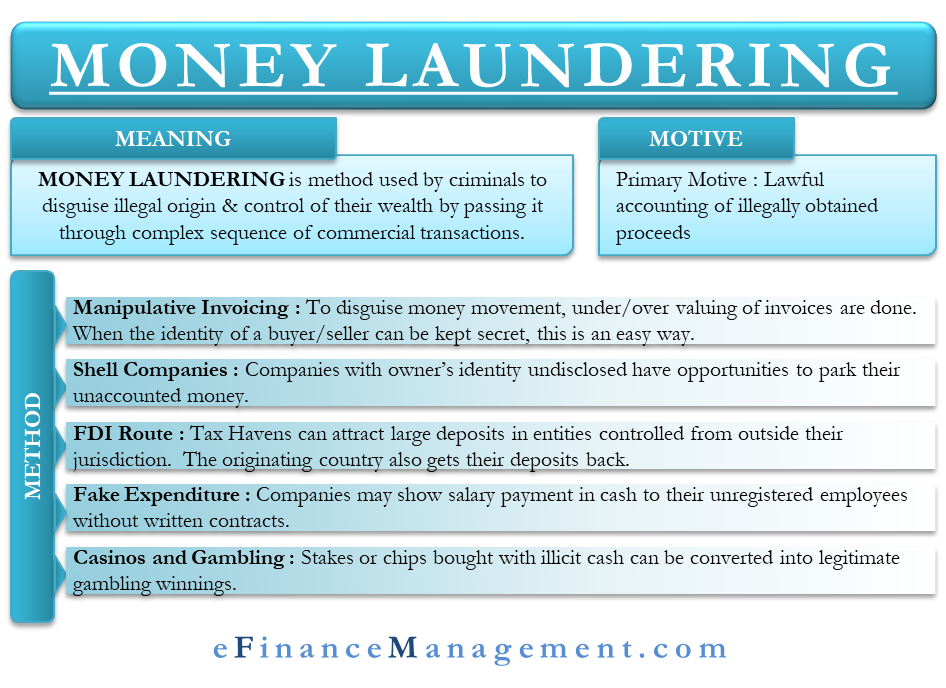

Investing in Real estate ie. Money Laundering refers to converting illegal earned money into legitimate money. Occupation-specific clothing protective clothing and unique distinctive uniforms. Taxpayer when you are involved in money laundering it is obvious that you are hiding the money in question. Investing in Real estate ie.

Source: bbcincorp.com

Source: bbcincorp.com

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. The legislation may include tax crimes as a predicate offence to money laundering. In terms of section 2 Money Laundering means i knowingly moving converting or transferring proceeds of crime or property involved in an offence for the following purposes- 1 concealing or disguising the illicit nature source location ownership or control of the proceeds of crime. The money laundering rules of particular concern in tax cases are found in Section 1956 of title 18 of the US. Citizen permanent resident the law requires you to report your income and pay taxes on the same.

Source: researchgate.net

Source: researchgate.net

Tax Evasion failure to pay the tax due. That is the profits from most activities concerning a perso. You can claim a deduction for occupation-specific clothing. You can claim tax relief if you wash the uniform given to you by your employer unless your employer provides a laundering service and you choose not to. This honors project will focus on tax fraud and money laundering as they relate to the financing of organized crime syndicates.

Source: efinancemanagement.com

Source: efinancemanagement.com

Citizen permanent resident the law requires you to report your income and pay taxes on the same. Occupation-specific clothing protective clothing and unique distinctive uniforms. Nothing too big but there is a little known loophole in the UK tax regime. Clothing and laundry It pays to learn what you can claim at tax time You can claim a deduction for the cost of buying and cleaning. This means that transactions with money solely derived from a tax crime eg.

Source: skillcast.com

Source: skillcast.com

It is also possible that tax crimes are not mentioned as a predicate offence. Taxpayer when you are involved in money laundering it is obvious that you are hiding the money in question. Cash smuggling transferring money to the Swiss bank. It is meant to make the trailing of illegal proceeds difficult for the law enforcement agencies. If left unchecked money laundering can destroy the nations economy by changing the demand and supply of cash.

Source: researchgate.net

Source: researchgate.net

Citizen permanent resident the law requires you to report your income and pay taxes on the same. According to IRS money laundering is tax evasion in progress if the underlying conduct violates income tax laws and Bank Secrecy Act. The concealment of the origins of illegally obtained money typically by means of transfers involving foreign banks or legitimate businesses. Money Laundering -The use of proceeds from a specified unlawful activity ie. If you are a US.

Source: researchgate.net

Source: researchgate.net

The concealment of the origins of illegally obtained money typically by means of transfers involving foreign banks or legitimate businesses. The allowance is assessable income which you must include on your tax return. The government does not get any tax on the money because there is no accounting of the black moneySo Money. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. It is also possible that tax crimes are not mentioned as a predicate offence.

In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. If you are a US. I had some guests at my house few days ago and one of them owned a forest in the UK. The money laundering rules of particular concern in tax cases are found in Section 1956 of title 18 of the US. Layering The purpose of this stage is to make it more difficult to detect and uncover a laundering activity.

Source: taxjustice.net

Source: taxjustice.net

I had some guests at my house few days ago and one of them owned a forest in the UK. I had some guests at my house few days ago and one of them owned a forest in the UK. It is also possible that tax crimes are not mentioned as a predicate offence. Non reported sales might not be considered as money laundering. The legislation may include tax crimes as a predicate offence to money laundering.

Source: amlc.eu

Source: amlc.eu

This honors project will focus on tax fraud and money laundering as they relate to the financing of organized crime syndicates. You can claim tax relief if you wash the uniform given to you by your employer unless your employer provides a laundering service and you choose not to. This means that transactions with money solely derived from a tax crime eg. First it will demonstrate that tax fraud and money laundering are a major means of financing organized crime operations. I had some guests at my house few days ago and one of them owned a forest in the UK.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title laundering tax meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.