19++ Launder money smurf information

Home » money laundering idea » 19++ Launder money smurf informationYour Launder money smurf images are ready. Launder money smurf are a topic that is being searched for and liked by netizens today. You can Find and Download the Launder money smurf files here. Find and Download all royalty-free photos.

If you’re searching for launder money smurf images information connected with to the launder money smurf topic, you have visit the ideal site. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly search and find more enlightening video content and graphics that match your interests.

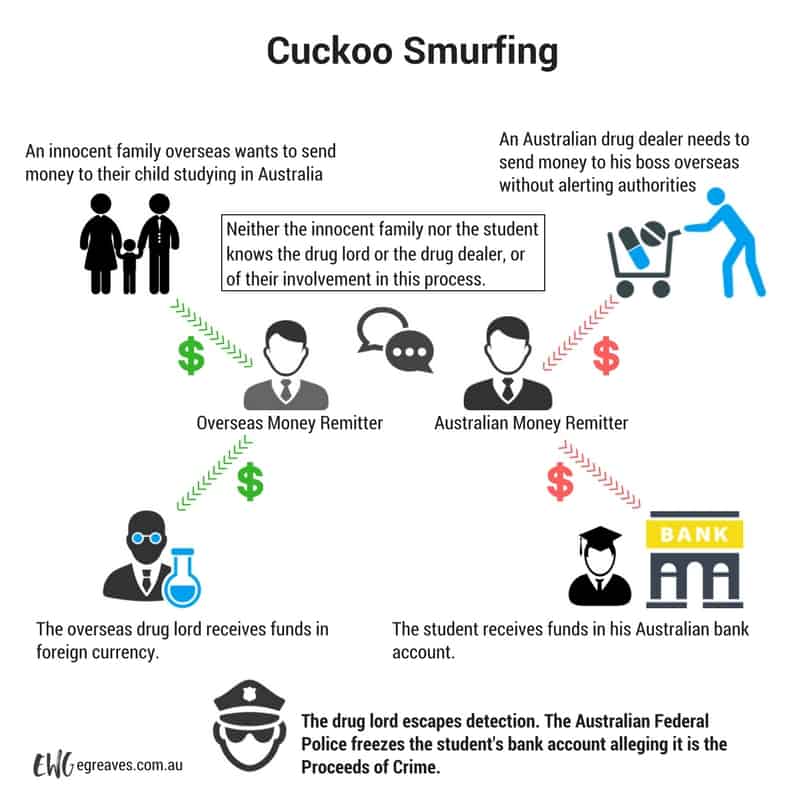

Launder Money Smurf. The illegal act of splitting cash deposits or withdrawals into smaller amounts or purchasing monetary instruments to. First they are NOT synonymous. What business is best for money. The Department of Justice stated The increasing use of OTC bitcoin brokers who are capable of transferring millions of dollars in bitcoin across international borders as part of a capital flight scheme is expected to continue to intertwine criminal money laundering networks with capital flight.

Duhaime S Aml On Twitter Our Popular Story On Smurfs Who Are Used In China To Get Money To Vancouver Http T Co Ietzdik5le Donthave1million Http T Co Vflbvv3qui From twitter.com

Duhaime S Aml On Twitter Our Popular Story On Smurfs Who Are Used In China To Get Money To Vancouver Http T Co Ietzdik5le Donthave1million Http T Co Vflbvv3qui From twitter.com

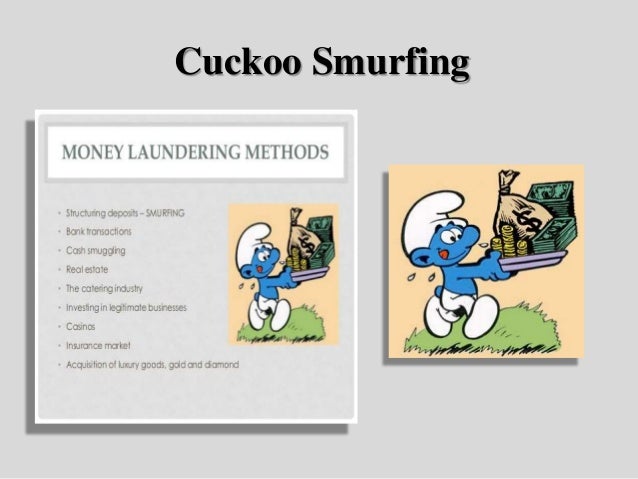

The slang use of smurf is purported to have originated to describe Colombian drug cartels use of armies of elderly blue-haired old ladies to conduct money laundering transactions. This method is used to beat suspicion of money laundering and to circumvent anti-money-laundering reporting requirements. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by breaking up cash amounts. For deposit into the individuals accounts. More Anti Money Laundering AML Definition. Smurfing is a method of placing smaller amounts of money in order to avoid reporting for suspicious money laundering activities.

