20+ Laundering risk meaning ideas

Home » money laundering idea » 20+ Laundering risk meaning ideasYour Laundering risk meaning images are ready. Laundering risk meaning are a topic that is being searched for and liked by netizens now. You can Get the Laundering risk meaning files here. Download all free photos.

If you’re looking for laundering risk meaning pictures information linked to the laundering risk meaning interest, you have pay a visit to the right site. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Laundering Risk Meaning. But in light of recent headlines its clear that risks of money laundering exist outside of financial services. So their problem is to turn illegally acquired assets into clean. Geographic location and jurisdiction. Earlier this year with over 200 pages on the scope and scale of money launderingestimated in the hundreds of billions of dollars globallyas well as.

How Money Laundering Works Money Laundering Budgeting Money Finance Investing From pinterest.com

How Money Laundering Works Money Laundering Budgeting Money Finance Investing From pinterest.com

Geographic location and jurisdiction. MLTF Risk in Customer Business Relationships. Type of corporate structure eg IBCs shell companies domestic or foreign or PICs. But in light of recent headlines its clear that risks of money laundering exist outside of financial services. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. Stages of anti-money laundering.

Criminals and terrorists need money but they usually acquire assets through illegal means.

These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering. With challenges such as a high-volume of detection on transaction-based scenarios segmentation and financial groups risk assessing high-net worth takes on a whole new meaning. Identifying Money Laundering Risks in Financial Institutions. Type of corporate structure eg IBCs shell companies domestic or foreign or PICs. Control risk is the risk that a misstatement which might appear in the account balance or transaction type might not be prevented in time or detected by the accounting system and internal control system while detection risk refers to the risk that auditors evidence procedures will fail to detect substantial misstatements in account balance or transaction types International Standard on Auditing. These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering.

Source: pinterest.com

Source: pinterest.com

Identifying Money Laundering Risks in Financial Institutions. Many foreign currency exchange services do not require the same identity verification measures as other types of financial service firms meaning that criminals can use their services to launder money anonymously. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. Managing money laundering risks for high-net worth individuals. A service provider or financial institution has the risk of accepting digital assets or fiat assets that fall within money laundering or terrorist financing offences.

In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers. Stages of anti-money laundering. The Financial Action Task Force FATF produced a report on anti-money laundering and counter-terrorist financing measures in the US. Managing money laundering risks for high-net worth individuals. Type of corporate structure eg IBCs shell companies domestic or foreign or PICs.

Source: pinterest.com

Source: pinterest.com

Control risk is the risk that a misstatement which might appear in the account balance or transaction type might not be prevented in time or detected by the accounting system and internal control system while detection risk refers to the risk that auditors evidence procedures will fail to detect substantial misstatements in account balance or transaction types International Standard on Auditing. Often they use either formal institutions where they may even have accomplices as well as informal. The previous terrorist financing risk assessment just as the money laundering risk assessment relied on a much lower volume of data and was for the most part related to an effort by the system to answer the questions concerning the financing of terrorism and. Control risk is the risk that a misstatement which might appear in the account balance or transaction type might not be prevented in time or detected by the accounting system and internal control system while detection risk refers to the risk that auditors evidence procedures will fail to detect substantial misstatements in account balance or transaction types International Standard on Auditing. Many foreign currency exchange services do not require the same identity verification measures as other types of financial service firms meaning that criminals can use their services to launder money anonymously.

But in light of recent headlines its clear that risks of money laundering exist outside of financial services. Criminals and terrorists need money but they usually acquire assets through illegal means. But in light of recent headlines its clear that risks of money laundering exist outside of financial services. Geographic location and jurisdiction. MLTF Risk in Customer Business Relationships.

