15+ Laundering tax definition ideas

Home » money laundering Info » 15+ Laundering tax definition ideasYour Laundering tax definition images are available in this site. Laundering tax definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Laundering tax definition files here. Download all free photos.

If you’re looking for laundering tax definition pictures information connected with to the laundering tax definition topic, you have visit the ideal site. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

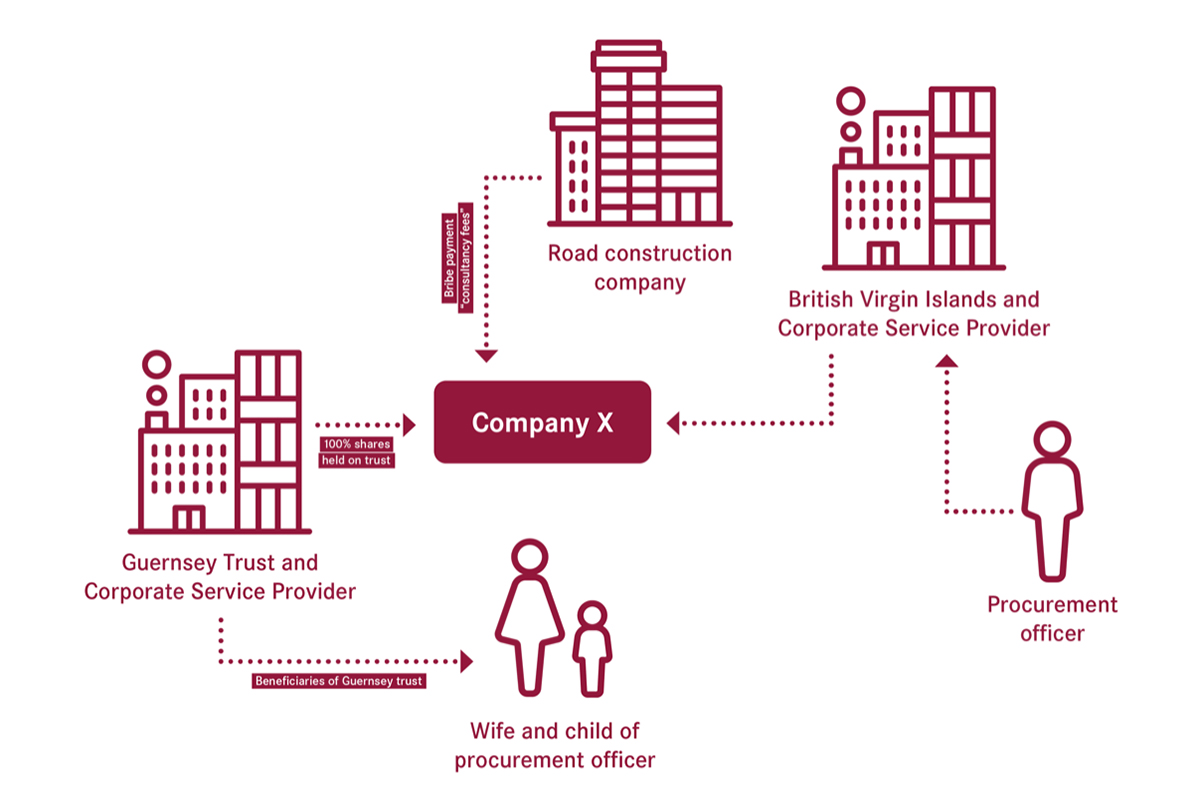

Laundering Tax Definition. Money laundering is a process whereby criminals. If you are a US. Tax fraud is a crime that generates significant amounts of illicit proceeds and tax fraudsters have devised increasingly complex transnational schemes that enables them to launder significant amounts of illicit proceeds. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways.

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation From en.ppt-online.org

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation From en.ppt-online.org

Money laundering is the processing of these criminal proceeds to disguise their illegal origin. Money laundering is a process whereby criminals. A tax haven country by definition is an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment. These countries rely on the foreign inflows foreign capital into the country through financial institutions and other investment vehicles for their development. The AMLGAS Anti-Money Laundering Guidance for the Accountancy Sector further expands on the tax adviser definition within its glossary. The definition of money laundering is broad.

Tax fraud however isnt a specified unlawful activity.

These are called specified unlawful activities and they include things like bank fraud and wire fraud and drug crimes. Retain disguise and conceal the proceeds of their crimes. That means that implementing the FATF standards supports efforts to stop tax. These countries rely on the foreign inflows foreign capital into the country through financial institutions and other investment vehicles for their development. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Tax adviser means a firm or sole practitioner who by way of business provides advice about the tax affairs of other persons when providing such services.

Source: baselgovernance.org

Source: baselgovernance.org

That means that implementing the FATF standards supports efforts to stop tax. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. In UK law the common law definition is wider. Money laundering has a specific legal definition and you can be convicted of money laundering only if your money comes from certain kinds of unlawful activities. According to IRS money laundering is tax evasion in progress if the underlying conduct violates income tax laws and Bank Secrecy Act.

Thus the Court affirms that the requirement of the intentional element in the conducts prevents considering laundering the mere use of the money corresponding to the unpaid tax in a tax crime for ordinary expenses without any purpose of concealment or the intention to obtain a law title apparently legal on assets from a previous criminal activity which is what constitutes the essence of the behaviour that is sanctioned through the crime of money laundering. We apply the FATF definition for money laundering as well as generally accepted definitions for tax evasion and for a standard predicate offense to identify the necessary conditions for each crime. These are called methods of laundering. These countries rely on the foreign inflows foreign capital into the country through financial institutions and other investment vehicles for their development. Money laundering is the processing of these criminal proceeds to disguise their illegal origin.