In March another Hong Kong resident Carson Yeung was sentenced to six years for laundering 9127 million.

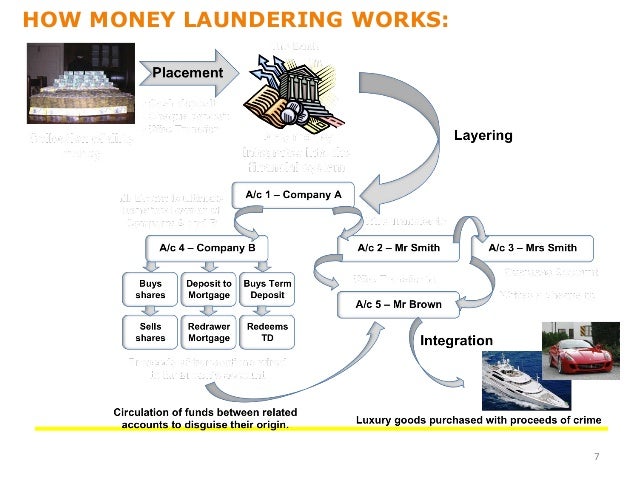

According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by breaking up cash amounts. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. In money laundering the most common use of smurfs is to deposit cash under the 10000 limit that triggers filing of a federal cash transaction report. Also called smurfing it is a method of placement whereby money is broken into smaller deposits. 2 To banking and financial service professionals smurf and smurfing define a type of low-level money handler and their illicit transactions respectively. What is the most common way to launder money.

Source: slideshare.net

Source: slideshare.net

In money laundering the most common use of smurfs is to deposit cash under the 10000 limit that triggers filing of a federal cash transaction report. Smurfing is often a method employed to structure transactions but many a financial institutions structuring reports have nothing to do with smurfs. As we said this article will explore the money laundering risks associated with a non-reloadable open-loop prepaid gift card which we have shortened for editorial purposes to prepaid gift card. To begin I would like to clear up a few misconceptions about these two money laundering terms. For deposit into the individuals accounts.

As we said this article will explore the money laundering risks associated with a non-reloadable open-loop prepaid gift card which we have shortened for editorial purposes to prepaid gift card. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting threshold normally around 10000. Often smurfs are just innocent unemployed people conned by an ad on a telephone poll that says Work from home make up to a thousand dollars a week and when they got the job as Financial Officer or some other lofty name have to open a strange kind of joint bank account with a shell company whose trustees have control over it and which is being used behind the smurfs back to launder money. What is the most common way to launder money. The Department of Justice stated The increasing use of OTC bitcoin brokers who are capable of transferring millions of dollars in bitcoin across international borders as part of a capital flight scheme is expected to continue to intertwine criminal money laundering networks with capital flight.

Source: egreaves.com.au

Source: egreaves.com.au

As we said this article will explore the money laundering risks associated with a non-reloadable open-loop prepaid gift card which we have shortened for editorial purposes to prepaid gift card. 2 To banking and financial service professionals smurf and smurfing define a type of low-level money handler and their illicit transactions respectively. These smaller sums can then be deposited in various banks by different peopleor smurfseffectively accomplishing the placement phase of traditional money laundering. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. Similar to a smurf.

Source: slideshare.net

Source: slideshare.net

In March another Hong Kong resident Carson Yeung was sentenced to six years for laundering 9127 million. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. First they are NOT synonymous. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting threshold normally around 10000. The illegal act of splitting cash deposits or withdrawals into smaller amounts or purchasing monetary instruments to.