Source: ft.lk

Source: ft.lk

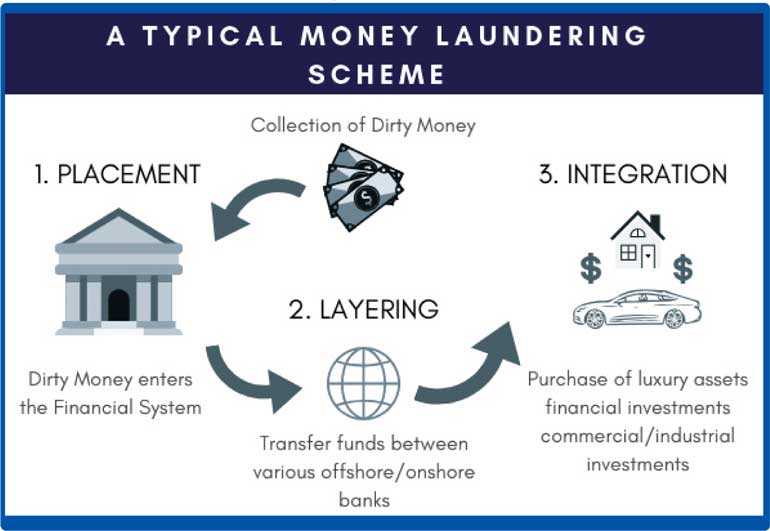

When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it. MLTF Risk in Customer Business Relationships. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it. Particularly in international business you run the risk that the companies or individuals with whom you do business are not in compliance with the regulations set by the government.

Source: bi.go.id

Source: bi.go.id

Conducting a due diligence investigation on your partners suppliers but also customers is therefore essential. With challenges such as a high-volume of detection on transaction-based scenarios segmentation and financial groups risk assessing high-net worth takes on a whole new meaning. Criminals and terrorists need money but they usually acquire assets through illegal means. The previous terrorist financing risk assessment just as the money laundering risk assessment relied on a much lower volume of data and was for the most part related to an effort by the system to answer the questions concerning the financing of terrorism and. Earlier this year with over 200 pages on the scope and scale of money launderingestimated in the hundreds of billions of dollars globallyas well as.

Source: bi.go.id

Source: bi.go.id

The key money laundering risks faced by foreign currency exchange service providers include. These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. Criminals and terrorists need money but they usually acquire assets through illegal means. The nature and duration of the banks relationship including relationships with affiliates with the private banking customer.

Source: ec.europa.eu

Source: ec.europa.eu

Control risk is the risk that a misstatement which might appear in the account balance or transaction type might not be prevented in time or detected by the accounting system and internal control system while detection risk refers to the risk that auditors evidence procedures will fail to detect substantial misstatements in account balance or transaction types International Standard on Auditing. The clean money and dirty money intermingle often becoming indistinguishable. These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. Often they use either formal institutions where they may even have accomplices as well as informal.

Source: bi.go.id

Source: bi.go.id

But in light of recent headlines its clear that risks of money laundering exist outside of financial services. The key money laundering risks faced by foreign currency exchange service providers include. Particularly in international business you run the risk that the companies or individuals with whom you do business are not in compliance with the regulations set by the government. Earlier this year with over 200 pages on the scope and scale of money launderingestimated in the hundreds of billions of dollars globallyas well as. When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. But in light of recent headlines its clear that risks of money laundering exist outside of financial services. Identifying Money Laundering Risks in Financial Institutions. MLTF Risk in Customer Business Relationships. Geographic location and jurisdiction.

Source: bi.go.id

Source: bi.go.id

In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers. The nature and duration of the banks relationship including relationships with affiliates with the private banking customer. A service provider or financial institution has the risk of accepting digital assets or fiat assets that fall within money laundering or terrorist financing offences. The clean money and dirty money intermingle often becoming indistinguishable. In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers.

Source: pinterest.com

Source: pinterest.com

Criminals and terrorists need money but they usually acquire assets through illegal means. Often they use either formal institutions where they may even have accomplices as well as informal. Many foreign currency exchange services do not require the same identity verification measures as other types of financial service firms meaning that criminals can use their services to launder money anonymously. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. When someone commits money laundering they take dirty money and pass it through several layers in an effort to clean it.

Source: pinterest.com

Source: pinterest.com

Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. Geographic location and jurisdiction. A service provider or financial institution has the risk of accepting digital assets or fiat assets that fall within money laundering or terrorist financing offences. The clean money and dirty money intermingle often becoming indistinguishable.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title laundering risk meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.