Source: researchgate.net

Source: researchgate.net

Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Thus the Court affirms that the requirement of the intentional element in the conducts prevents considering laundering the mere use of the money corresponding to the unpaid tax in a tax crime for ordinary expenses without any purpose of concealment or the intention to obtain a law title apparently legal on assets from a previous criminal activity which is what constitutes the essence of the behaviour that is sanctioned through the crime of money laundering. Regulation3 8 reads. Money laundering is the illegal process of making large amounts of money generated by a criminal activity such as drug trafficking or terrorist funding appear to have come from a legitimate. Money Laundering is an act of act of disguising the illegal source of income.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

Examples of money laundering offences include tax evasion theft fraud bribery corruption smuggling modern slavery human trafficking drug trafficking and illegal arms sales. Tax evasion is where someone deliberately understates their income or overstates allowable costs in order to artificially depress the tax liability. Thus the Court affirms that the requirement of the intentional element in the conducts prevents considering laundering the mere use of the money corresponding to the unpaid tax in a tax crime for ordinary expenses without any purpose of concealment or the intention to obtain a law title apparently legal on assets from a previous criminal activity which is what constitutes the essence of the behaviour that is sanctioned through the crime of money laundering. Both schemes use nominees currency multiple bank accounts wire transfers and international tax havens to avoid detection. Tax evasion is a predicate offence for money laundering under these standards.

Source: bbcincorp.com

Source: bbcincorp.com

These are called methods of laundering. The FATF is an intergovernmental body that sets the global standards for anti-money laundering counter terrorist and proliferation financing. Money laundering is a threat to the United States tax system in that taxable illegal source proceeds go undetected along with some taxable legal source proceeds from tax evasion schemes. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. These countries rely on the foreign inflows foreign capital into the country through financial institutions and other investment vehicles for their development.

Source: eimf.eu

Source: eimf.eu

Tax evasion is where someone deliberately understates their income or overstates allowable costs in order to artificially depress the tax liability. In US law it is the practice of engaging in financial transactions to conceal the identity source or destination of illegally gained money. We then use these conditions to test opposing hypotheses regarding the nexus between tax evasion and money laundering. Starting with MLR17 tax adviser means a firm or sole practitioner who by way of business provides advice about the tax affairs of other persons when providing such services. Gross Profit Gross profit is the.

Source: researchgate.net

Source: researchgate.net

Thus the Court affirms that the requirement of the intentional element in the conducts prevents considering laundering the mere use of the money corresponding to the unpaid tax in a tax crime for ordinary expenses without any purpose of concealment or the intention to obtain a law title apparently legal on assets from a previous criminal activity which is what constitutes the essence of the behaviour that is sanctioned through the crime of money laundering. Examples of money laundering offences include tax evasion theft fraud bribery corruption smuggling modern slavery human trafficking drug trafficking and illegal arms sales. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. Tax adviser means a firm or sole practitioner who by way of business provides advice about the tax affairs of other persons when providing such services. These countries rely on the foreign inflows foreign capital into the country through financial institutions and other investment vehicles for their development.

Source: researchgate.net

Source: researchgate.net

This process is of critical importance as it enables the criminal to enjoy these profits without jeopardising their source. Gross Profit Gross profit is the. Regulation3 8 reads. Tax fraud however isnt a specified unlawful activity. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits.

Source: efinancemanagement.com

Source: efinancemanagement.com

Tax adviser means a firm or sole practitioner who by way of business provides advice about the tax affairs of other persons when providing such services. Regulation3 8 reads. Illegal arms sales smuggling and the activities of organised crime including for example drug trafficking and prostitution. There are 3 stages of money laundering. HMRCs position was that the Company was a tax adviser and so a relevant person for the purposes of the Regulations paras 47 48.

Source: jagranjosh.com

Source: jagranjosh.com

The AMLGAS Anti-Money Laundering Guidance for the Accountancy Sector further expands on the tax adviser definition within its glossary. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. The AMLGAS Anti-Money Laundering Guidance for the Accountancy Sector further expands on the tax adviser definition within its glossary. Tax adviser means a firm or sole practitioner who by way of business provides advice about the tax affairs of other persons when providing such services. Retain disguise and conceal the proceeds of their crimes.

Source: researchgate.net

Source: researchgate.net

A tax haven country by definition is an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment. There are 3 stages of money laundering. These are called specified unlawful activities and they include things like bank fraud and wire fraud and drug crimes. That means that implementing the FATF standards supports efforts to stop tax. Tax evasion is a predicate offence for money laundering under these standards.

Source: amlcompliance.ie

Source: amlcompliance.ie

Tax adviser means a firm or sole practitioner who by way of business provides advice about the tax affairs of other persons when providing such services. This process is of critical importance as it enables the criminal to enjoy these profits without jeopardising their source. A tax haven country by definition is an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment. In US law it is the practice of engaging in financial transactions to conceal the identity source or destination of illegally gained money. Citizen permanent resident the law requires you to report your income and pay taxes on the same.

Source: en.ppt-online.org

Source: en.ppt-online.org

In UK law the common law definition is wider. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Money laundering is a process whereby criminals. Money laundering is a threat to the United States tax system in that taxable illegal source proceeds go undetected along with some taxable legal source proceeds from tax evasion schemes. Tax fraud however isnt a specified unlawful activity.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title laundering tax definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.