Source: acamstoday.org

Source: acamstoday.org

Traditionally smurfs are a group of individuals who have been. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. Smurfing is a financial structuring method that refers to the divvying up of large sums of cash into lesser amounts preferably smaller than 10000 the reporting threshold for banks and US Customs. This method is used to beat suspicion of money laundering and to circumvent anti-money-laundering reporting requirements. However even with these sensible restrictions these cards are susceptible to a money laundering scheme which can be described as prepaid gift card smurfing.

Source: fincen.gov

Source: fincen.gov

In one common form of money laundering called smurfing also known as structuring the criminal breaks up large chunks of cash into multiple small deposits often spreading them over many. Other smurfs come to attention of authorities through their flamboyant lifestyles. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. This method is used to beat suspicion of money laundering and to circumvent anti-money-laundering reporting requirements. Often smurfs are just innocent unemployed people conned by an ad on a telephone poll that says Work from home make up to a thousand dollars a week and when they got the job as Financial Officer or some other lofty name have to open a strange kind of joint bank account with a shell company whose trustees have control over it and which is being used behind the smurfs back to launder money.

Source: slideshare.net

Source: slideshare.net

According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by breaking up cash amounts. The Department of Justice stated The increasing use of OTC bitcoin brokers who are capable of transferring millions of dollars in bitcoin across international borders as part of a capital flight scheme is expected to continue to intertwine criminal money laundering networks with capital flight. For deposit into the individuals accounts. What business is best for money. In March another Hong Kong resident Carson Yeung was sentenced to six years for laundering 9127 million.

Source: cartoonmovement.com

Source: cartoonmovement.com

Instead of placing 100000 cash in one shot you split the placement into smaller amounts not attracting the attention of the compliance officers. The IT systems are aware of smurfing. These smaller sums can then be deposited in various banks by different peopleor smurfseffectively accomplishing the placement phase of traditional money laundering. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting threshold normally around 10000. In March another Hong Kong resident Carson Yeung was sentenced to six years for laundering 9127 million.

Source: aml-assassin.com

Source: aml-assassin.com

Smurfing is a method of placing smaller amounts of money in order to avoid reporting for suspicious money laundering activities. What business is best for money. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting threshold normally around 10000. In March another Hong Kong resident Carson Yeung was sentenced to six years for laundering 9127 million. To begin I would like to clear up a few misconceptions about these two money laundering terms.

Source: parientelaw.com

Source: parientelaw.com

A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. Smurfing is often a method employed to structure transactions but many a financial institutions structuring reports have nothing to do with smurfs. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. More Anti Money Laundering AML Definition. Other smurfs come to attention of authorities through their flamboyant lifestyles.

Source: huffingtonpost.com.au

Source: huffingtonpost.com.au

2 To banking and financial service professionals smurf and smurfing define a type of low-level money handler and their illicit transactions respectively. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. In one common form of money laundering called smurfing also known as structuring the criminal breaks up large chunks of cash into multiple small deposits often spreading them over many. Often smurfs are just innocent unemployed people conned by an ad on a telephone poll that says Work from home make up to a thousand dollars a week and when they got the job as Financial Officer or some other lofty name have to open a strange kind of joint bank account with a shell company whose trustees have control over it and which is being used behind the smurfs back to launder money.

Source: signnet.blogspot.com

Source: signnet.blogspot.com

A smurf is a colloquial term for a money launderer who seeks to evade scrutiny from government agencies by breaking up large transactions. Also called smurfing it is a method of placement whereby money is broken into smaller deposits. Smurfing A commonly used money laundering method smurfing involves the use of multiple individuals andor multiple transactions for making cash deposits buying monetary instruments or bank drafts in amounts under the reporting threshold normally around 10000. Smurfing is often a method employed to structure transactions but many a financial institutions structuring reports have nothing to do with smurfs. SmurfingIn one common form of money laundering called smurfing also known as structuring the criminal breaks up large chunks of cash into multiple small deposits often spreading them over many different accounts to avoid detection.

Source: twitter.com

Source: twitter.com

What business is best for money. The illegal act of splitting cash deposits or withdrawals into smaller amounts or purchasing monetary instruments to. The slang use of smurf is purported to have originated to describe Colombian drug cartels use of armies of elderly blue-haired old ladies to conduct money laundering transactions. In March another Hong Kong resident Carson Yeung was sentenced to six years for laundering 9127 million. More Anti Money Laundering AML Definition.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title launder money smurf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.